Welcome to your latest edition of the ROI monthly.

Today I bring you my take on a stock that is one of my highest conviction individual longs currently. It already makes up close to 6.5% of my value-focused portfolios and I intend to scale that up to even 10%+ if it gets any cheaper as I believe this could net me 2-500% returns over the next 12-36 months. Full breakdown is available below for paid subscribers.

The company’s operations provide a truly unique solution that vertically integrates the collection, treatment, processing and transportation of natural gas. Yet whilst it will enjoy arbitraging any upside in the arbitrage between HH and TTF gas prices it is in the enviable position of boasting a utility-type business model. The market IMHO has completely mis-understood this stock. The company has spent nearly $3.5 Billion in infrastructure and lazy analysts have simply taken past numbers and extrapolated them into the future. The fact is however, management have recently confirmed that there remains little in the way of future CAPEX to be spent now that they have completed most of their infrastructure. Ergo, instead of billions of dollars leaving the company’s coffers, that CAPEX will instead be turning into revenues, and lots of them starting in 30 days when their latest infrastructure piece comes online.

If you’re like me, you may be instantly be turned off as soon as you hear the word ‘GAS’ as the below chart might justify.

However the company I’m viewing today has locked in contracts and is more of my favourite ‘clip the ticket’ style business with a bonus upside kicker on higher gas prices.

What’s On Ben’s Brain?

In this segment I summarise some of my many ponderings in dot point form

The fed seems serious about holding the line RE: Fed funds rate (FFR) which for me will eventually lead to cashflow negative enterprises crashing/going bankrupt before they get scared and ease the liquidity spigots which will ignite the next run of an inflationary bubble.

Ergo, I’m sticking to cash flow generating businesses trading at both a discount to net asset value AND a with a high (15%+ FCF yield) mainly in the energy sector

How to play the demise of the tech sector? I am hunting for bankruptcy candidates whose ‘bankruptcy insurance’ I believe to be far too cheap. An example of that here

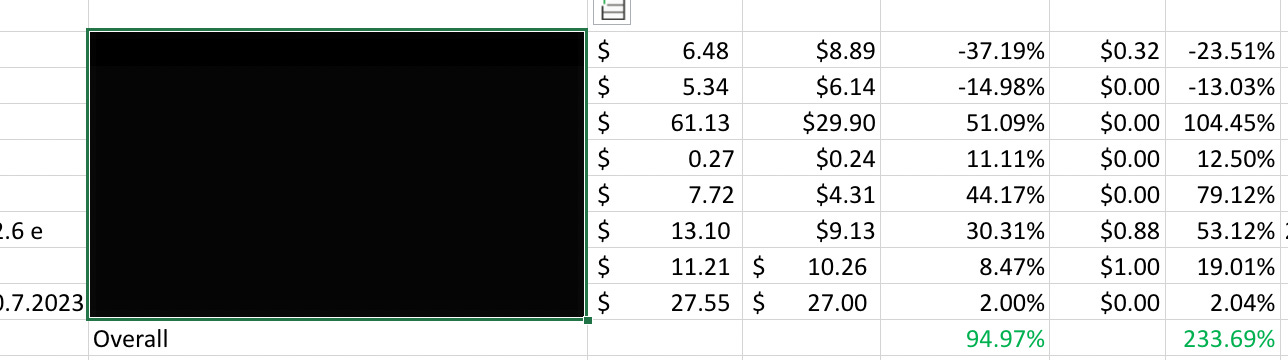

The stocks I’ve mentioned in this publication to paid subscribers have performed VERY well so far - see below. I’ll be closing some out soon if we keep marching higher.

*Important* this is a hypothetical selection of assets, the author does not and cannot guarantee results. The author is NOT qualified to give financial advice of any kind and nothing in this publication is to be considered financial advice.

Become a paid subscriber today (less than $5/month when you pay annually) and get access immediately to the video below.

Until next time, all the best & DYODD.

Benjamin.

Keep reading with a 7-day free trial

Subscribe to The ROI Club to keep reading this post and get 7 days of free access to the full post archives.