Welcome to the ROI Club.

My no-frills, entry level publication that I believes delivers some of the best value (ROI) around.

MARKET UPDATE:

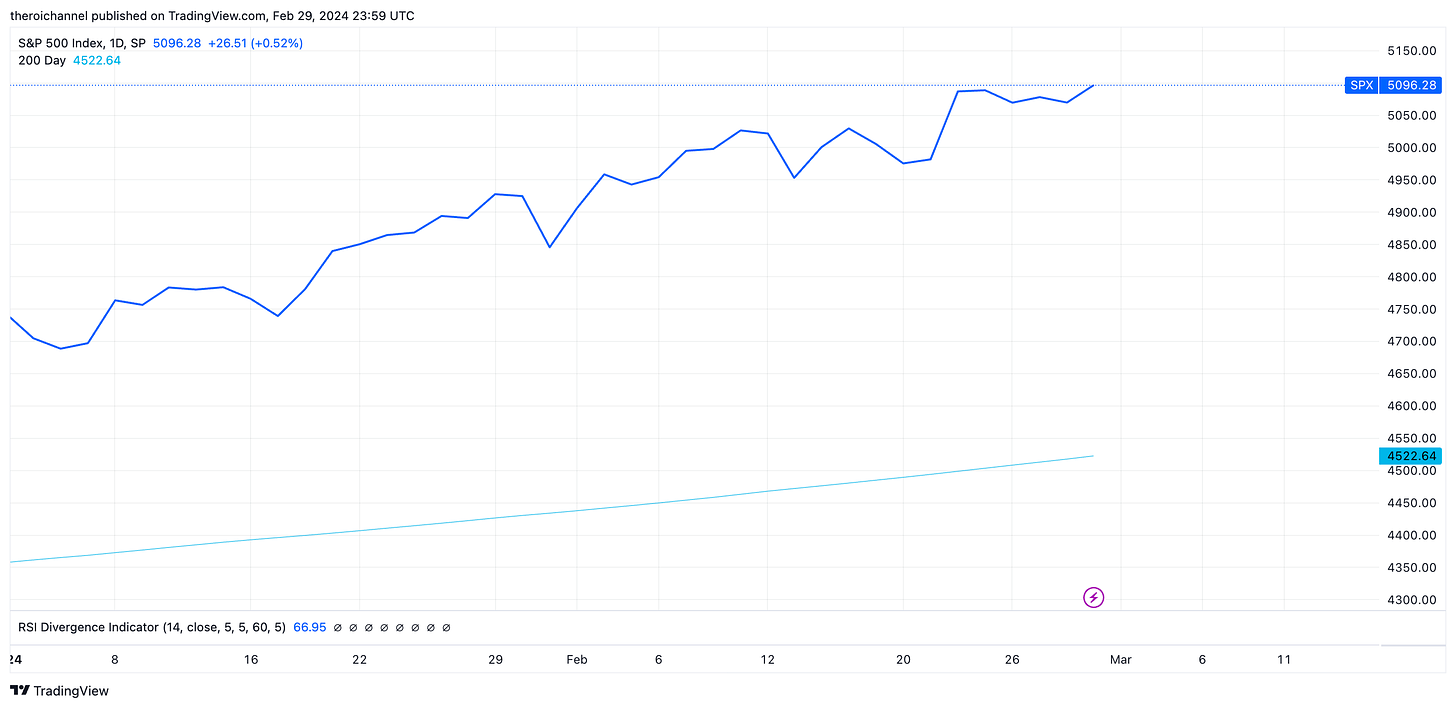

Every man and his dog is commenting on the absurdity that is the S&P “500” index pricing right now and as my style involves looking where everyone else isn’t, I won’t add much here other than to say that since Jan I’ve been increasing my cash weightings across all of my portfolios. I now hold 21% cash in the publicly available portfolio and circa 40% in my private wealth portfolio.

I still believe the energy and now precious metals sectors present opportunity and as such I’m continuing to look over the aforementioned sectors with an eye for a 18-24 month horizon.

Chinese stocks appear interesting given their recent shellacking, but I am yet to make any meaningful purchases as I need a LOT more ignorant recklessness confidence to enter a market of which I really know nothing.

Natgas I’ve never liked it, too hard basket for me. I think my good friend James MacKay sums it up best here in an excerpt from a DM:

Coal I want to increase my exposure over the long term here, even with thermal prices likely to be softer on the back of a gas glut. As you know, I went heavily into YAL over other options as I just think it was a simpler play. With the WHC deal being brought forward (April is now the due date to close) I want to see how they go with their cash reserves. YAL still for me is my biggest position in the private wealth portfolio.

Oil remains my preferred sector, in particular offshore oil services (VAL RIG BORR) and large vertical integrated SOE in LATAM (PBR and EC).

*Today’s featured stock is a little-known ONSHORE service Co. which has: ZERO debt, accelerating growth in free cashflow, a TTM dividend yield of 25% and John Fredriksen at the helm as a 48% major shareholder.*

My friends, if it’s one thing we know about Johnny Boy - he looooooves a divvy!.

Full analysis and valuation is below behind the paywall BUT… for those of you too cheap to pay $99 a year you can read my executive summary for free here

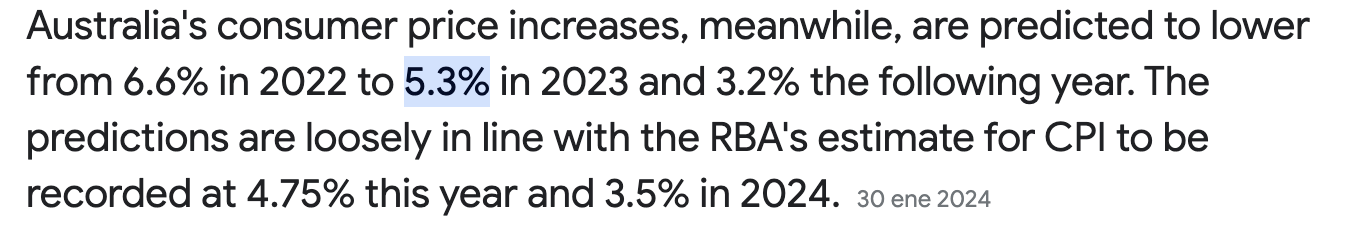

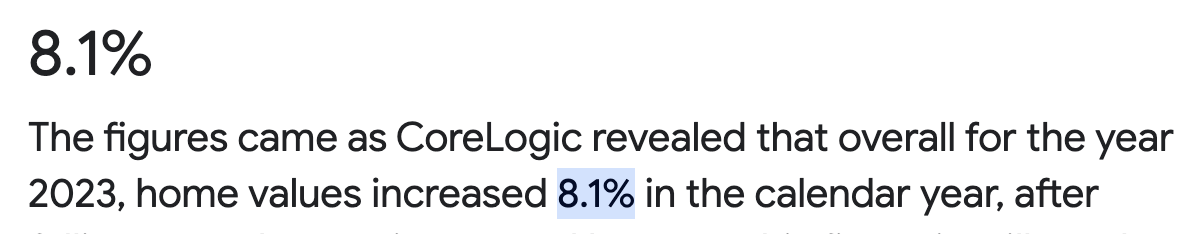

INFLATION, METALS, AUSSIE PROPERTY PONZI.

Gold in USD is up 11% and yet the major gold miners fell nearly 5%

Not even the great Aussie Property juggernaut is keeping pace with my true indicator of inflation..

I am (begrudgingly) looking to re-enter this ponzi as I need a hedge for my future if I decide to stay here longer term. I consider it essentially a levered short position against the AUD with optionality for the future (residence to raise kids, rental, development etc) I think I’ve found one that fits the description - will do a full breakdown if the purchase goes through.

E Toro update

I hope you enjoyed reading my thoughts for Feb, just a reminder:

*Today’s featured stock is a little-known ONSHORE service Co. which has: ZERO debt, accelerating growth in free cashflow, a TTM dividend yield of 25% and John Fredriksen at the helm as a 48% major shareholder.*

Ok, here is where I drop the curtain and share in exact detail how I’m positioning to profit from the aforementioned thesis. When you become an ROI club member you will get my full deep-dives from all past editions + this month’s idea which is set to print huge profits in this sector, trading at a discount to their Net Asset Value.

See you in the club.

Benjamin

Disclaimer: Each and every publication of the author, Benjamin, is intended solely for documenting my personal journey with options trading for income and travel purposes. I am not a certified financial advisor, and none of the content provided should be construed as investment advice. It is essential to conduct your own thorough research and consult a registered financial service provider for appropriate guidance. I cannot guarantee the accuracy or completeness of the information presented. Any actions taken based on the information shared in Options Mavericks are done at your own risk and discretion.

Keep reading with a 7-day free trial

Subscribe to The ROI Club to keep reading this post and get 7 days of free access to the full post archives.