Welcome to the ROI Club.

My no-frills, entry level publication that I believes delivers some of the best value (ROI) around.

Ask any of the members - they’ll verify.

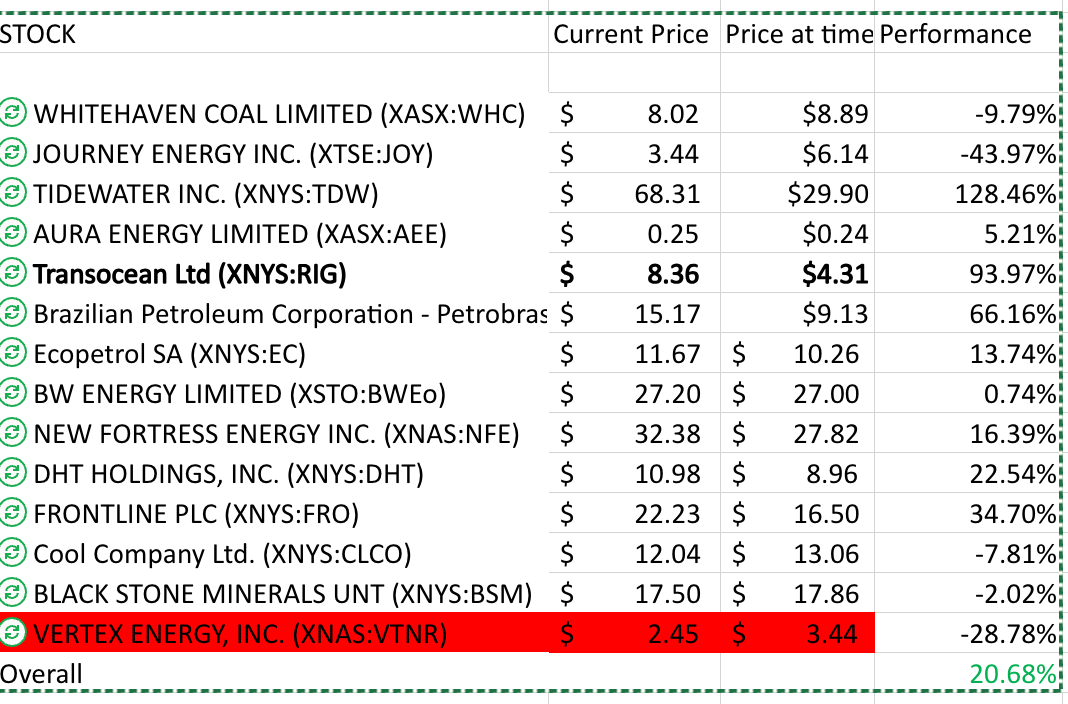

Below is a snapshot of the names mentioned last year and their current price performance.

Or simply take a free trial and you can literally go all the way back and view the content as it was put out.

What’s The Deal With This?

Here I publish minimum once per month to give my take on what’s happening in the market and when you become a paying member you get access to my deep-dive analysis and valuation on at least one investment opportunity per month.

In the club I keep things super-simple and share my thoughts on opportunities I find appeal along with resources I think will be of great benefit to you.

As you can see from the above results I think the investment of $99.95 / year is more than made up from the value provided.

I buy things at a discount to the Net Asset Value (NAV), trading at high Free Cashflow Yields with a clear pathway to shareholder returns. My philosophy here is to identify those opportunities with multi-bagger potential (100%+ returns) over a 3-5 year time frame.

Sector Sentiment: Offshore Oil

Something that’s been on my mind over the New Year break - Stanley Druckenmiller’s incredible performance record:

Ave yearly return of 30% over three decades.

Considering the size of the portfolio he manages and the duration of the outperformance, this is simply incredible.

- For context: 30% yearly for 30 years can turn $10,000 into $26,000,000.

My ‘resolution’ for 2024 is to apply the following concepts from ‘Druck to my investing religiously:

Focus is on predicting future market conditions in an 18-24 months timeframe.

How will I set up to invest with that mindset?

Concentrated bets:

“When you have tremendous conviction on a trade, you have to go for the jugular”. I am willing to pay the price of looking silly in the short term in order to benefit enormously in the event my 2-3 year thesis play out.

So whilst it's been uranium that has been all the rage recently, I’ve already start to think about the best opportunities set to mature in 2025/26.

I’m extremely excited to be doing some deep dives into the oil services sector, particularly those companies in the offshore space. I’ve already began allocating capital buying stocks and selling options on various names, one of which is the featured company in today’s article which you’ll find behind the paywall.

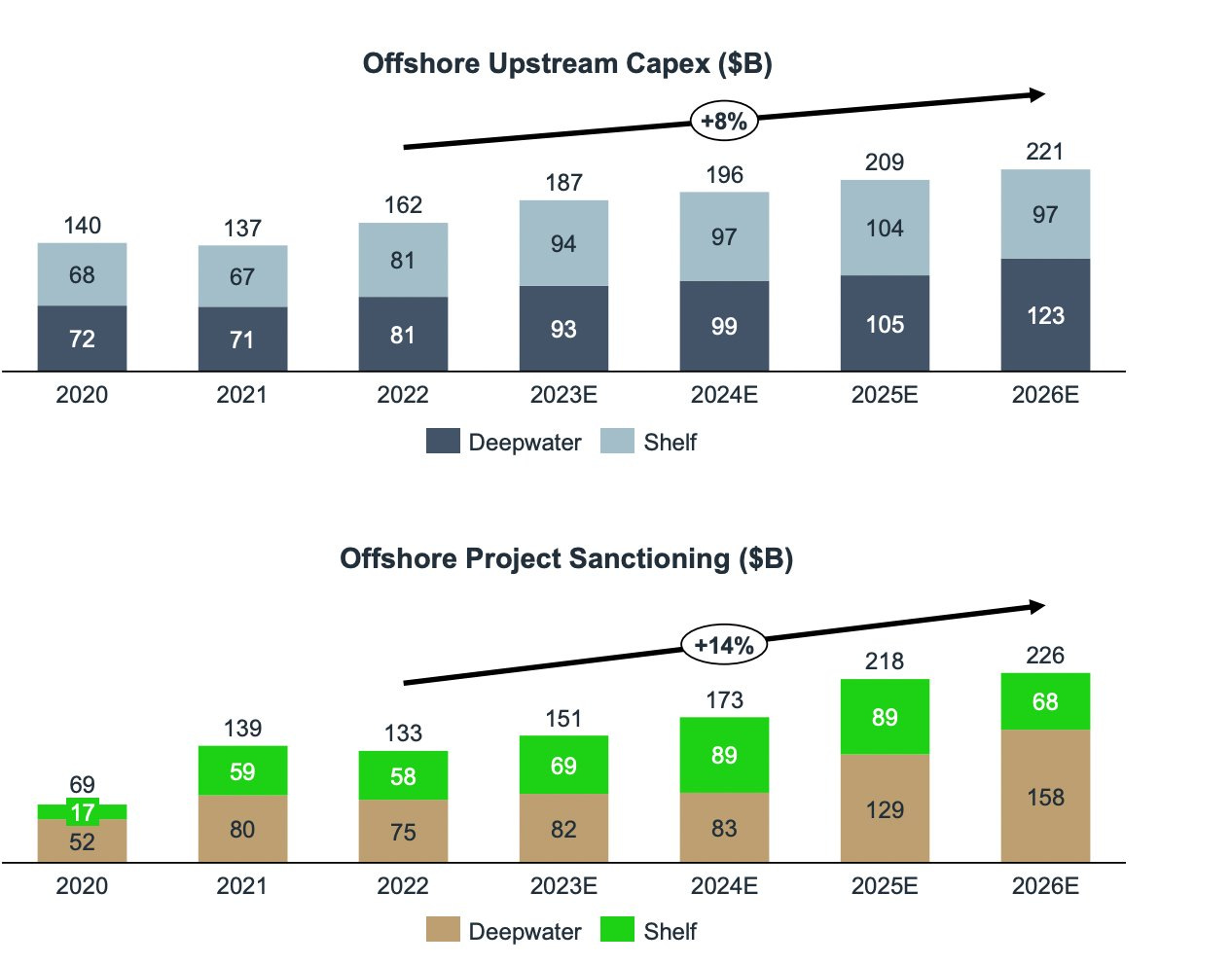

Take a look at the growth runway for capital inflows in this sector below.

The sector has inflected from a bad bear market and now not only are we on the verge of a supply crunch with circa 27% of the fleet (net) coming into retirement age in the case of jack-up rigs but some of these names are trading at STEEEEEEEEP discounts to their replacement costs.

One such company is set to PRINT cash over the next 3-5 years and I believe the price today is only equal to 1x its 2026 est. EBITDA.

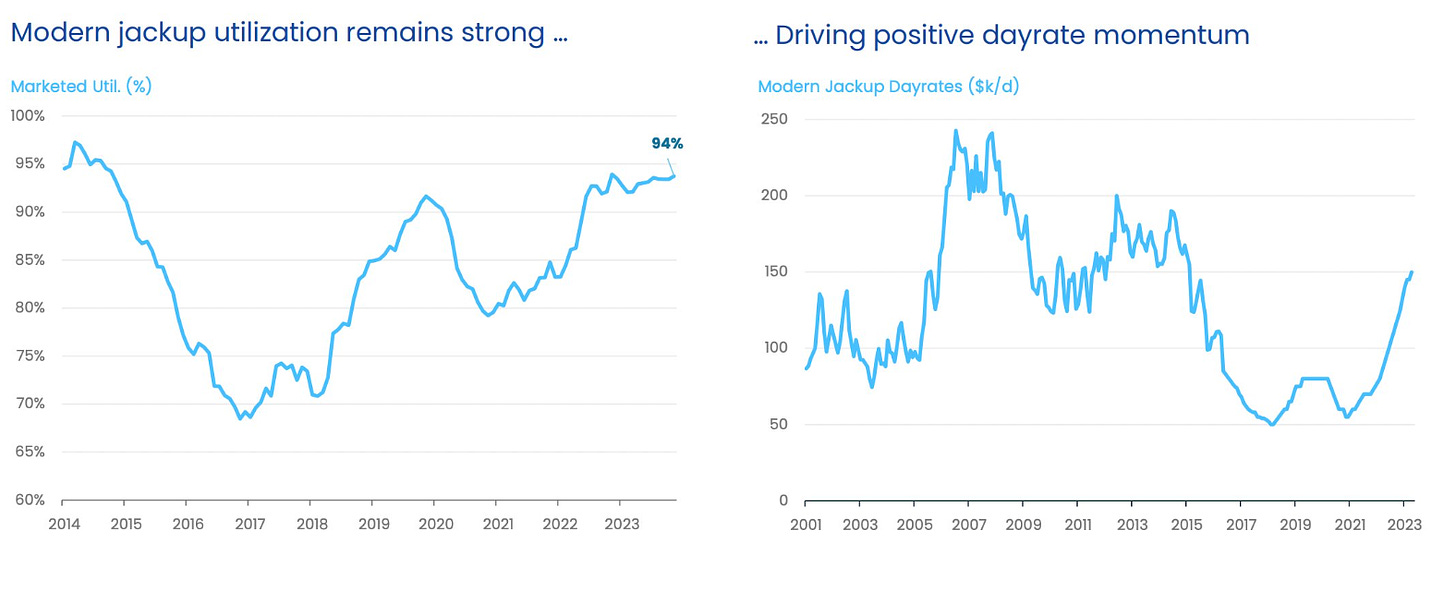

Here’s the thing, when the fleet utilization rate gets above 95%, the prices (day rates) these companies can charge simply takes off. Think vacancy rates at a hotel, when there are plenty of rooms available and lots of competition, the owner has to keep prices low and competitive. But when your occupancy is close to saturated and the same goes for every hotel in your town… well prices skyrocket.

And that is where I believe we are just a whisker away from this year… see below

Ok, here is where I drop the curtain and share in exact detail how I’m positioning to profit from the aforementioned thesis. When you become an ROI club member you will get my full deep-dives from all past editions + this month’s idea which is set to print huge profits in this sector, trading at a discount to their Net Asset Value.

See you in the club.

Benjamin

Disclaimer: Each and every publication of the author, Benjamin, is intended solely for documenting my personal journey with options trading for income and travel purposes. I am not a certified financial advisor, and none of the content provided should be construed as investment advice. It is essential to conduct your own thorough research and consult a registered financial service provider for appropriate guidance. I cannot guarantee the accuracy or completeness of the information presented. Any actions taken based on the information shared in Options Mavericks are done at your own risk and discretion.

Keep reading with a 7-day free trial

Subscribe to The ROI Club to keep reading this post and get 7 days of free access to the full post archives.