$NFE Update: $1 Billion per year contracted EBIT = misunderstood opportunity.

The 1% That Causes 50% of The Problems..

Welcome to the ROI club, a club for private investors interested in growing their net worth and increasing individual sovereignty.

Today’s piece outlines my updated take on NFE 0.00%↑, an amazing infrastructure/utility company well situated to take cheap natural gas and sell energy to a growing market, mainly in Latin America.

Everyone is familiar with Vilfredo Pareto’s 80/20 principle whereby in many situations in nature 80% of some result is due to 20% of the factors included.

Few, however, extrapolate that further and realise that 0.8% of factors included in any given set likely produce 51.2% of the outcome measured.

(Keep applying 20% of the initial 20% on the causative side and 80% of the initial 80% of the measured side, or just remember the rough rule of 1% of inputs produces ~50% of the outcomes in power law distributions..)

NFE represents circa 4% of my private portfolio currently and yet I estimate about 64% of the questions and requests I’ve been receiving have been centred around this stock. So here’s my take..

The company has exhibited tech-like growth on the top line and continues to cement its competitive advantage in the region by acquiring long life (~15 year+) government contracts guaranteeing billions of future earnings.

It is a misunderstood infrastructure/utility co masquerading as a natural gas dealer and has been recently doing its best impersonation of a complete shambles.

You can find my original thesis on the company here where I summarised the opportunity as ‘ A Utility-like company with multi-bagger potential.

So, why all the fuss?

Let’s concisely put together the ingredients of this recent comedy of errors in recipe form:

Puerto Rico exercises its right to buy back the power plant NFE had built there, causing uncertainty as to when the funds would be received.

This significantly alters NFE’s debt/asset ratio to the point it puts it outside their creditors accepted range, technically leaving them in violation with their loan covenants.. uff..

In turn, this causes the company to halt the dividend payment the market was expecting.

NFE is given 7 days to basically restructure their entire debt stack.

Add all this into the mix and the market sells this thing off indiscriminately.

So after some time in the oven, how does this thing look now?

Kind of like the first time I baked empanadas, rough on the outside but tasty AF once I let them cool off.

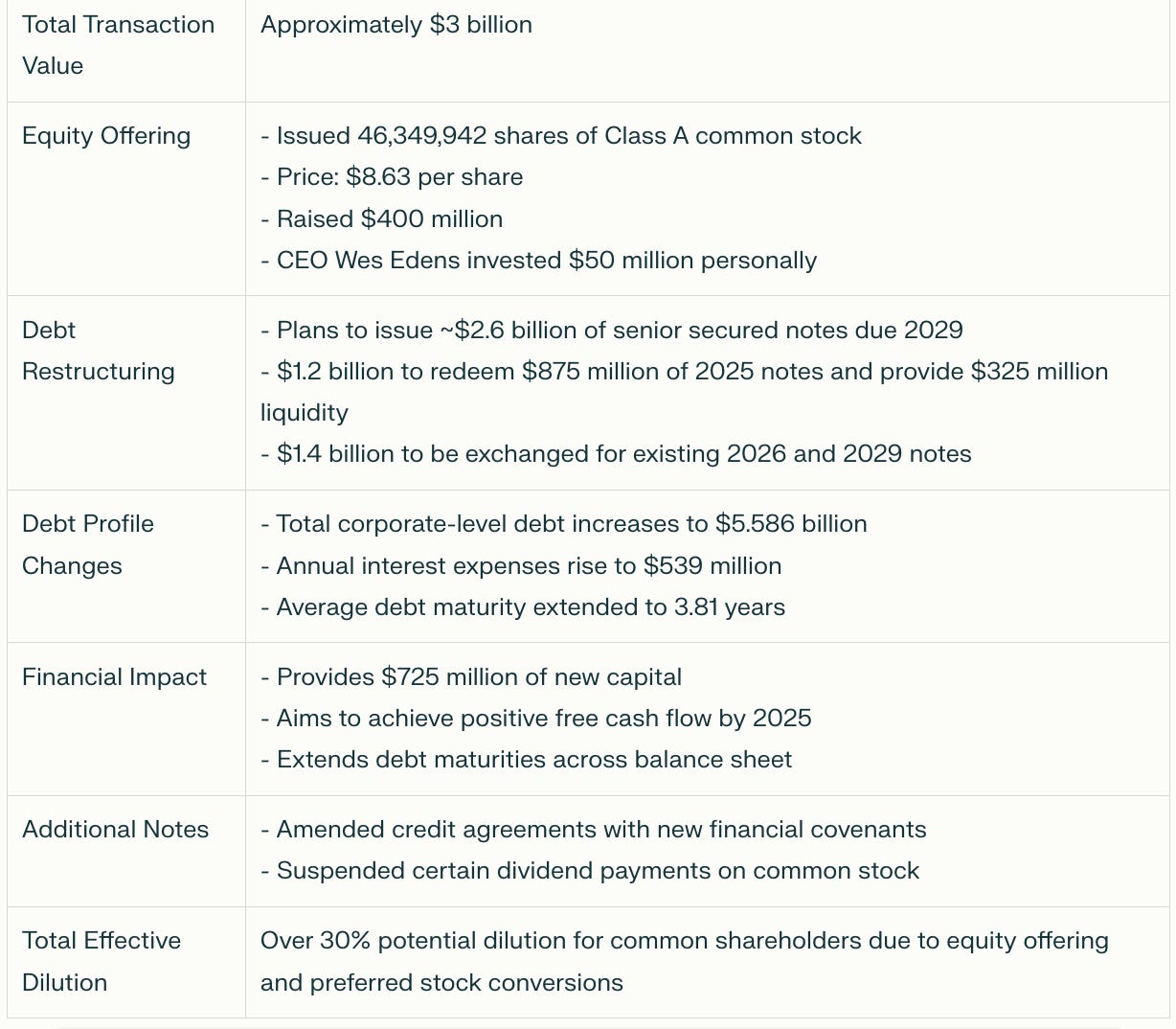

For a more financially precise take:

New debt wall:

So, what do I expect this thing to earn and will it be enough to comfortably service and pay down these liabilities?

In short, yes.

NFE has longstanding government contracts to supply 170 TBTU per annum with an average margin of $7/mmBTU which is roughly $1.1 Billion in EBITDA with an average overall life of contract at 18 years.

That’s the reality.

So whilst the legal team and CFO should have seen the contingency coming, if the PR gov didn’t execute the buy back, or delayed doing so we’d all be none the wiser.

The knocks on this company were always around: doubts over whether fast LNG would work and the debt.

Whilst the c-suite hasn’t exactly alleviated concerns over the eventual capital returns policy expected, FAST LNG is operational and adds roughly $500 million in free cash from Altamira alone now.

With several new power plants due for completion and operational by Q4 this year I see a pathway to doubling EBITDA over the next 3-4 years. This implies that although NFE currently looks like a burnt empanada, I think it will do $2.5B annually in EBITDA by 2026 or 1x its current MC.

With circa $1 Billion in CAPEX PA, the 2029 notes can (should) be retired and you’re likely looking at quasi-utility confirmed free cashflows of $1.5-$2 Billion expected over a further decade or so.

Without the debt load + locked in margins and infrastructure that’s damn hard to compete with, 17x EV/FCF doesn’t seem unreasonable at all to me.

Without accounting for future growth and contracts won that logic allows me to envision an EV of ~$25 Billion by the end of this decade or 10x its current market cap.

As always though, not a recommendation - DYODD.

Benjamin

where ru Ben, NFE is crushed, will it survive. what say you?