Iron OREsome: Mesabi Trust $MSB Valuation Deep Dive

My New Favourite Income Play: 45% upside + 8% dividend on this quality royalty.

Disclaimer: This article is for informational purposes only and should not be considered as financial advice. Always consult with a professional financial advisor before making any investment decisions.

Contents:

RULE SYMPOSIUM - GET YOUR TICKETS HERE

Opinion: everyone’s talking about copper when they should be peeking at Iron Ore.

My valuation on a supreme royalty operation on an unloved commodity that I think delivers me: equity upside + growing reserves + pays me ~8% to wait..

Welcome to the ROI Club, the publication that’s obsessed with the art and science of return on investment and offers you a chance to discover discover hidden investment opportunities where no one else is looking.

I have registered for the Rule Symposium and am very much looking forward to learning from the greats of the industry - If you’re interested check out my affiliate link here where you can get your tickets either online or in person.

Iron Ore

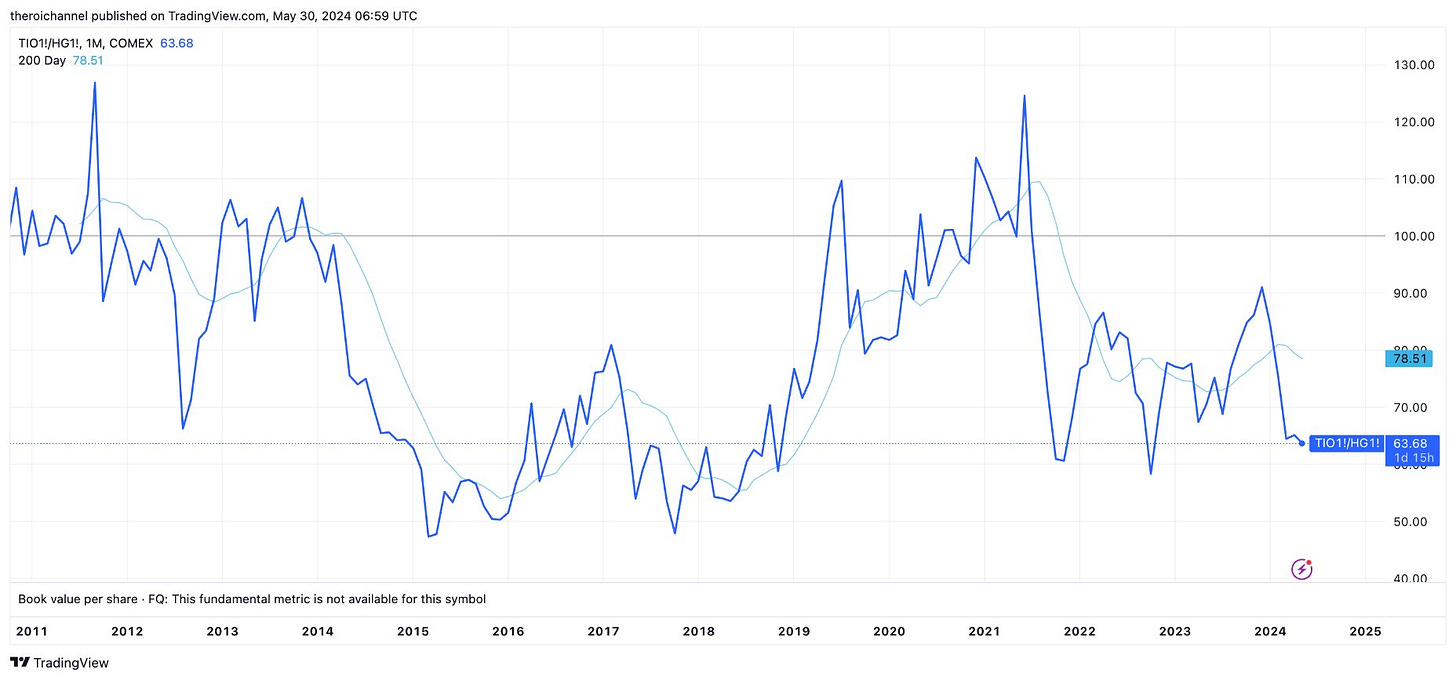

Everyone is aware of the long-term supply/demand imbalance for copper. I couldn’t find a copper play I liked at the start of 2024 and since the price has rocketed upwards over the last 6 months I’m no chasing. Yet this chart got me thinking during the week that perhaps there’s another way to get exposure to the thesis of infrastructure upgrades and the great electrification theme which is really the driver of the copper narrative.

The main demand use for Iron Ore is steel production: for infrastructure, construction and manufacturing sectors, similar in fact to copper, yet Fe2O3 (iron ore) has rarely been cheaper relative to copper in recent history (see below).

60% of global consumption is driven by China which leads people to be wary of Iron Ore prices as they are heavily exposure to economic conditions in China. However, given the size of its economy even an incremental increase in demand will boost prices.

India is expected to become a net importer by 2030 and will need an ungodly amount of steel for its urbanisation plans.

My last comment on the demand side is in regard to a higher grade of ore now being sought after due to its low emissions, this bodes well for the focus of today’s investment case, $MSB.

So, if you’re interested in what I consider a safer bet in lower price environments along with a double call option in the good times…. Stick around!

I’ll give you my take on why I expect this stock to deliver me handsome returns well into the future, with ZERO operating risk exposure while I get paid a fat dividend to wait.

Let’s dig in..

Keep reading with a 7-day free trial

Subscribe to The ROI Club to keep reading this post and get 7 days of free access to the full post archives.