Land+Gold+Bitcoin = My Approach Is Working.

Portfolio Update + New Investments I'm making this week.

Welcom back to the ROI club.

In today’s Maverick Life segment I’m commenting on financial market action YTD and providing commentary where I think I can add some value.

In the premium section you’ll find my portoflio overview, along with trades I’m putting on next month.

Make sure you check out my latest podcast with Don Durrett where we discuss the recent stock market action plus a solid 30 mins of commentary on crypto in the aftermath of the US election.

An Important chart that has (almost) everyone confused it seems is the below, showing gold rising in tandem with the US 10 year bond yield during the first half of the year. Most run-of-the-mill economists expect gold to sell off in the face of rising yields as investors view the opportunity cost as more attractive and hence captial chases the higher yield.

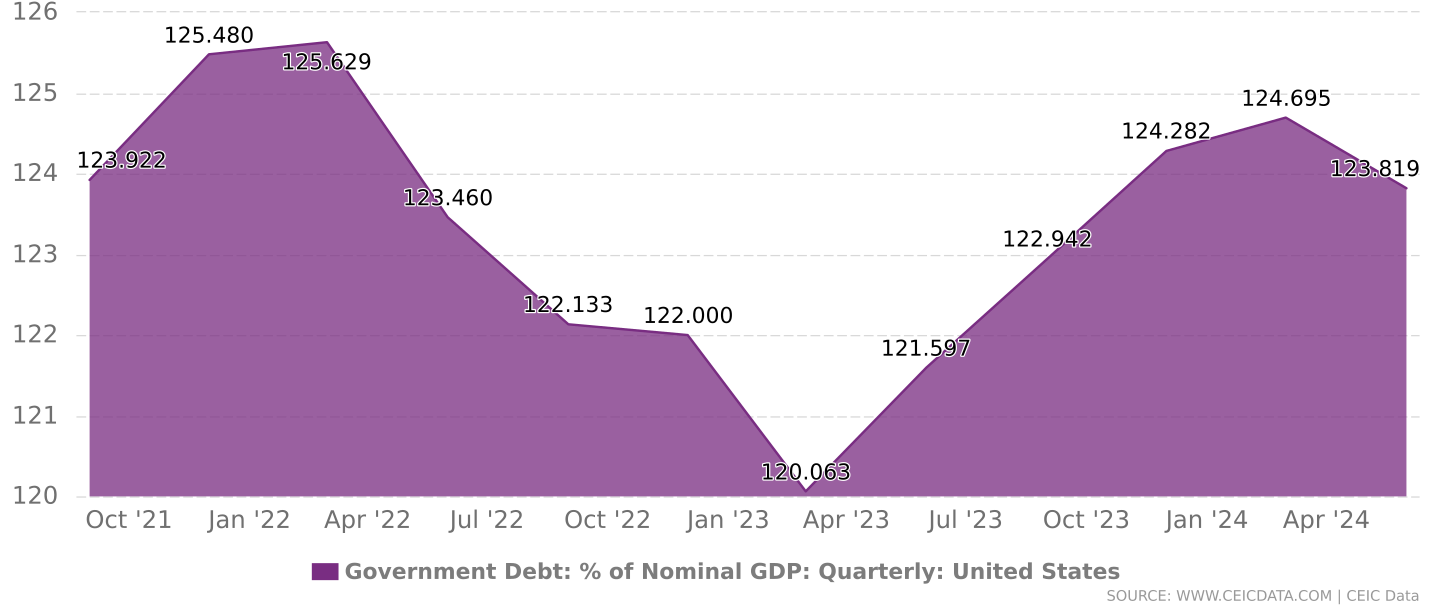

This theory only holds true in economies where the government can raise real interest rates i.e interest rates above that of the rate of inflation. However, with the US government debt/GDP sitting around 122% and approximately 20% of all tax receipts going towards servicing the interest alone by 2025 there’s simply no way I can see real interest rates shooting upwards anytime soon.

People will point to the TIPS market and CPI to make the case for inflation holding steady, with CPI expected to annualise at 2.9% in the USA for 2024.

The TIPS currently show market expectations of inflation sit at 2.1% yearly average over the next decade see here.

I will definitely take the over on that.

My Central Investment Thesis - How’s it working out?

Whilst I’m still a deep value degen at heart, I’m completely sold on keeping those plays to 20-25% of my portfolios and allocating towards capital-light, high quality compounders for the remainder.

My time studying Murray Stahl and conversing with James Davolos from Horizon Kinetics has evolved my thinking and capital allocation. I feel very comfortable passing on so many opportunities and allocating more of my investment capital towards fewer, higher quality business models which, unlike the turn-arounds, do not have to be ‘re-allocated’ nor ‘rotated’ over time. Rather these businesses can compound away through virtually any type of macro economic environment and over multiple cycles.

Much easier to win with this playbook and far less stressful.

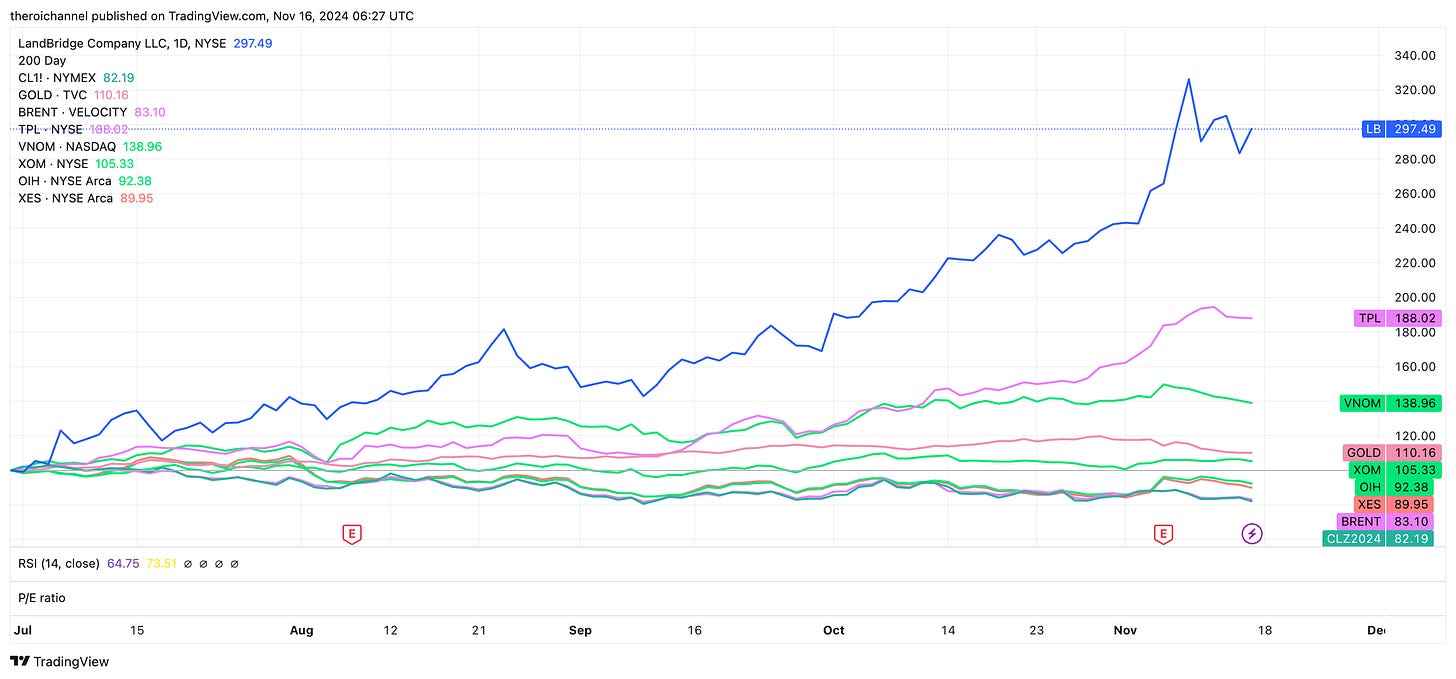

Here’s an example from the oil space illustrating the difference between the higher quality business models (Royalties) vs the main producer and two service indices in the sector.

Indexed to 100, the chart shows how a $100 allocation to each of the names has performed YTD.

Now you might be thinking, ok Benji but that’s only YTD and LB only IPO’d in July. Over time that might revert or somehow look different, right?

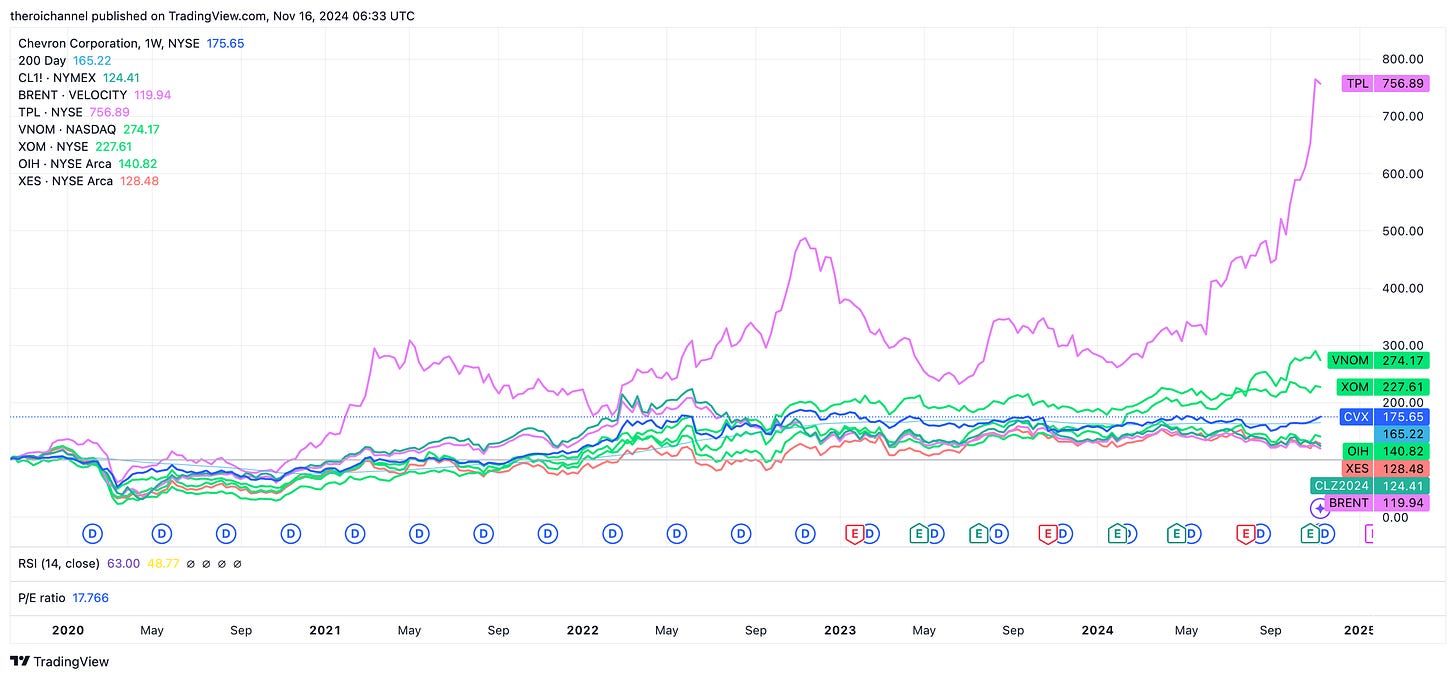

Well, let’s take a look over the last 5 years, I’ll take out LB due to it being such a new company.

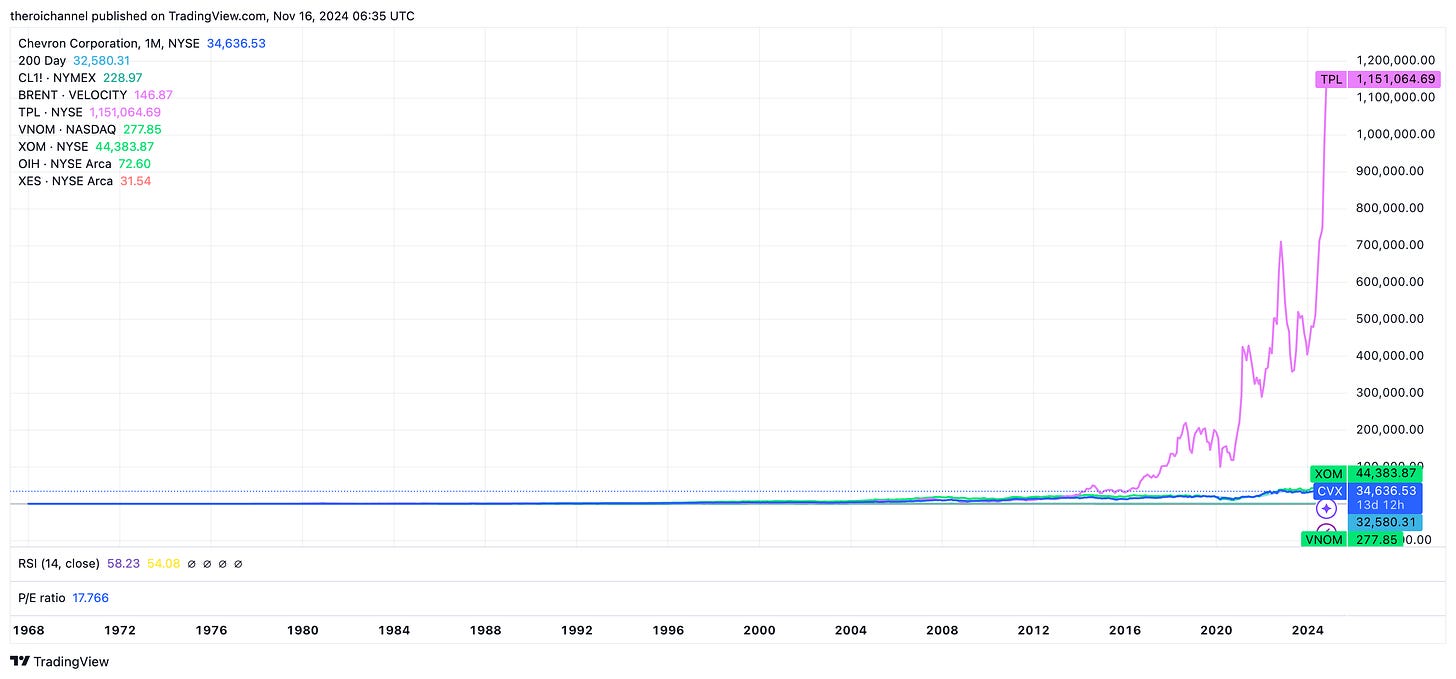

What about a longer timeframe then?

So there you have it.

Hopefully you’re starting to appreciate why I’ve been dropping everything else and moving more and more towards these types of businesses.

They are simply superior models and better stores of value.

The only thing I could find that matches TPL’s performance is Bitcoin.

But that’s a subject for another day..

If you’re interested in learning about the trades I’m putting on this week, sign up for a free trial today and you’ll gain immediate access + access to the entirety of my investment research.

If you then choose to stay on, paying annually will cost you the monthly equivalent of $25 and save a ton of processing fees. I humbly suggest it’s a no-brainer, given many of my ideas, such as TPL and LB etc have already been mutibaggers.

See you in the club.

Disclaimer: This publication is intended solely for documenting my personal journey with trading and investments for income and travel purposes. I am not a certified financial advisor nor am I a financial professional and none of the content provided should be construed as investment advice. It is essential to conduct your own thorough research and consult a registered financial service provider for appropriate guidance. I cannot guarantee the accuracy or completeness of the information presented. Any actions taken based on the information shared in any of my work are done at your own risk and discretion.

Keep reading with a 7-day free trial

Subscribe to The ROI Club to keep reading this post and get 7 days of free access to the full post archives.