How to invest in gas without the widow-maker trade.

Royalty with 4x potential. November deep dive & Equity Research Valuation.

Hello and welcome back to the ROI club.

The following quote sums up the sector thesis for today’s focus.

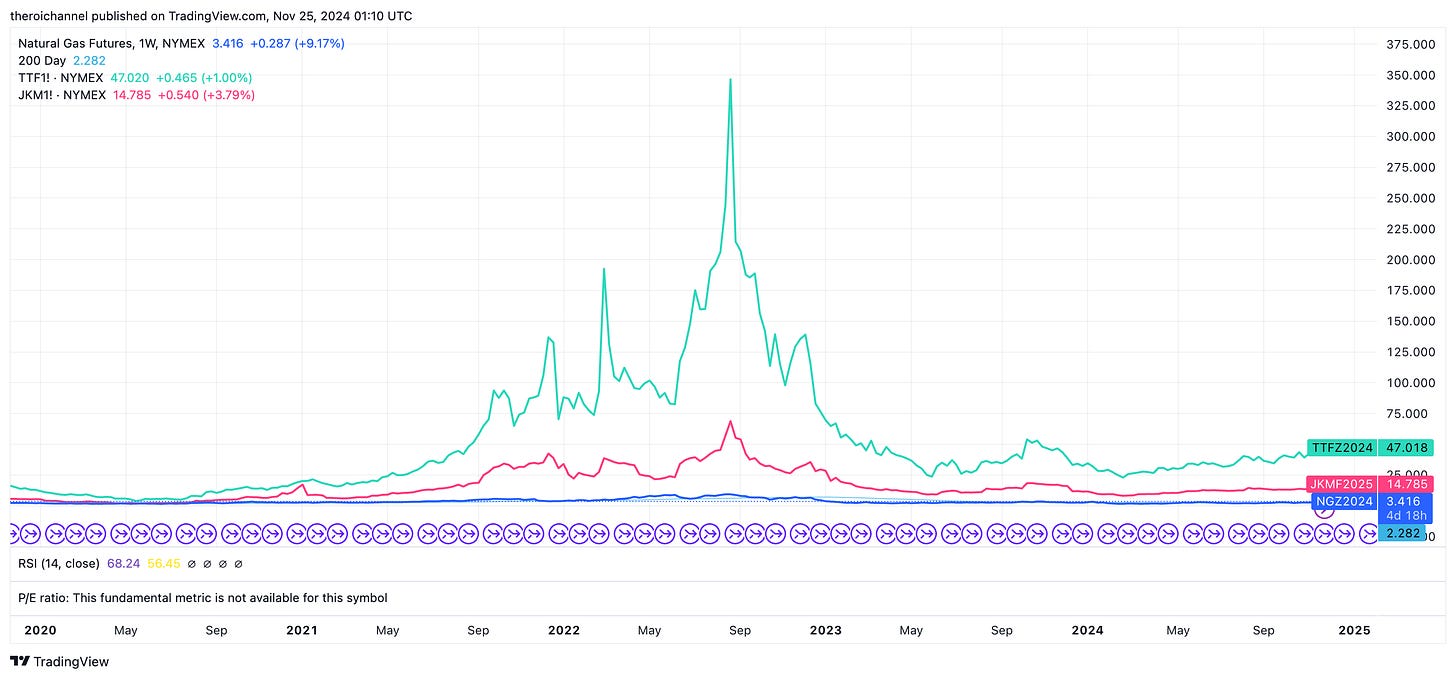

“North American natural gas is the cheapest energy molecule on the planet by as much as 75%. Over the next twelve months, we believe this discount could close entirely, boosting US gas prices as much as four-fold. As we go to print, Henry Hub gas costs $3.00 per mcf while European and Asian gas is $14 and $16.50”

- Goehring & Rozencwajg Q1 2024 Commentary.

US natgas has since risen to $3.4 (HH) yet it remains the cheapest molecule on the planet. It’s also a renown widow maker.

My focus today is how do I gain exposure to this thing without several young latinas weeping at my funeral and squabbling over the life insurance?

That’s a joke…

There are two main arms to the convergence theme:

US gas converging with global gas markets (apples to apples)

US gas converging on an mmBTU basis with WTI (different fruits but with some substitutable qualities).

This is merely the icing on the cake when added to my theme of Data centres encroaching the Permian in order to take advantage of their unique and perfectly suited set up. Cheap gas is only one part of that thesis, albeit a significant part.

Many a man has been ruined by trying to trade this via futures, arb spread trades and producers.

My philosophy is to position myself asymmetrically such that I have limited/no downside and a free call option to the upside.

How do I do that?

You should know me by now caballeros - by buying a royalty.

What’s better than buying cheap local gas?

Buying a revenue interest in cheap local gas.

My Royalty holdings in the Permian (TPL, LB, VNOM etc) already act as call options to nat-gas, given TPL’s latest report showed that their gas at WAHA actually realised negative prices. So even a small move to the upside there adds a lot of additional profits straight to their bottom line.

However, rather than repeat myself by talking about stocks who have risen 50-100% on the year, there’s a lesser known gem which has been sold off 40% over the last 12 months due to a situation that will soon be rectified.

While the market doesn’t understand this, I fully intend to take advantage while this is on sale and before the gap between global gas prices converge as per below. 98% of this stocks’ royalties are from nat gas making it a form of ‘pure play’.

So, let’s take a look at this month’s deep dive which is a company whose market cap is currently only $186 mm, yet traded at $673 mm only 2 years ago. I believe is a fairly straightforward 3-4x or more from here.

Keep reading with a 7-day free trial

Subscribe to The ROI Club to keep reading this post and get 7 days of free access to the full post archives.