Welcome back to the Return On Investment Club.

Today’s piece focuses on pillar 2, of my investing themes for 2025 and beyond, monetary debasement and how to survive it.

I’ve recently been reading a lot of Gabriel García Márquez’s writing. In Cien Años De Soledad (One Hundred Years Of Solitude) the main character, José Arcadio Buendía, becomes consumed by the pursuit of alchemy after meeting the enigmatic gypsy, Melquíades. (Where there are Gypsies there’s always gold in my experience).

His obsession with transforming base materials into gold illustrates the human intuition to create lasting value from transient things.

It struck me that what I’m trying to do today, transform fiat currency—fleeting and subject to devaluation—into enduring, inflation-resistant assets is a modern form of alchemy. (I am being dramatic and creative, but it’s true).

Inflation is the silent thief of wealth. Once cash flows exceed our living expenses, the challenge becomes one of preserving purchasing power while maintaining liquidity and flexibility.

In today’s piece, I’m sharing the very system I use to that end, you can even copy and change it to suit yourself.

The transformative power of this approach lies in its ability to counteract the devaluation of fiat currency. Just as ancient alchemists sought to convert lead into gold, today we convert devaluing fiat into tangible, enduring stores of value. This modern "alchemy" safeguards our purchasing power and ensures that our wealth isn’t eroded by time or monetary debasement (or gypsies).

📬 Like what you’re reading? Why not jump on the free list?!

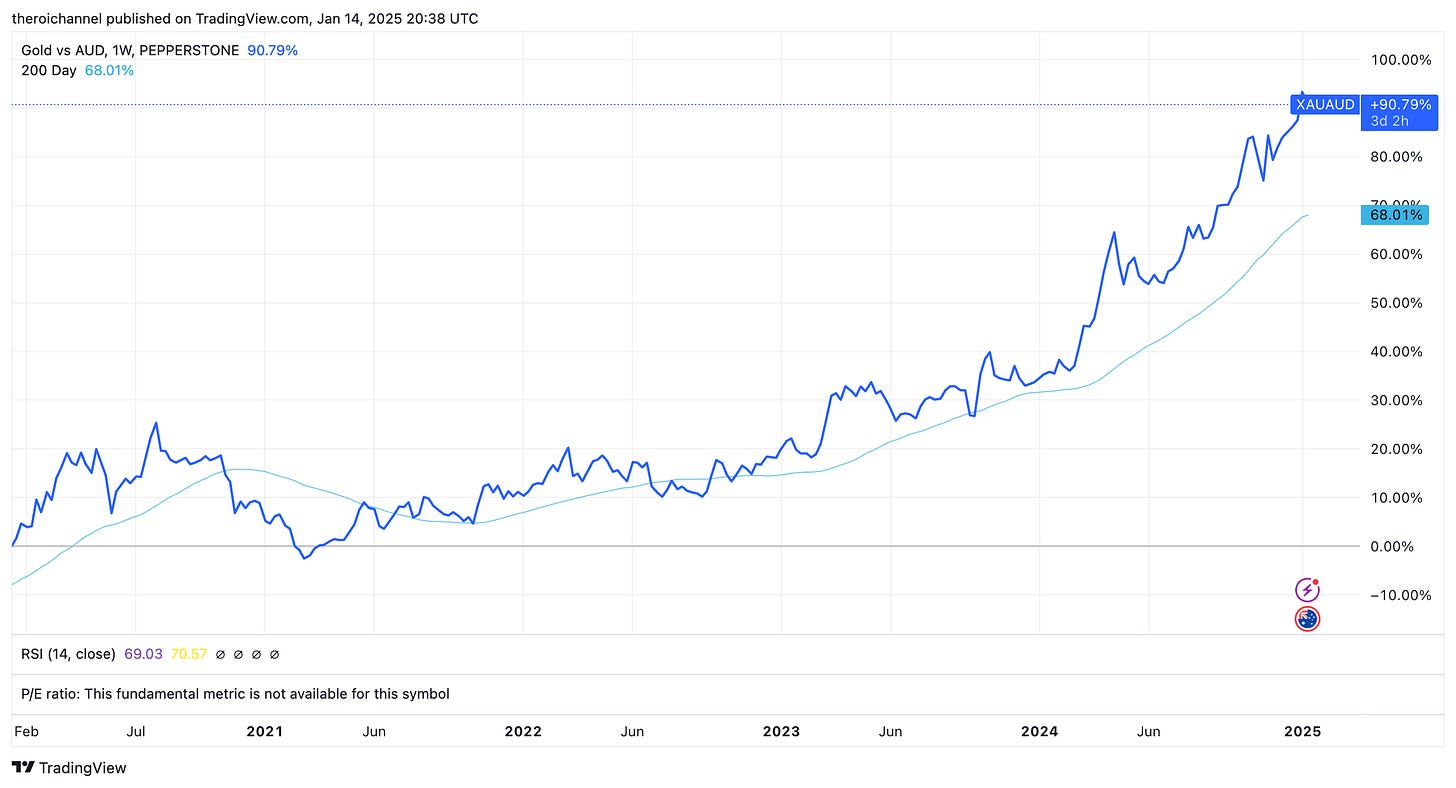

Recently, I’ve been posting on X about the Aussie Dollar’s decline against not just the USD, but particularly against gold. Yes, I’m one of those loonies who believes that’s a more reliable measure of purchasing power than the CP-lie stats put out by the governing bodies that be. (Gypsies in suits)

Rather than re-hash the same old arguments, I’ll merely point readers towards the book that really changed my mind about this ‘The New Case For Gold’ By Jim Rickards. There you will gain a great appreciate as to the innate qualities that make gold uniquely suited as a ‘monetary measuring stick’.

Over the past five years, the Aussie Dollar has depreciated by a staggering 90.44% against gold, or approximately -10% per year.

I’m going to repeat and rephrase that so that you might understand the severity of such an outcome.

An annual depreciation rate of 10% means that the purchasing power of $1 AUD will be reduced to just $0.318 in less than a decade…

So those calculations you’ve been doing, you know the ones which tell you how much you need to retire, send the kids to school etc?

Yeah - Nah as we say in Australia.

This realisation hit me hard: as a businessman and investor who spends countless hours striving, who basically sacrificed his early twenties to try to get ahead and ‘be responsible’ did I even manage to outpace the rate of monetary debasement?

Just. But holy moly - it sure would’ve been easier just to stack gold (and better if I had’ve bought more Bitcoin earlier).

Collecting assets over time is the name of the game.

The problem is, when you're saving to buy a property, a private business or any asset that requires a decent whack of cash up-front, you want to preserve your purchasing power, yet you need to remain liquid.

This is where I use the following system.

Income Alchemy

The core principle of my approach is to minimise exposure to inflation whilst maintaining liquidity in case of emergency. Here's the breakdown in simple steps:

Cash Reserve: I maintain 3 months of living expenses in cash. This is less than most experts recommend but I have a business credit card and line of credit if ever I really needed it. You do you.

Income Allocation: Once my cash reserve is set, I allocate 90% of my income into inflation-robust, yet liquid forms:

Precious Metals (90% of the 90%):

Gold: 90% of my metals allocation goes into gold, the ultimate inflation hedge with a track record stretching back millennia.

Silver: The remaining 10% is allocated to silver, offering diversification and the potential for outsized gains during a bull market.

Cryptocurrency (10%):

Bitcoin (BTC): 90% of my crypto allocation (90% of 10%), goes into Bitcoin which my hero Murray Stahl considers the solution to Hayek’s problem of private money.

Others: The remaining 10% is split between Bitcoin Cash (BCH) and Litecoin (LTC), both of which offer unique transactional advantages and growth potential and use the same protocol as BTC.

Pro tip: I use an investment holding trust which allows me tax flexibility and a 50% discount on capital gains in Australia when held over 12 months (not advice, subject to change etc).

All the above could be liquidated and transferred into a bank account in 24-48 hours.

To fully automate this, I simply get a rough idea of what my gross income from all operations will be on a monthly average, calculate the respective percentages above to get a dollar amount and then set up auto transfers with my banks and brokers.

I judiciously organised my private business into capital-light operating models a 5 years ago which allows me to be fairly aggressive in this form of Alchemy: turning fiat into gold.

That’s the income statement.

The Balance Sheet

How should I allocate my long term investments?

Usually every 3 months or so I step back and take a broader view of where my wealth is situated in terms of asset classes and aim to balance it in accordance to what I call ‘The Colonna Formula.’

The Colonna family is one of Italy’s oldest and most prominent nobilities. Their name has been synonymous with power and wealth throughout the Italian peninsula since the 10th century where thenceforth they have survived numerous scuffles including clan wars with the Orsini and even an excommunication from the Pope in 1297.

The secret to their storing their wealth for centuries lies in a deceptively simple allocation formula:

Allocate one-third of your wealth to business, one-third to land, and one-third in reserve - understood to be gold or rare artwork. (Handy if you need to take off in a hurry or hide from a pope - think Gypsy in a dress).

Here’s how I apply this framework:

Business (One-Third):

This includes both active business ventures in which I’m involved and public stocks.

Land (One-Third):

Real estate is a time-tested asset class, providing both tangible value and potential income. Not easy to transport, as the Colonna learnt in 1297, however Sciarra Colonna retook their stolen land in 1303 after killing the nasty

GypsyPope. So whilst you can’t take it with you, it’s there when you return as not even a pompous papal can destroy land.

Reserves (One-Third):

This is where my cash flow allocations to precious metals and crypto ultimately reside. Whilst the Colonna ancestors didn’t mention crypto, I’m guessing today’s kin do hold some. Occasionally, I also include art in this category for diversification.

By rebalancing my net worth to align with this structure, I want to ensure that no single asset class dominates my portfolio, providing both resilience and growth potential in the event of a market downturn.

Or excommunication / encounter with a Gypsy.

Ready to Take Your ROI to the Next Level?

Upgrade to premium membership and gain exclusive access to:

The ROI Club: Dedicated to the art of Return On Investment

My investment research that has delivered multi-baggers returns.

The Maverick Life: How To Generating Location-Independent Income so you can live:

Where you want

When you want

With whom you want

Doing what you want

Become A Premium Member Of The ROI Club Today.

Disclaimer: This publication is intended solely for documenting my personal journey with trading and investments for income and travel purposes. I am not a certified financial advisor nor am I a financial professional and none of the content provided should be construed as investment advice. It is essential to conduct your own thorough research and consult a registered financial service provider for appropriate guidance. I cannot guarantee the accuracy or completeness of the information presented. Any actions taken based on the information shared in any of my work are done at your own risk and discretion.

Nice article. In what form(s) do you hold your gold and silver? Physical in your own possession, physical through a custodian, digital through an ETF, etc?