Ecora Resources: Is This Royalty Worthy of The Throne?

An overview of a reformed, growth royalty.

Hear ye, hear ye! 👑

Welcome to the ROI Club.

It is with great honour that I accept recently being crowned ‘The Royalty King’ in this cracker of an article by our friend Steeeeeeeeve from

.As my first official act, I shall heed the voice of the people and take a look at this intriguing suggestion from Matteo who commented the following on the article above:

So, by royal decree, I declare Ecora Resources worthy of further investigation and free from a paywall, let’s dig in.

History & Corporate Transitions

Originally known as Anglo Pacific Group and mainly focused in coal royalties the company rebranded to Ecora Resources in October 2022 to “better reflect its commitment to sustainability and the energy transition”.

Translation: They wanted to be eligible for inclusion in indices and have an easier time raising capital.

So far, this appears to be working as they gained inclusion in FTSE UK SmallCap and All-Share Indices in December 2024.

Business Model

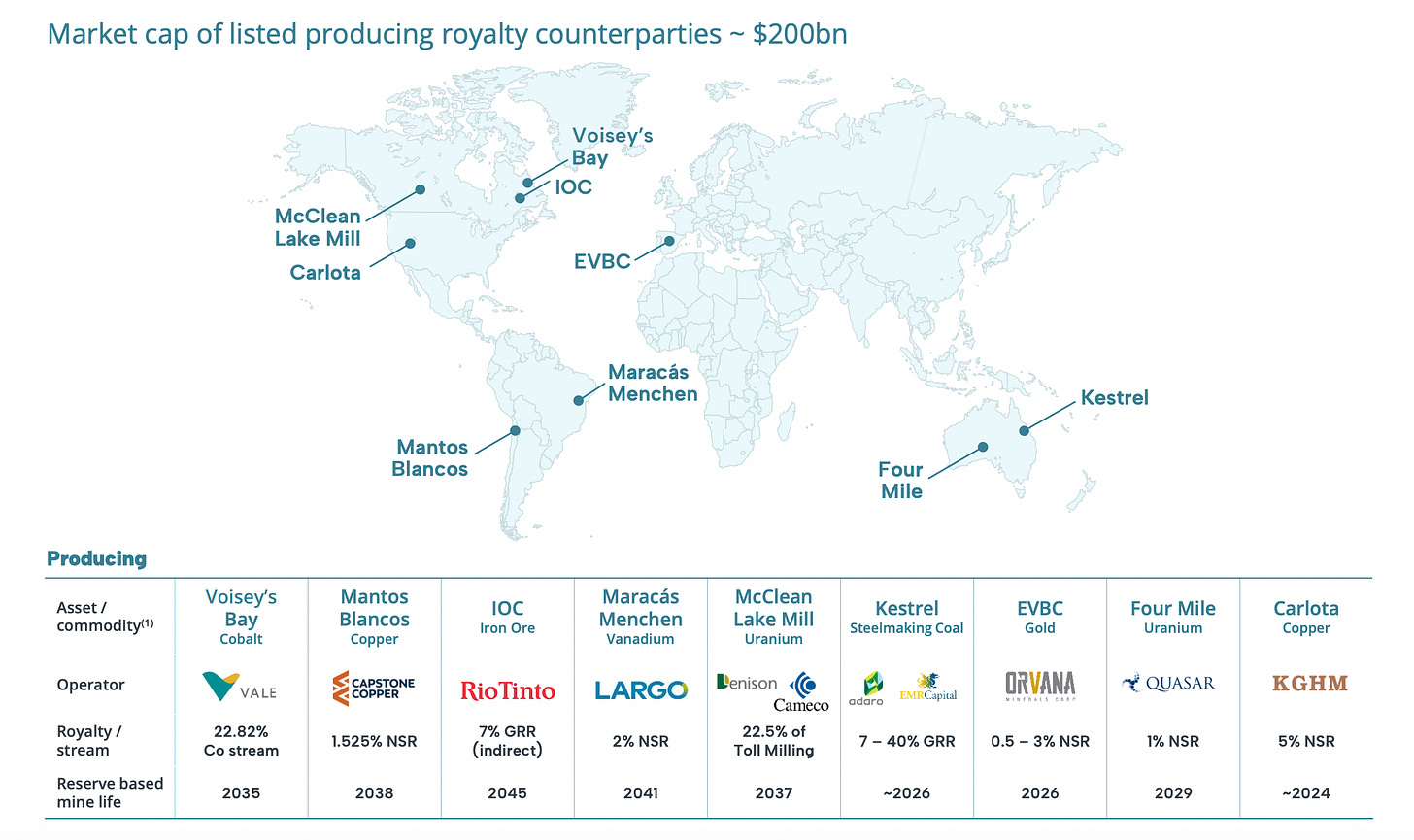

Ecora acquires royalties and streams over low-cost mining operations in established mining jurisdictions. They have diversified quickly in line with their new strategy and today offer exposure to: uranium, copper, nickel, cobalt, and lithium et al.

As the royalty king, you know I love to harp on how the royalty model is superior when securing revenue-based payments as it offers upside participation in the top line without participation in cost inflation in the expense column.

Now, royalties ain’t royalties. Within the different types of agreements their exist stronger claims and weaker claims, but this might be a subject of another article.

As far as Ecora is concerned, they boost some very strong agreements with very reliable partners across a broad range of commodities as seen below.

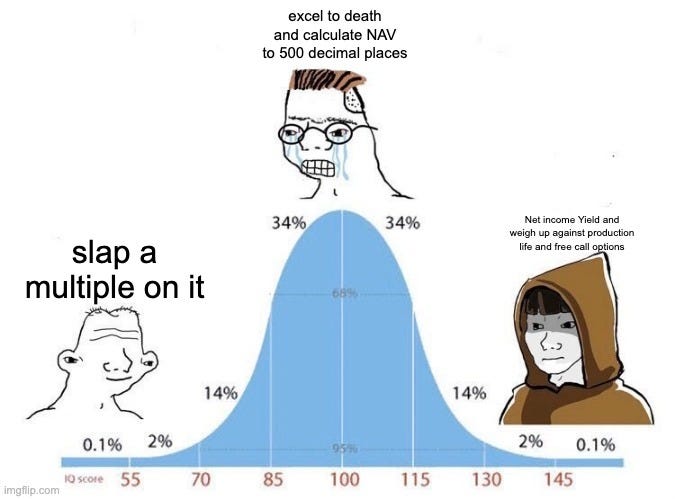

One question I’m often asked when it comes to Royalty Co.s is ‘ What is its Net Asset Value?’. Typically this is posed by excel ninjas and investment bankers who find comfort in perceived precision, rather than overall accuracy of thesis.

It’s not a bad question per se, but consider the following:

NAV is for finite resource or vessel value (shipping), while royalties are perpetual and often outlive initial mine life expectation.

Doesn't reflect the compounding or counter-cyclical capital allocation ability

Ignores the embedded free call options endemic to this model via: Higher Prices + Higher Margins + Volumes

Discount rates used are usually too high: Royalty cash flows are less risky than producers', so they should have a lower discount rate, but NAV models often misapply producer-level discount rates.

Doesn't Account for Capital Efficiency: Producers alter CAPEX based on commodity markets, i.e high prices = they drill more, low prices = they drill less. NAV assumes a fixed production scenario.

I’m being somewhat facetious when I say that basically every small cap in this space claims to be trading at a steep discount to NAV… see this from their quarterly report.

"When a measure becomes a target, it ceases to be a good measure."

-Charles Goodhart

This quote comes to mind…

So then, how do I go about estimating value?

Firstly, in the case of Ecora, we need to ex-out the Kestrel revenue because it’s coal and hence commodity non-grata ergo it’s due to wind down in 1-2 years.

I’m going to write it down to zero and leave room to be pleasantly surprised to the upside.

The company is estimating ~$35 mm in 2025 from its non-coal related interests and scaling to $100 mm PA from non-coal by 2030. I’m not so confident here as this relies on commodities I have less confidence in like Cobalt, Nickel etc.

I like their copper and uranium interests which combined represent 9% of 2024’s annualised revenues. The rest of their exposure, both commodity - wise and geopolitically would not be my first choice.

The flip side here is that they do appear to be doing a good job of targeting the low cost producers, meaning their royalties should be steady and they have significantly invested in the future, albeit mostly in base metals which I don’t love nearly as much as owning precious metals and land/water companies.

I’ll suggest that a 10% top line growth might be more reliable as a base case and a 60% free cashflow margin and 10x multiple is very achievable.

So, to give ourselves a (likely false) sense of comfort and precision let’s take a look at some assumptions that I feel give a very wide margin of safety when one applies one of the few advantages a non-institutional investor has which is extending the time horizon out further than most people’s attention span.

Assumptions:

Revenue in 2025: $35 million

Annual Revenue Growth: 10% per year

Ave Free Cash Flow (FCF) Margin: 60%

Discount Rate: 7%

Terminal Multiple: 10 (applied to revenue in 2044)

Total Present Value (PV):

PV of Free Cash Flows (2025–2044): $553.15 million

PV of Terminal Value: $553.16 million

Total Present Value: $1.106 billion

If something close to the above plays out, that’s a total return close enough to 7x over 20 years or 10.5% PA. Obviously there are many ways they may do better as I’ve been fairly conservative. A more bullish investor might underwrite the company’s growth target above of $100mm PA by 2030. That would be a 23% growth rate which is not out of the question, but it would only take a slump in industrial metal demand for their development projects to be delayed and given they are counting heavily on their pipeline to come online without a hitch to hit their targets..there’s little room for error.

Contrast this with a permian or even Canadian land owner with energy royalties. Sure their revenues may drop in a down market, but they’ll still bank cash every quarter. It’s just such a better game to play imho.

My take: It’s an interesting way to gain some capital-light exposure to base metals and uranium. I like the copper and vanadium, I have little interest in nickel and cobalt. The growth story is intertwined with geopolitical risk as well as development risk + commodity risk. Why allocate capital here vs the biggest and best?

Or vs similar MC play like GROY who also offers copper exposure via their 100% stream on the copper from the Vares project?

In summary, I think Ecora is very interesting and I’ll be keeping an eye on it without taking any position worth mentioning. Right now I’m too obsessed with water, land-energy and gold royalties to make a place in my kingdom for base metals in any great quantity. Should things change then a royalty with growth potential such as Ecora will likely play a key role in expressing that theme.

Thanks to Matteo for bringing this to my attention and thank you to Steeeeeeeve for sharing his insights and a great (paywalled) royalty play of his own.

Take care and do your own due diligence.

Benjamin.

Must be one of the companies with the most exposure to cobalt, if you want to treat the elements like pokemon and catch em all.

i think coal has more of a future than you credit- both met and thermal. coal power plants are having their lives extended, and although electric arc furnaces can work with scrap, iron ore requires met coal except for some novel/experimental methods which are being developed. one way to play coal and oil and gas is arlp - produces coal, pays 10% and uses the rest of its fcf to buy oil/gas royalty properties. sends a k-1.

another interesting company is nrp. it pays a low dividend but has been paying down debt aggressively and is almost at the finish line in that process. management has said they will then switch to paying sig dividends and/or stock buybacks.