How To Survive The Coming Storm With Royalty Co.s - I'm Buying This One With 10% Div Yield.

ROI Club Monthly - Oct Edition.

Welcome to your October edition of the ROI club monthly.

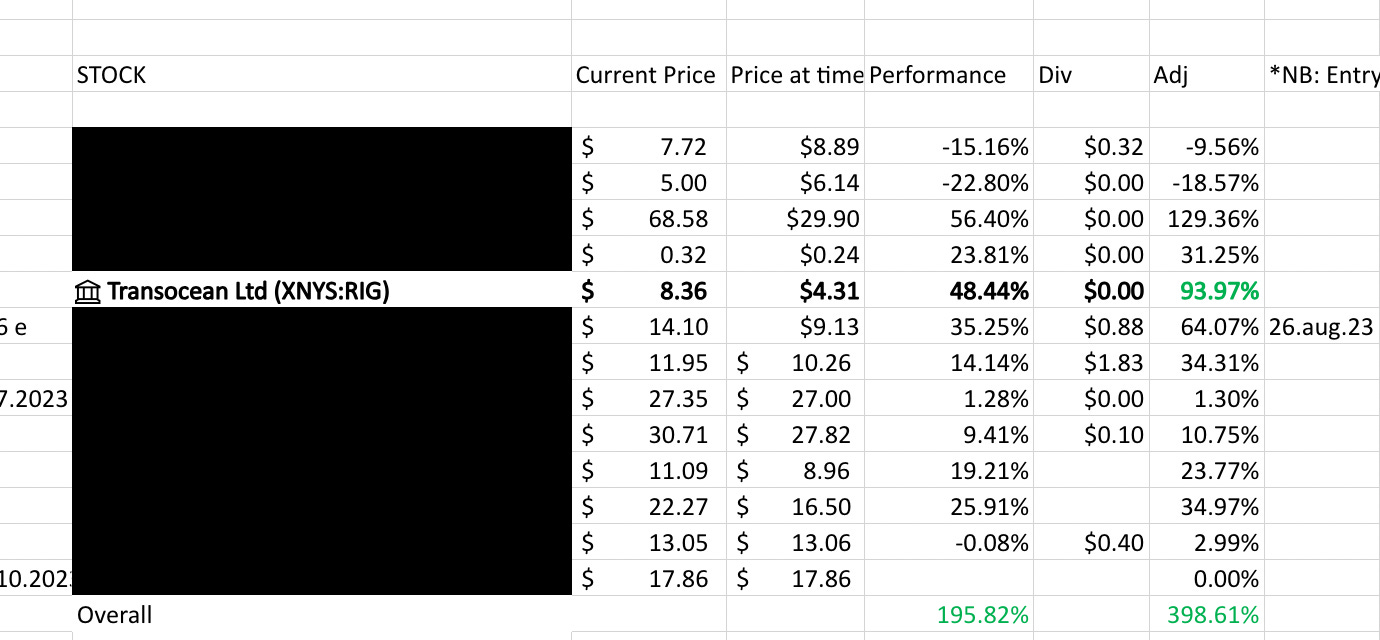

Past Picks & Their Performance

Contents:

My thoughts on the current macro environment

How I’m Positioning

Stock Analysis & Valuation (Paywall)

Now, let’s dig in to the macro.

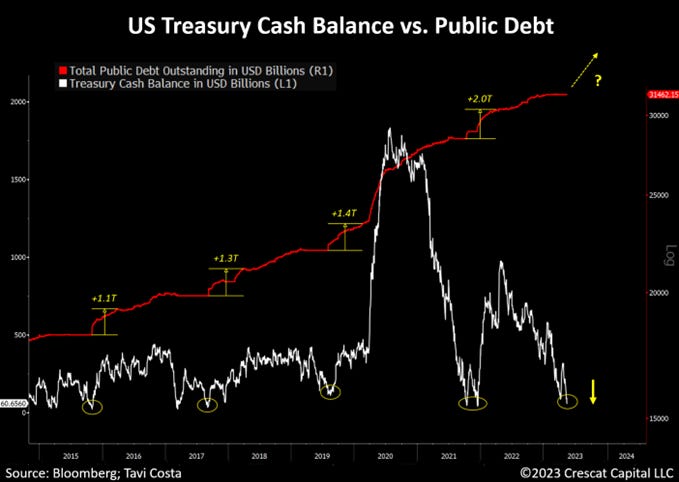

As mentioned in my recent discussion with the great Rick Rule (see here) and in reference to the chart above the US IMHO will have to intentionally engage in financial repression in order to decrease the NPV of their debt (dishonestly default and leave you and I with a nasty inflation problem).

I will not go into the weeds on that here as it’s outside the scope of what I intend to be a nice, simple publication, nevertheless there are a few implications I want to touch on.

My take: The Fed will continue to raise rates to make it look like they care ‘combat inflation’ whilst the government continues to deficit spend on all sorts of bad ideas. With the deficit to cash and deficit to GDP this is obviously unsustainable and will eventually (although I don’t know when) lead to the US either: ‘pivoting’ and lowering rates or the FED returning to QE-type measure to continually create the new currency units necessary to service the ever increasing debt and interest on said debt.

This inevitably has lead to nasty inflation historically and this time I see similar outcomes, however I expect some truly bone-rattling volatility between now and whenever this things is sorted (could be a decade or more).

Ergo my main concern right now is ‘ I want to protect purchasing power through owning commodities, particularly energy equities, but how do I survive the cost inflation and price volatility of the producers?’

There are a few options:

Buying the commodity itself i.e gold bullion

Gaining derivatives exposure through options, futures etc

Royalty Co.s (today’s focus)

I buy things at a discount to the Net Asset Value (NAV), trading at high Free Cashflow Yields with a clear pathway to shareholder returns. This sector provides a few opportunities with just such a setup, I share one example with ROI club members in the following section.

Ok, here is where I drop the curtain and share in exact detail how I’m positioning to profit from the aforementioned thesis. When you become an ROI club member you will get my full deep-dives from all past editions + this month’s idea which is set to print huge profits in this sector, trading at a discount to their Net Asset Value and are currently paying double-digit dividends!

See you in the club.

Benjamin

Disclaimer: Each and every publication of the author, Benjamin, is intended solely for documenting my personal journey with options trading for income and travel purposes. I am not a certified financial advisor, and none of the content provided should be construed as investment advice. It is essential to conduct your own thorough research and consult a registered financial service provider for appropriate guidance. I cannot guarantee the accuracy or completeness of the information presented. Any actions taken based on the information shared in Options Mavericks are done at your own risk and discretion.

Keep reading with a 7-day free trial

Subscribe to The ROI Club to keep reading this post and get 7 days of free access to the full post archives.