3 Bargain Stocks I'm Buying With Double Digit Dividend Yields.

ROI Club Monthly - September Edition.

Welcome to your September edition of the ROI club monthly.

In this edition I will give my high-level view on: my ‘Macro Indicators’ scorecard, the sector which has been calling most of my attention recently, plus a free analysis to 1 of the 3 companies I’m currently allocating capital to by both their stock and options plays. If you’re enjoying the value I’ve been adding through the service, please do share with your friend via the button below.

Now, let’s dig in to the macro scorecard.

Energy

For the last month or so I’ve been really thinking about the dynamics of the tanker market. Now whilst this is complex, with there being many different types of tankers for different commodities etc, I stumbled across a pretty enticing factor that leaves me now allocating to the sector. Tankers are valued by the market in terms of how much money they make (duh!) which is reflected in each particular carrier’s Time Charter Equivalent, or TCE.

What Is Time Charter Equivalent (TCE)?

Time charter equivalent (TCE) is a shipping industry measure used to calculate the average daily performance of a vessel. TCE is calculated by taking voyage revenues, subtracting voyage expense, including canal, bunker and port costs, and then dividing the total by the round-trip voyage duration in days.

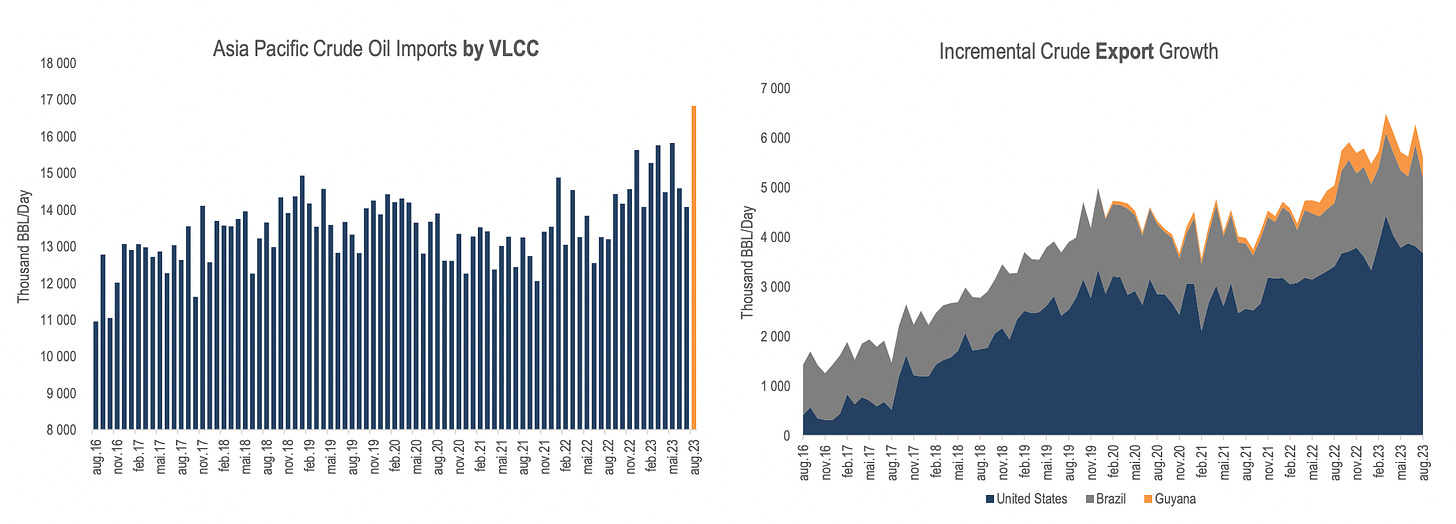

TCE, like all pricing, are determined by supply and demand. Hence in this case, the number of tankers available in the global fleet and the demand for their services moving crude oil, refined oil product or LNG from one place to another across the ocean. Now, it’s important to note that you need a specific vessel type for each good listed above, you can’t mix ‘em up. I believe the setting is good for all the above so I have a favorite company for each type of carrier of the 3 commodities named above.

I am investing in DHT carriers, as they are the only pure-play company in the VLCC (very large crude carrier) market. For my analysis on the company check this piece

Tankers Set To Rally.

Supply: supply is obviously tight right now as witnessed by DHT’s quarterly presentation showing spot rates for Q2 reached $64,800/day. When you consider their fleet’s average breakeven rate sits around $25,000 it’s not difficult to see what kind of profits they’re printing in this environment now they are essentially debt-free. Add to the fact I believe they are trading at a decent discount to their cost of new-build I think we may be in for another super-cycle.

Similar dynamics appear to be in play with refined product and LNG carriers.

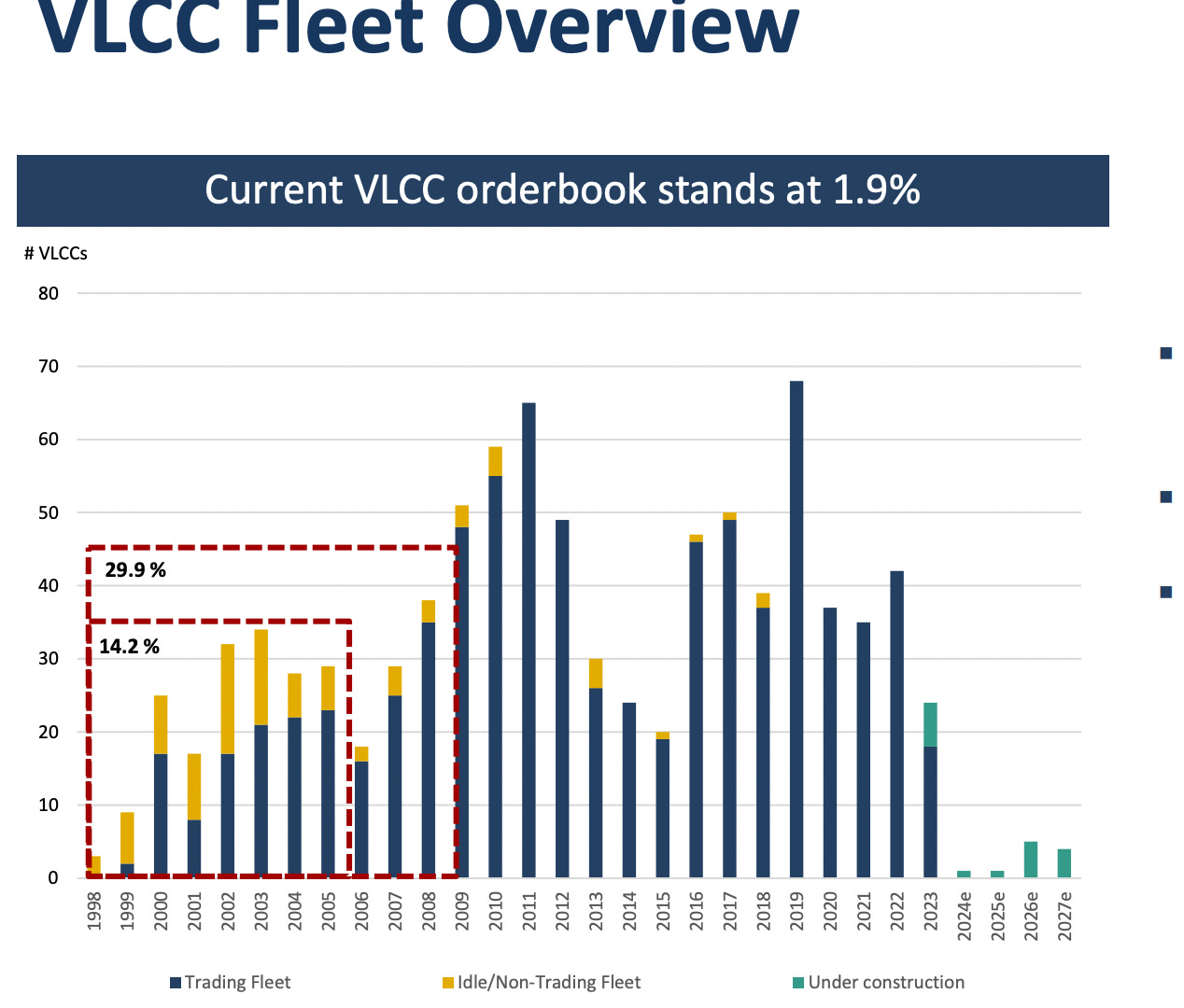

So, the key to determining where this niche is heading - number of ships coming up. Let’s take a look at the order book which actually looks a little scary..

Add the lack of new capacity to the fact that as these things age they need to be taken out of the global fleet and it’s easy to see that a supply squeeze appears imminent.

On the demand side, some estimate the global demand for shipping these commodities to grow at 4-5% CAGR over the next 2-3 years regardless of recession and/or OPEC+ changes in production.

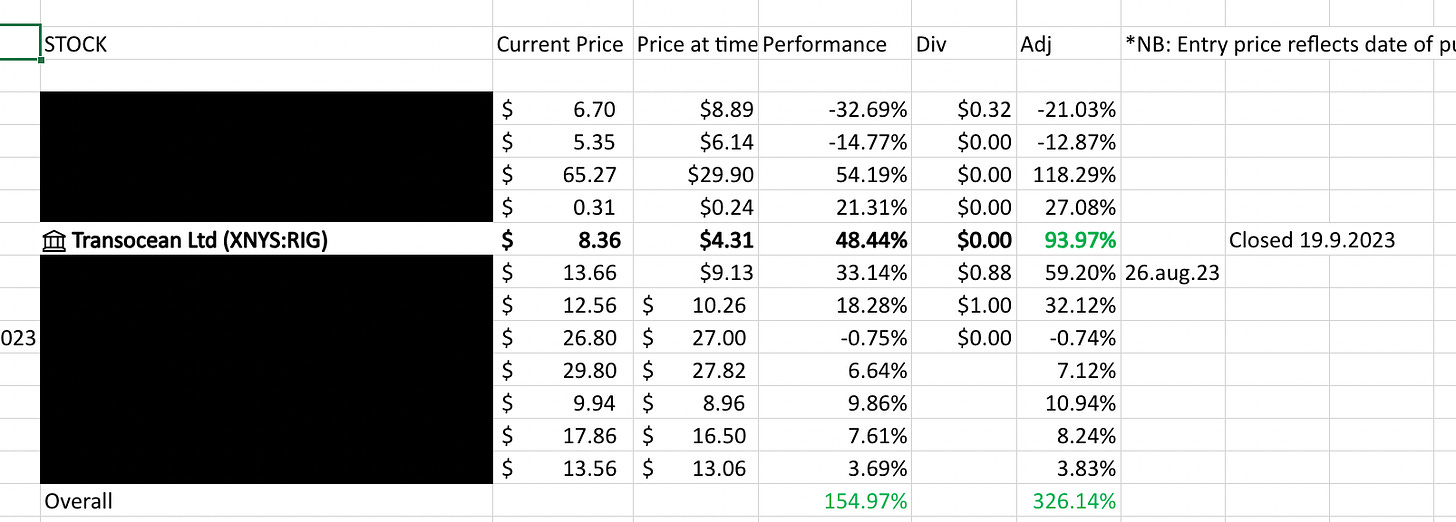

Since I published the excerpt below last month, tanker stocks have shot up, with names I’ve mentioned to private readers rising well over 10%:

“ In my view, the set up for the tanker sector is the best it’s been in a LONG time, potentially it could be the best ever given that the current fleet appears to be saturated whilst the order book for the near term future for VLCC is at merely 1.9% of the current fleet.

If that wasn’t enough, the supply of vessels appears even more tight when one considers the following facts:

- 15% of the current fleet is over 15 years old

- 14% of said fleet is over 20 years old

- By year’s end in 2025 there will be circa 90 ships 20 years of age or more.”

I’ve long since articulated my approach to value investing being buying things at a discount to the Net Asset Value (NAV), trading at high Free Cashflow Yields with a clear pathway to shareholder returns. This sector provides a few opportunities with just such a setup, two more examples of which are shared with ROI club members in the following section.

Ok, here is where I drop the curtain and share in exact detail how I’m positioning to profit from the aforementioned thesis. When you become an ROI club member you will get my full deep-dive on 2 more companies that are set to print huge profits in this sector, trading at a discount to their Net Asset Value and are currently paying double-digit dividends!

See you in the club.

Benjamin

Disclaimer: Each and every publication of the author, Benjamin, is intended solely for documenting my personal journey with options trading for income and travel purposes. I am not a certified financial advisor, and none of the content provided should be construed as investment advice. It is essential to conduct your own thorough research and consult a registered financial service provider for appropriate guidance. I cannot guarantee the accuracy or completeness of the information presented. Any actions taken based on the information shared in Options Mavericks are done at your own risk and discretion.

Keep reading with a 7-day free trial

Subscribe to The ROI Club to keep reading this post and get 7 days of free access to the full post archives.