Hello and welcome back to the ROI club, where members get access to my investment insights from all around the globe.

Volatility in global capital markets has me very excited and also pondering the meaning of life. Must be the panorama..

Now, onto the news and what I’m thinking.

So much chatter around the health of the US regional banking sector which has been smacked down 35%+ recently as seen below:

Fear selling followed from the demise of Silicon Valley Bank.

In short, the bank held way too many poor investments in a ‘hold to maturity account’ (HTM) which suffered losses when bond yields rose on the back of the FED raising rates. Normally the bank can carry these losses and redeem the bonds at expiration but when customers begun withdrawing their cash at scale, the bank was forced to sell these assets at large losses to cover the withdrawal needs to the point where it ran out of assets to cover withdrawals and bankrupted.

Panic selling thereon ensued throughout the entire sector.

My question: Do I believe the entire us regional banking sector is going to zero?

Because if I don’t, surely I can find some bargains and make some nice juicy profit.

Next thought, how to play it?

Safest way is probably to buy the ETF, reducing idiosyncratic stock risk and ride a reversion to mean valuation which might even yield me a 100% ROI if the ETF returns to where it was only in January.

What about searching through the rubble for an individual company that’s trading at criminally low valuations i.e a stock that feature’s in this months feature analysis trading at less than a third of its book value?!

Or, what If I could have the relative safety of the ETF AND massive leverage to the sector upside?

Well that’s one trade I’m making, the type of which I normally only share with my premium subscribers in Options Mavericks.

But today I’m going to share with you 2 trades that give me just the balance of asymmetric risk-reward ratio mentioned above.

If the ETF rises by just 10% by Jan 24th I’ll have made a 200%+ ROI, seriously!

If you interested in me sharing with you the exact details of this trade, become a paid member of the ROI club today for just $5/month paid annually.

So, what could end these banks?

Bank run.

Have depositors calmed down their rate of withdrawals?

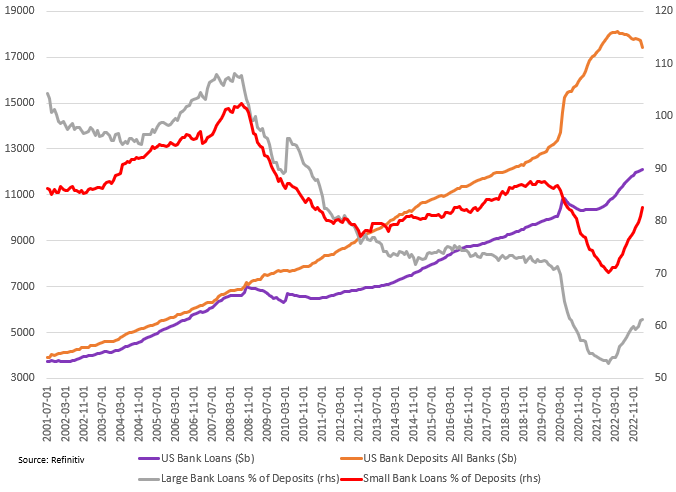

The chart below suggests they have.

So things appear to be calming for now.

What’s the future upside for banks when the market expects a far tougher business environment moving forwards?

My thoughts:

Banks can maintain/increase their net interest margins (NIM) as loans roll over by increasing interest rates on loans. Eg: today’s featured stock has basically doubled their loan rates in QOQ comparison to last year.

Discounted future earnings more than priced in, the market is pricing in expected ROA % at similar rates to during COVID.

Liquidity will likely be drawn from certain credit facilities if needed to survive for 12-18 months.

Many stocks will pay dividends while I wait for the trade to play out.

What’s Ben Buying This Month?

In this segment I give you my take on a particular stock, including my investment thesis and valuation estimate.

In this month’s members-only section:

My take on a stock I believe could potentially return 2-3x simply by reverting to its book value.

An options trades I am making with massive leverage to any sector recovery; one offers me 216% ROI if the ETF rises just 10% by January ‘24.

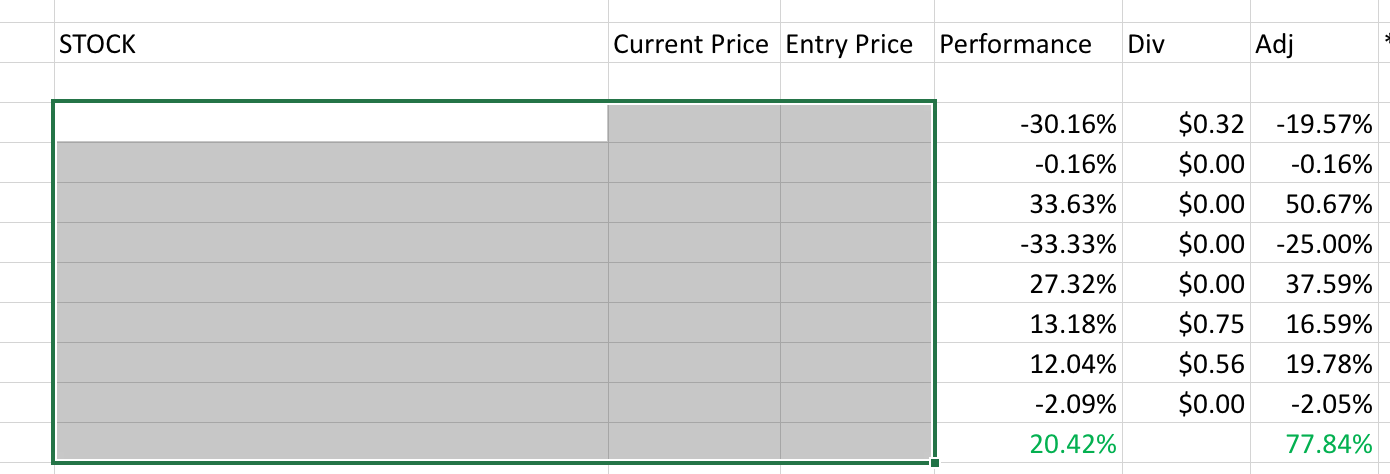

Subscribe to the ROI club today and become a member and gain access to ALL of my analyses + see a live performance breakdown of the stocks I’ve looked at in the excel sheet below ( currently up 77.84% Adj. at time of writing).*Important* this is a hypothetical selection of assets, the author does not and cannot guarantee results. The author is NOT qualified to give financial advice of any kind and nothing in this publication is to be considered financial advice.

Until next time, all the best & DYODD.

Benjamin.

*Disclaimer: I am not a financial advisor and this is NOT financial advice. The purpose of this publication is merely to document my journey in investing and to share it along with my opinion. Everything shared in this publication is purely my opinion, you should not make any financial decisions based on anything you see me do or hear me say. Please seek the appropriate professional advice before making any financial decisions. *

Keep reading with a 7-day free trial

Subscribe to The ROI Club to keep reading this post and get 7 days of free access to the full post archives.