Offshore Oil Vs Uranium.

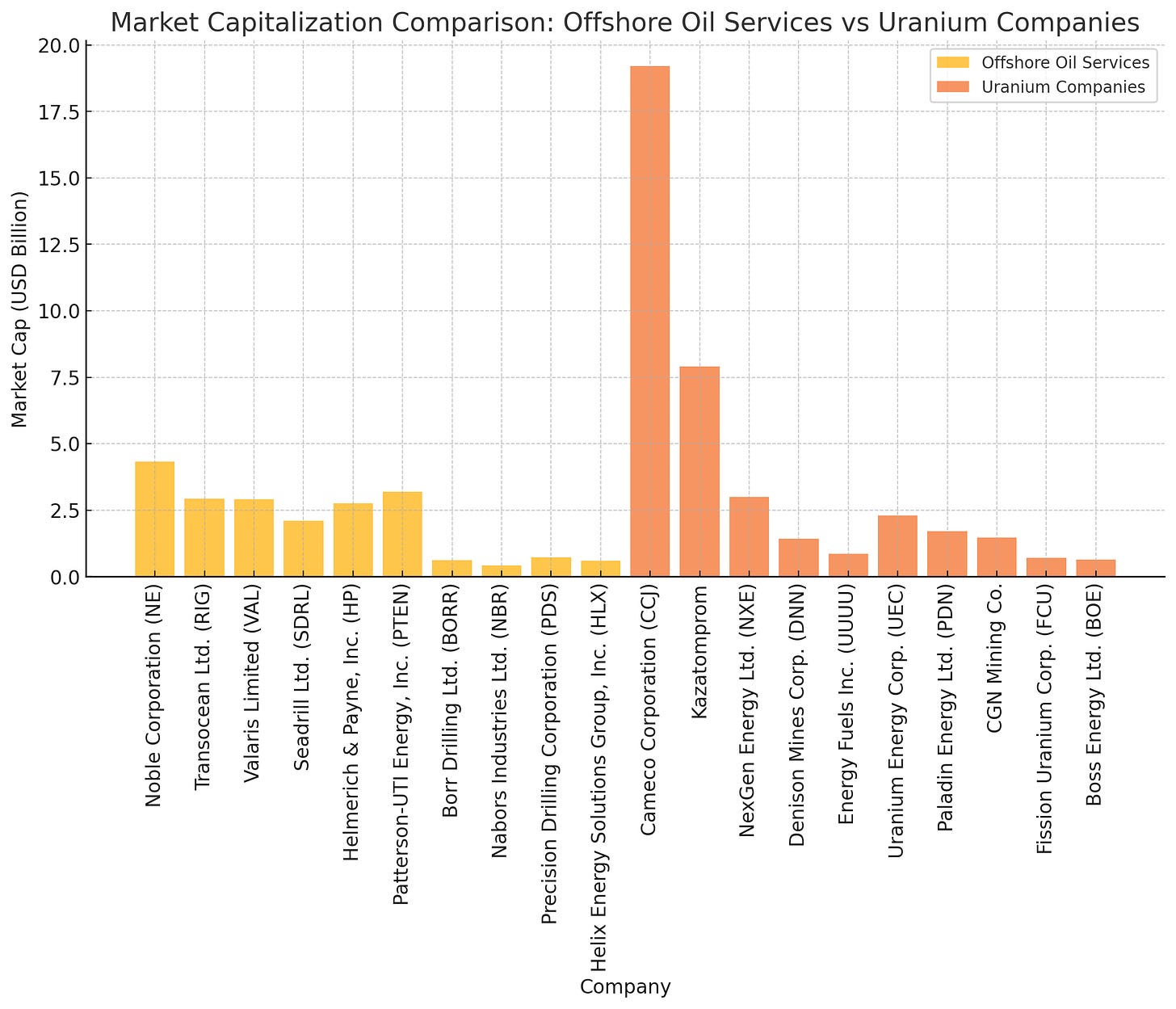

Comparing a select basket of oil service Co.s with the Uranium sector.

Welcome back to the ROI club.

I have not had significant exposure in the Uranium sector since early 2024 and currently my only related holding is UROY, expressing my preference for royalties as a superior business model.

However I have owned and continue to hold a significant interest in the Oil services sector, particularly in the offshore sub-sector niche since circa 2021.

With the recent aggressive selling pressure across both sectors, I thought I would leave my thoughts below for perusal as to where we stand currently in both sectors’ theses and their relative value.

The Big Picture

As of today, March 4th 2024, the energy sector makes up about 3.17% of the S&P 500.

This historically meagre percentage is mostly composed of the production giants:Exxon, Chevron, et al. Almost unbelievably the oil service companies, which provide the essential technology and infrastructure for hydrocarbon production used by the above companies, have de minimis representation.

Schlumberger (SLB), holding just 12 basis points in the index. The rest are are practically without representation.

For reasons I have mentioned in the past, my investments in energy are barbelled between high quality capital light land owners with royalties on-shore and cyclical, capital intensive service companies backed by unencumbered steel in the offshore sector.

Those ‘inflection investors’ looking to catch the next wave of ‘capital rotation’ must surely see a Tsunami on the horizon when they cast gaze towards the Oil services sector.

There has been a lot of noise made on X over the last 5 years about the Uranium story. Apart from the impending supply-demand deficit posited by many, an influx of institutional capital to the relatively small collective market cap of that sector is central to the thesis.

So if one adopts a similar lens to that of the Uranium crowd’s that capital will flow into the space and applies that to the offshore services how do the two sectors compare?

Which stands to benefit the most from the ‘ Hoover dam through a garden hose ‘ effect? (To quote my other uncle, Doug Casey).

The Numbers Tell the Story

Oil Services Companies (Excluding SLB, HAL, and Baker Hughes):

Noble Corporation (NE): Approximately $4.33 billion.

Transocean Ltd. (RIG): Approximately $2.93 billion.

Valaris Limited (VAL): Approximately $2.91 billion.

Seadrill Ltd. (SDRL): Approximately $2.11 billion.

Helmerich & Payne, Inc. (HP): Approximately $2.75 billion.

Patterson-UTI Energy, Inc. (PTEN): Approximately $3.20 billion.

Borr Drilling Ltd. (BORR): Approximately $0.62 billion.

Nabors Industries Ltd. (NBR): Approximately $0.42 billion.

Precision Drilling Corporation (PDS): Approximately $0.73 billion.

Helix Energy Solutions Group, Inc. (HLX): Approximately $0.60 billion.

Combined Market Capitalization: Approx. $20.60 billion.

Top Uranium Companies (Excluding BHP):

Cameco Corporation (CCJ): Approximately $19.2 billion.

Kazatomprom: Approximately $7.9 billion.

NexGen Energy Ltd. (NXE): Approximately $3.0 billion.

Denison Mines Corp. (DNN): Approximately $1.42 billion.

Energy Fuels Inc. (UUUU): Approximately $0.86 billion.

Uranium Energy Corp. (UEC): Approximately $2.3 billion.

Paladin Energy Ltd. (PDN): Approximately $1.7 billion.

CGN Mining Co.: Approximately $1.46 billion.

Fission Uranium Corp. (FCU): Approximately $0.7 billion.

Boss Energy Ltd. (BOE): Approximately $0.63 billion.

Combined Market Capitalization: Approximately $39.17 billion.

So, a select basket of the offshore players which are more directly involved in the extraction and heavily backed by tangible assets and clean balance sheets (ex. RIG) comes in at a meagre $20.6B Vs the top uranium stocks which includes the two sector bell weathers at a collective $39.2B or almost 2x.

Given the lack of ‘steel-backing’ in the U sector and the serious doubts I have over most of the producers/developers on the above list, paying half the collective price for debt-free drillers who are, or soon will be, net income positive and trading at dimes on the dollar for their new build values seems more attractive to me.

Note: These figures are approximate and based on the latest available data as of March 2025. Market capitalizations are subject to change due to market fluctuations.

The Supply Crunch: Imminent V Futuristic

With the U.S. Strategic Petroleum Reserve depleted and global geopolitical uncertainties afoot, supply constraints in hydrocarbons are a real concern. The natural solution would be to ramp up oil production, particularly in the USA being the world’s swing producer, but that inherently requires investment from oil producers into oil services both onshore and offshore.

The Uranium story has promised a supply shock moment, yet if we think about it, even if the utilities were to awake from their slumber any squeeze would occur in the spot market whilst the list of suspects above rely on the term market- in some cases in order to even kickstart production.

The Investment Case

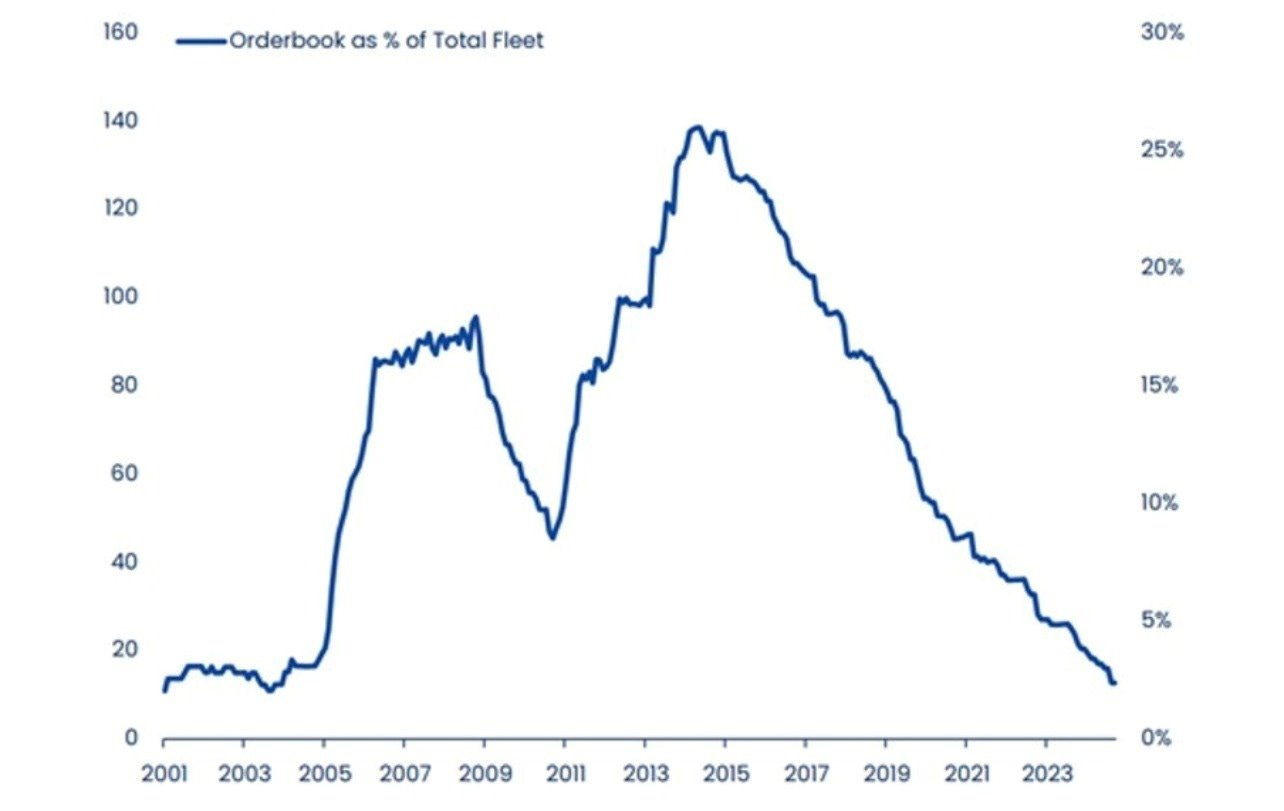

Oil service companies are uniquely positioned. After enduring a decade-long industry depression, they have adapted to survive under the lowest break-even conditions. Unlike most industries, which struggle in downturns, oil service firms are already operating at depressed levels—meaning they have significant upside if demand rises. and day rates have in fact, continued to rise since 2020.

The only real threat to this thesis is a flood of new builds entering the market which would tank the price as it did in 2014 at the dawn of the shale boom.

As the above shows, we are light years away from that and the only factor that would drive such CAPEX decisions by drillers away from shareholder returns and into new builds would be significantly higher day rates which, in turn, would print astounding levels of cash for the drillers and result in the influx of capital so many expected in the Uranium sector.

I suspect this is what ultimately happens.

In an investment landscape where many assets are correlated, oil service stocks could serve as a non-correlated play with asymmetric upside.

While governments bet on renewables, the reality is that hydrocarbons remain essential. As supply tightens and demand remains steady, oil service companies may be among the biggest beneficiaries. Investors looking for an overlooked, high-upside sector should take note.

Take care and do your own due diligence.

Benjamin.

I have read a few 4Q reports from the offshore drillers, like Noble, and find that they are turning some cold-stacked assets into scrap, including a 7th generation drillship. With companies scraping assets rather than pay the ongoing costs of cold stacking, I don't see any evidence of newbuilding being a problem in the near future, which is consistent with the thoughts in your article. Thanks.