Review - March 2023

Greetings from Playa Del Carmen, Mexico.

Firstly, welcome to all the new subscribers.

It’s a pleasure to have you onboard during these most interesting times.

In last month’s edition I noted that two of the key variables I’ve been following of late are the SPX as a measure of broad equities and the Us 10 yr yield.

Now, the 10 yr yield has dropped significantly over the last month despite the FED doing ‘NOT QE’. The latest fiascos in the US banking system caused by rate hikes has caused the market to believe the FED is close to ‘pausing’.

Meanwhile, the broad index looks set to close the month flat. Both these data points can be seen in the chart below, measured by % changes.

With regards to commodities, the below chart shows that despite broad downward pressure on the CRB index, a small rally appears underway. If/when the FED announces its pause/ease I expect this rally to resume its next leg up in this bull cycle. (And no, I don’t know when that will be but I suspect as soon as q4 this year is possible, although more likely in late 2024).

Crude oil futures specifically are currently down c.8% YTD mainly on the back of recession fears. It’s worth noting that even at current prices of WTI at $73 (as of writing) many producers, such as this month’s featured stock, are doing just fine with expected dividend returns of well over 20%. (Start your free trial to get my take).

Ben’s Buys.

What’s Ben Buying This Month?

In this segment I give you my take on a particular stock, including my investment thesis and valuation estimate.

To survive this inflationary environment it’s no secret that I’m looking for companies that have exposure to revenues that will out-grow the rate of their expenses in sectors that have seen a dearth of CAPEX and as such are due for a rebound in the prices of what they sell as demand starts to rapidly outpace supply.

In the video below I give a complete overview of one such company which I think can deliver outstanding returns, without the risks normally associated with the producers.

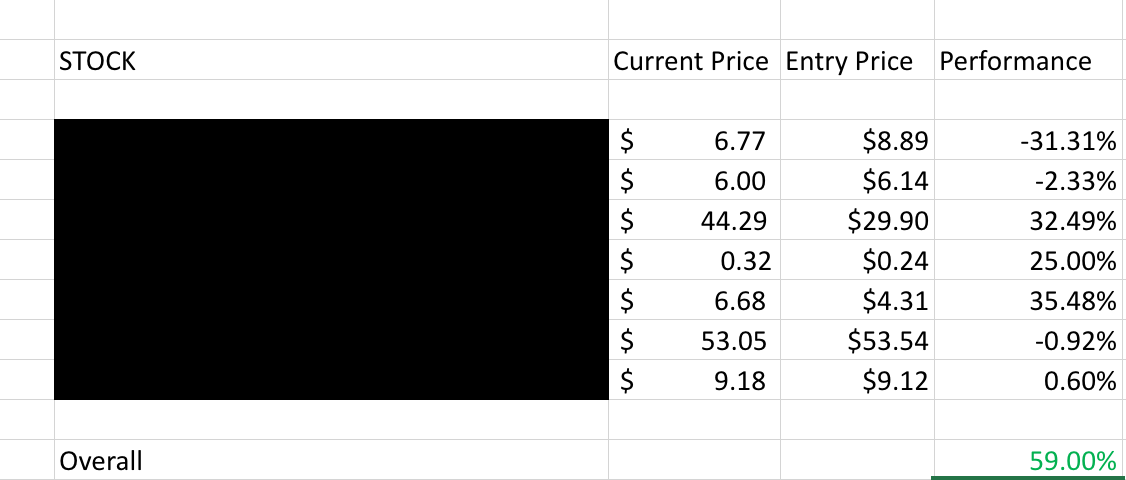

Subscribe to the ROI club today and become a member and gain access to ALL of my analyses + see a live performance breakdown of the stocks I’ve looked at in the excel sheet below ( currently up 55.44% at time of writing).

Start your free trial today and get access to everything FREE for 7 days and then decide if you do or don’t want to continue.

In my humble opinion, for less than $5/month when paid annually, it’s ridiculously good value.

See you inside the ROI club.

Ben

Not convinced?

Well take a look at how my take’s have done so far (obviously de-identified, but you can verify with free trial + member feedback)

Until next time, all the best & DYODD.

Benjamin.

*Disclaimer: I am not a financial advisor and this is NOT financial advice. The purpose of this publication is merely to document my journey in investing and to share it along with my opinion. Everything shared in this publication is purely my opinion, you should not make any financial decisions based on anything you see me do or hear me say. Please seek the appropriate professional advice before making any financial decisions. *

Keep reading with a 7-day free trial

Subscribe to The ROI Club to keep reading this post and get 7 days of free access to the full post archives.