Welcome back to the ROI club where I share with you my equity research and valuation of investment opportunities I find interesting.

Today’s edition is the 3rd and final instalment of the trio of major investments I have made in the offshore space; RIG, VAL and BORR drilling, which is the subject of today’s instalment. I’ve dubbed the trio ‘ The 3 sisters of offshore drilling’ and you can find my analysis of VAL and RIG in the free articles below:

If you enjoy my work I’d really appreciate you spreading the word via the share button below, additionally you’ll find a ton of value in my youtube channel here where you can judge my acumen for yourself by looking back on the calls I’ve publicly made over the last 3 years.

Let me begin today’s analysis with an excerpt from GoRozen’s most recent commentary:

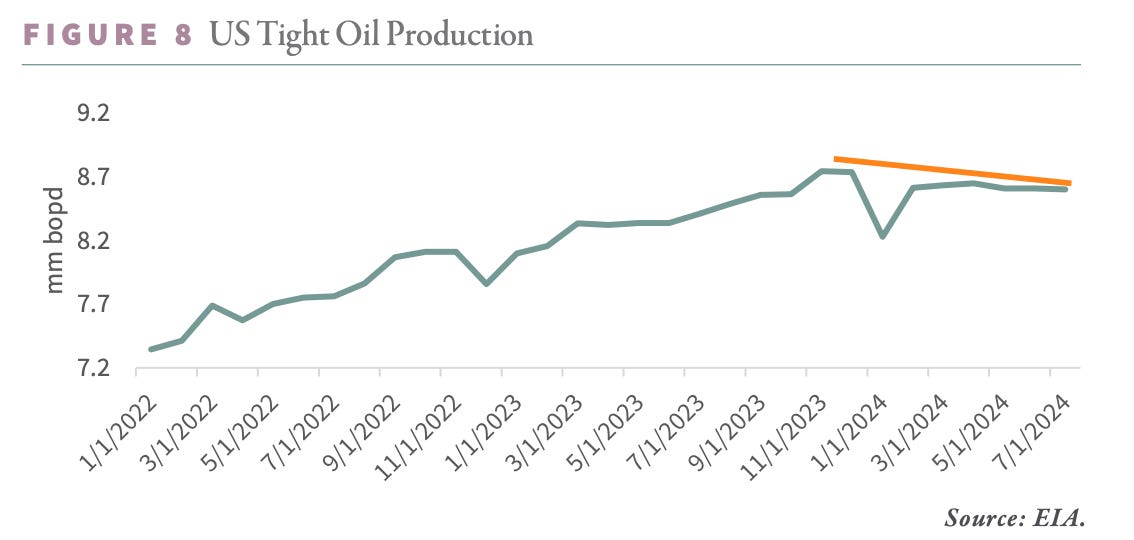

“ Our view remains steadfast: the cessation of shale growth will likely steer oil companies back offshore. The current dayrate structure, while sufficient to generate healthy cash flows for drilling companies, is far from adequate to spur newbuilds. Moreover, many shipyards have shifted away from the oil and gas sector after years of tepid demand. A new offshore bull market is likely emerging. As shale production wanes and high-quality drilling opportunities become scarcer, we anticipate reallocating more of our investments from the shales to the offshore sector.”

My sentiments echoed.

The anaemic growth in Shale is likely to be good for oil services, particularly offshore, along with producers outside of the USA. I’ve spoken about such companies in the past i.e: PBR, EC, GPRK, MEG etc.

Sticking with offshore, Evercore estimates that “capex is expected to exceed $200 billion in 2024 and reach $234 billion by the end of 2027”. Given that the average offshore project can return an IRR of 30% at $70/BBl I contend that the recent sector selloff has been overdone.

We don’t need a moonshot in oil prices to continue to see an uptick in rig contracting and capital flowing into the offshore sector, rather E&P majors need a stable environment suitable to the long term nature of these projects.

Which leads me to BORR 0.00%↑ a pure play on Jack- up rigs. The equipment of choice for shallow water oil drilling.

For access to my equity research, including my full valuation of the stock and expected return on investment please become a premium member of the ROI club below. You can opt for a free trial hence I’m sure you’ll appreciate the opportunity to get access to my best ideas risk-free.

See you in the club

Keep reading with a 7-day free trial

Subscribe to The ROI Club to keep reading this post and get 7 days of free access to the full post archives.