Review - March 2023

Greetings from Australia, welcome to the new subscribers - what wonderful Autumn weather!

Now, on to markets.

Key takeaways for me: US 10 yr treasury yield is down MTD 3.55% which has helped the SP500 rise 3.93% as shown on the chart below.

Taking a look at credit conditions we can see the yield curve remains inverted with short term Fed Funds Rate (FFR) remaining higher than longer duration treasuries such as the 10 yr note. This means the bond market is still pricing in a recession and anticipates the FED will have to pause/reverse its rate hiking cycle. If/when that happens I’d expect to see the dollar index (DXY) roll over and weaken as short term US instruments will become less attractive and foreign inflation-resistant stocks (which I own and have shared with group members) should see their values realised.

Commodity Kings.

Gold also anticipates a softening of monetary policy on the horizon in the USA, up 1.65% in April and 8.78% YTD while oil was up 5.17% in April it remains down YTD (-5.44%) and below its 200MA.

This much anticipated recession may or may not occur, I continue to look further on the horizon towards value opportunities which I continue to see in the energy sector.

I consider the main threat to my portfolio to be inflation, which remains stubborn.

Energy, combined with some precious metals exposure (mainly physical) is how I have been mainly positioned for 2-3 years now and I see no reason to change that.

Ben’s Buys.

What’s Ben Buying This Month?

In this segment I give you my take on a particular stock, including my investment thesis and valuation estimate.

To survive this inflationary environment it’s no secret that I’m looking for companies that have exposure to revenues that will out-grow the rate of their expenses.

‘Clip the ticket’ type royalty or brokerage companies generally exhibit this quality and have high margins on their earnings.

They also tend to make similar profits regardless of market conditions.

In the video below I give a complete overview of one such company which I think can deliver outstanding returns, without the risks normally associated with the producers.

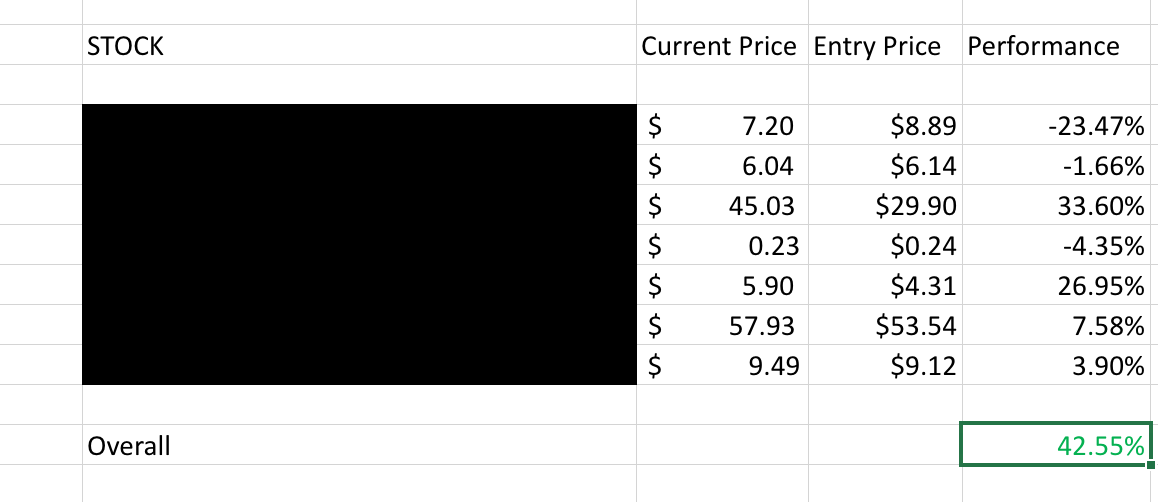

Subscribe to the ROI club today and become a member and gain access to ALL of my analyses + see a live performance breakdown of the stocks I’ve looked at in the excel sheet below ( currently up 42.55 % at time of writing).

Start your free trial today and get access to everything FREE for 7 days and then decide if you do or don’t want to continue.

In my humble opinion, for less than $5/month when paid annually, it’s ridiculously good value.

See you inside the ROI club.

Until next time, all the best & DYODD.

Benjamin.

Keep reading with a 7-day free trial

Subscribe to The ROI Club to keep reading this post and get 7 days of free access to the full post archives.