Like buying Visa, but at 1x Book. PagSeguro!

Clipping the ticket on 192 million Brazilians adopting Digital banking & Payments.

Hello and welcome to the ROI Club, the club for private investors dedicated to the art & science of return on investment (ROI) and increasing their personal freedom.

This publication provides you access to my equity & investment research along with my sharing insights on how to live ‘The Maverick Life’ as I call it.

Today’s piece focuses on an investment opportunity that is unusual in that it touches on part of all of my main investment themes, yet doesn’t fit fully into any.

I hold a small but growing weighting in my private wealth portfolio (~1% equity + options) at time of writing and have made today’s piece free to give you a taste for my equity research and valuations.

You can gain access to all my research and even the exact trades I’m making in one of my portfolios, The Maverick Portfolio with premium access.

Paying annually, the membership is ~$20/month which I humbly believe is far less than the worth of the content.

Many ideas mentioned have appreciated 100%+ in the ~2 years I’ve been publicly sharing and I’m grateful for my subscriber’s appreciation for my work which often takes me to obscure and exotic places.

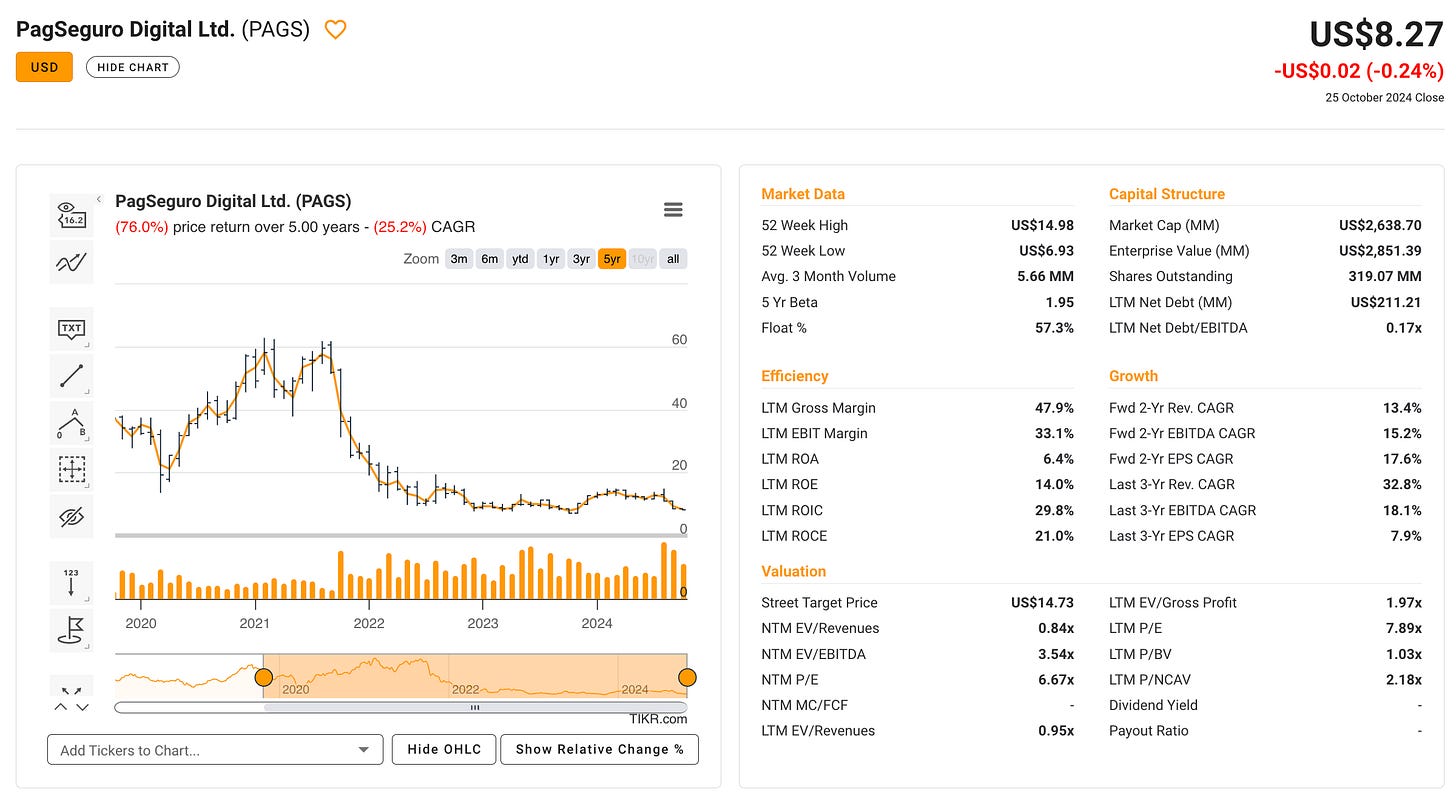

Today’s investment deep- dive is one such example, where I detail a little-known Brazilian Fin-tech Co. who’s currently trading at 1x Book value, having grown revenues AND earnings at over 50% YOY for the last 8 years and who’s market cap could soon 6x back to where it traded only 3 years ago.. You read that correctly.

See what fun we have in the ROI club?

Investment Idea: PagSeguro Digital Ltd. NYSE: PAGS

Executive Summary:

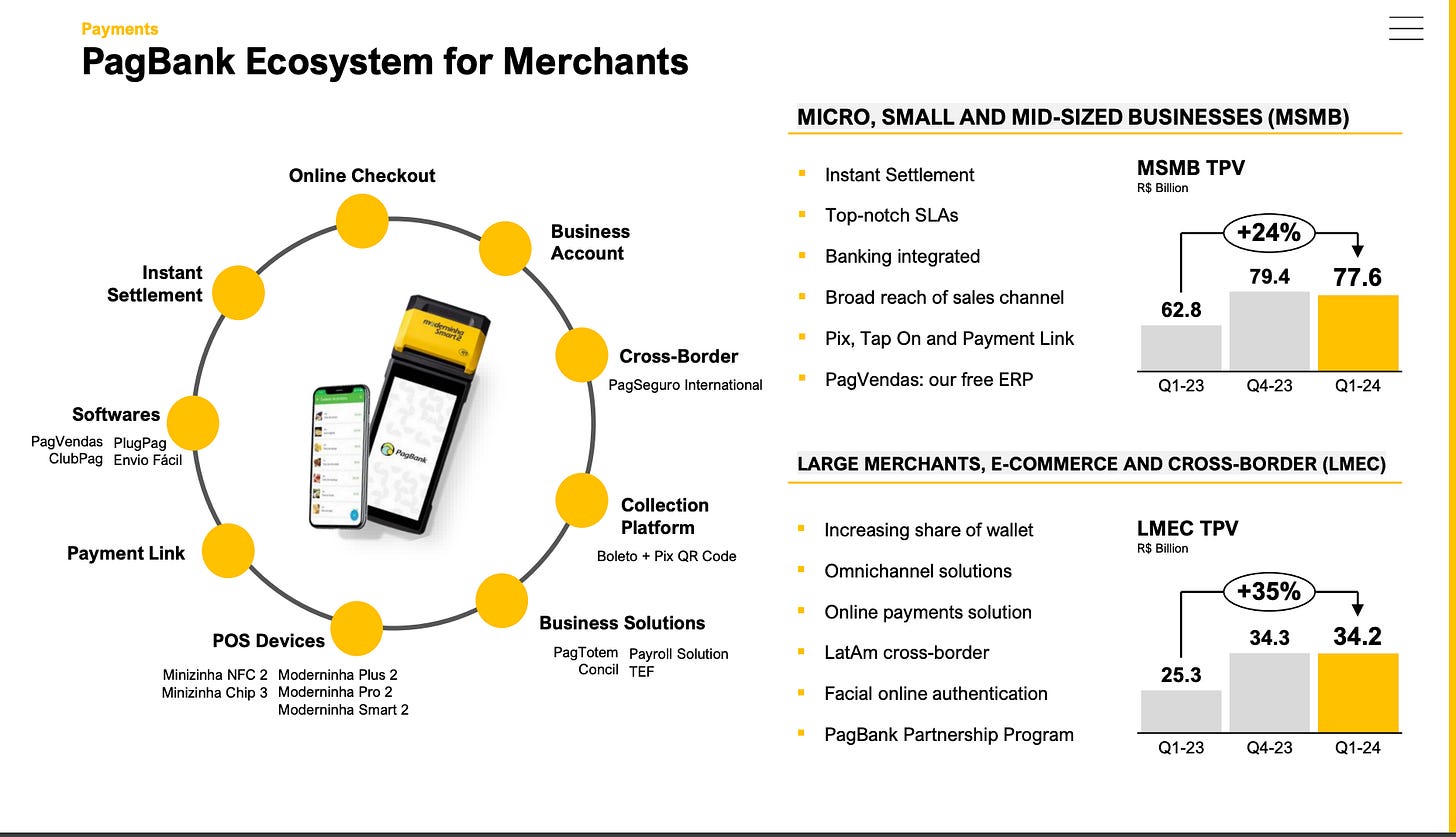

PagSeguro Digital Ltd. is a leading financial technology company based in São Paulo, Brazil, primarily serving consumers, individual entrepreneurs, micro-merchants, and small to medium-sized businesses.

PAGS provides payment systems, finance, banking and insurance products across the rapidly growing Brazilian market.

Investment Thesis:

PAGS is the leading capital-light investment instrument of choice to profit from both growth and normalised market valuations in Brazil. Its consistent 20%+ return on capital deployed speaks to its quality and stewardship and should echo an investors expected IRR over more than one capital cycle. A rare thing in an ‘emerging’ market.

Ben’s Brainstorm:

PAGS has a capital light business model and stands before an EPIC growth runway, being the digitalisation of the economic giant that is Brazil. Although without a claim on hard assets as such, it stands to benefit from increased transaction volumes and price amounts expected during inflationary periods without associated increases in its expenditure.

Contrary gringo prejudice, I see Brazil’s central bank as (relatively) sane and conservative which gives me confidence to invest (selectively) in its financial sector. In fact, it is the only financial company I own.

The Market Opportunity:

Brazilians are becoming increasingly digitalised in their payments and banking, this vast trend merits further discussion but in my summation here are the pertinent points:

Population and Digital Adoption:

Brazil's population is approximately 214 million as of 2024.

Digital payment adoption has grown rapidly, from 20% in 2018 to 90% in 2024.

The number of digital payment users has increased from 42.02 million in 2018 to 192.60 million in 2024.

Unbanked Population:

The number of unbanked adults has decreased from 34 million in 2018 to 22 million in 2024 = more and more transactions in the payment system

The overall digital payments market is projected to reach $253.70 billion by 2028, growing at a CAGR of 10.51% from 2024 to 2028.

Growing Credit and Banking Segment:

PAGS total credit portfolio stood at R$2.9 billion in Q2 2024, up 10.9% year-over-year.

The Network effect

Valuation:

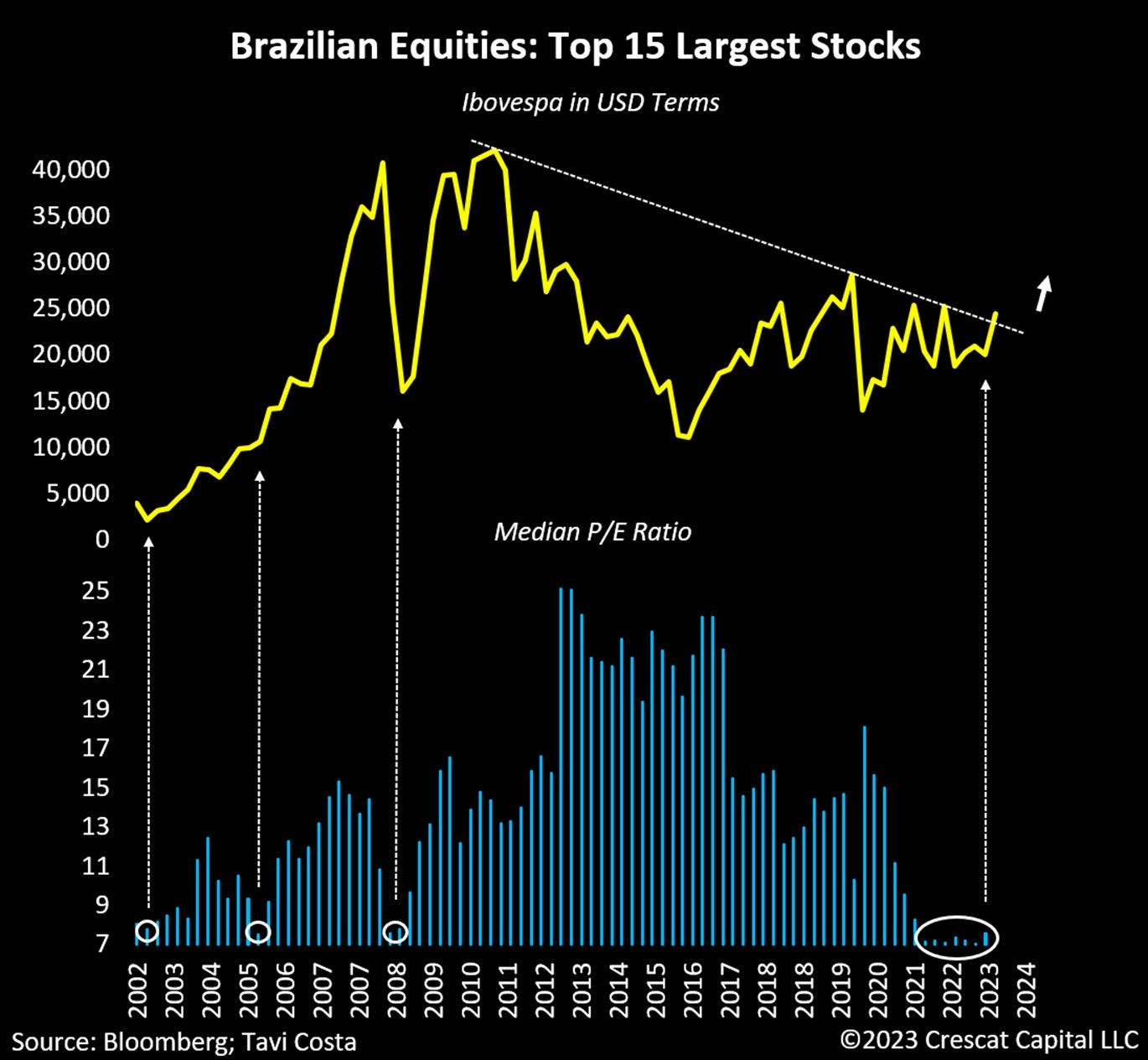

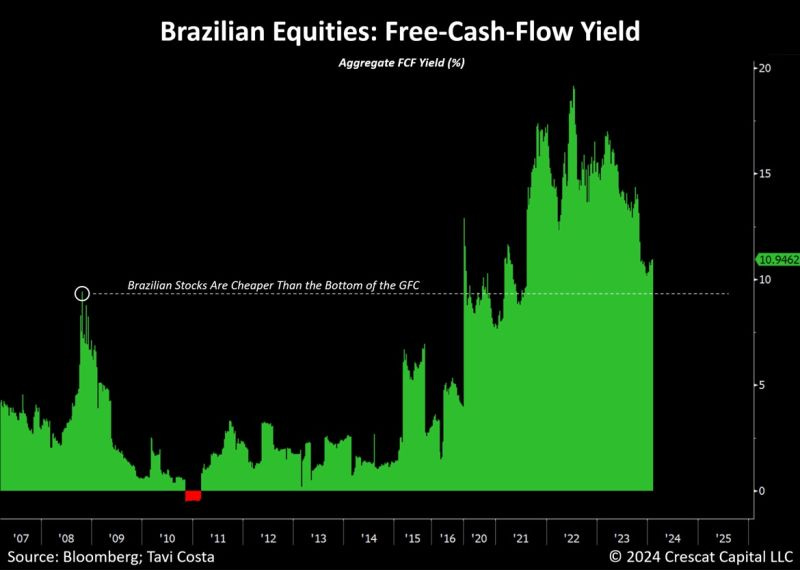

Despite all time highs in revenue and earnings PAGS trades at a lower market cap measured either BRL or USD than 5-8 years ago.

While top line growth is projected to moderate to high single digits over the next 4 years, margin expansion is on the cards with EBIT expected to grow over 20% CAGR and Free cash flow tipped to CAGR at 40%+.

Given the capital-light nature of its ecosystem I do think it’s likely to achieve over $1 Billion in FCF by 2026, which incidentally is an election year in Brazil (October 4, 2026).

Should Lula be ousted and Brazilian stocks receive a re-rating, neither a PE valuation of 10x or an EV/EBIT of 8x would be unprecedented.

Assuming minimal dilution, that implies a 2-5x might be on offer here for a high-margin solid financial co who sports a ROIC of over 15% in every one of the past 6 years, with >20% being the norm.

Just remember though..