Private Equity: License To Deal Or Steal?

Tangible goes Digital and fees will be charged. $DBRG Opportunity.

Welcome back to the ROI club.

Today’s piece focuses on one of main investment thematics, the advancement of AI and data centres - more specifically the insane amount of dollars which are currently, and will continue to be, invested in the infrastructure necessary to support these two very topical growth markets.

My philosophy here is not to invest in the technology directly, which is a mug’s game, but rather to be long those who will benefit from the CAPEX invested by the major tech companies who are currently all trying to out-spend each other to win this AI arms race.

Overlay this thinking by filtering such companies for those who display my preferred high ROIC, capital-light business models who can scale revenues faster than expenses and I think I continue to do well over this decade.

One such business model is the fee-collecting, asset gathering world of private equity. Today I’m sharing an initial overview of one such company who has grown their assets at an astronomical rate and will not only be collecting fees on that capital year in, year out, they also have a capital-light interest in $35 Billion worth of tangible assets specifically designed for the digital infrastructure revolution we are witnessing.

It’s time to peel back the murky veil of private equity and see what I make of this rapidly growing private investment firm.

Investment Idea: Digital Bridge Group, Inc. (NYSE: DBRG)

A former REIT, DBRG pivoted in 2021 and is a leading global alternative asset manager specialising in digital infrastructure investments. With over 25 years of experience, DigitalBridge manages approximately $75 billion in assets, focusing on sectors such as data centers, cell towers, fiber networks, small cells, and edge infrastructure.

Business Model Overview:

Private equity can be opaque at the best of times so I’m going to drastically simplify things.

This is essentially a funds management business that invests in non-public companies, buildings and infrastructure. In US private equity firms the most common structure by far is the General Partner (GP) / Limited Partner (LP) model.

The GP manages the fund—they find deals, invest in companies, and aim to grow their value. The LPs are the investors who provide the capital, such as pension funds, endowments, or wealthy individuals. In the case of DBRG, the LP consist of some gigantic institutional capital managers such as: Australian Super, an Aussie pension fund that invested $1.5 Billion in DBRG’s DATABANK initiative which builds and operates data centres. Verizon also put $3.3 Billion in their Vertical bridge segment which owns 6339 signal and data towers.

What’s important to know is that the GP makes their money 2 ways: asset management fees, traditionally 2% of Funds under management (lol), nowadays more like 1% and a profit share of any income or appreciation of the investments they make on the LPs behalf - traditionally 20% of profits above a stipulate return rate for the LP.

This in the industry is known as ‘carried interest’.

Much to my shame, I once contemplated starting something similar when I was 28 and sold my first business. COVID arrived and saved me from such a fate and I ended up becoming a humble derivatives trader and sub-stacker. It’s honest work (well more honest than private equity anyway) and I get to interact with you fine folk.

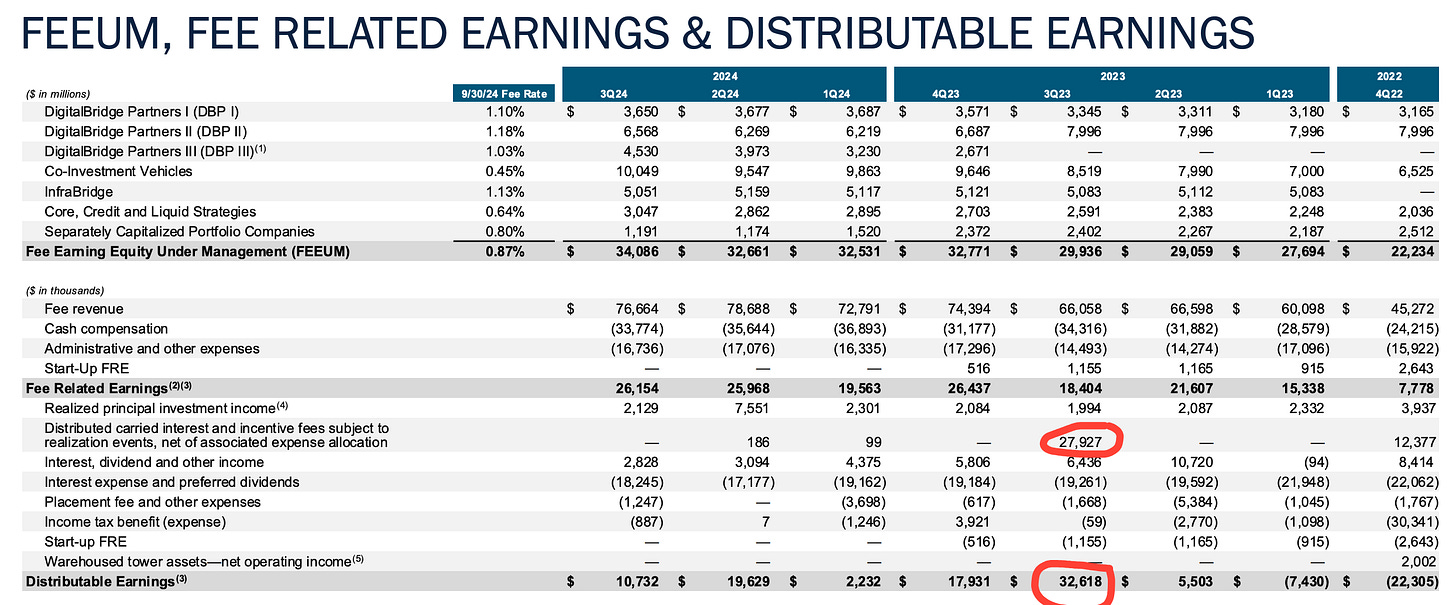

DBRG charges an average management fee of 1% in what they call Fee-Earning Equity Under Management (FEEUM).

I don’t intend to fully deep dive into their holdings today as I’m simply earmarking this as an idea to keep an eye on. Their infrastructure holdings are all focused on tangible assets needed in the digital economy i.e:

Data Centers: Facilities that house essential computing and storage resources.

Cell Towers: Structures supporting wireless communication networks.

Fiber Networks: High-capacity data transmission systems.

Small Cells and Edge Infrastructure: Technologies enhancing network coverage and reducing latency.

They all sound good to me and will be the focus of further investigation - it’s not easy to value these things as their privately held and can sometimes carry multiples that are wayyy different to public comparisons.

Today I’m interested in 2 things: the capital-light, inflation benefitting recurring revenue from the management fees they charge and why their stock has been absolutely hammered.

REVENUES:

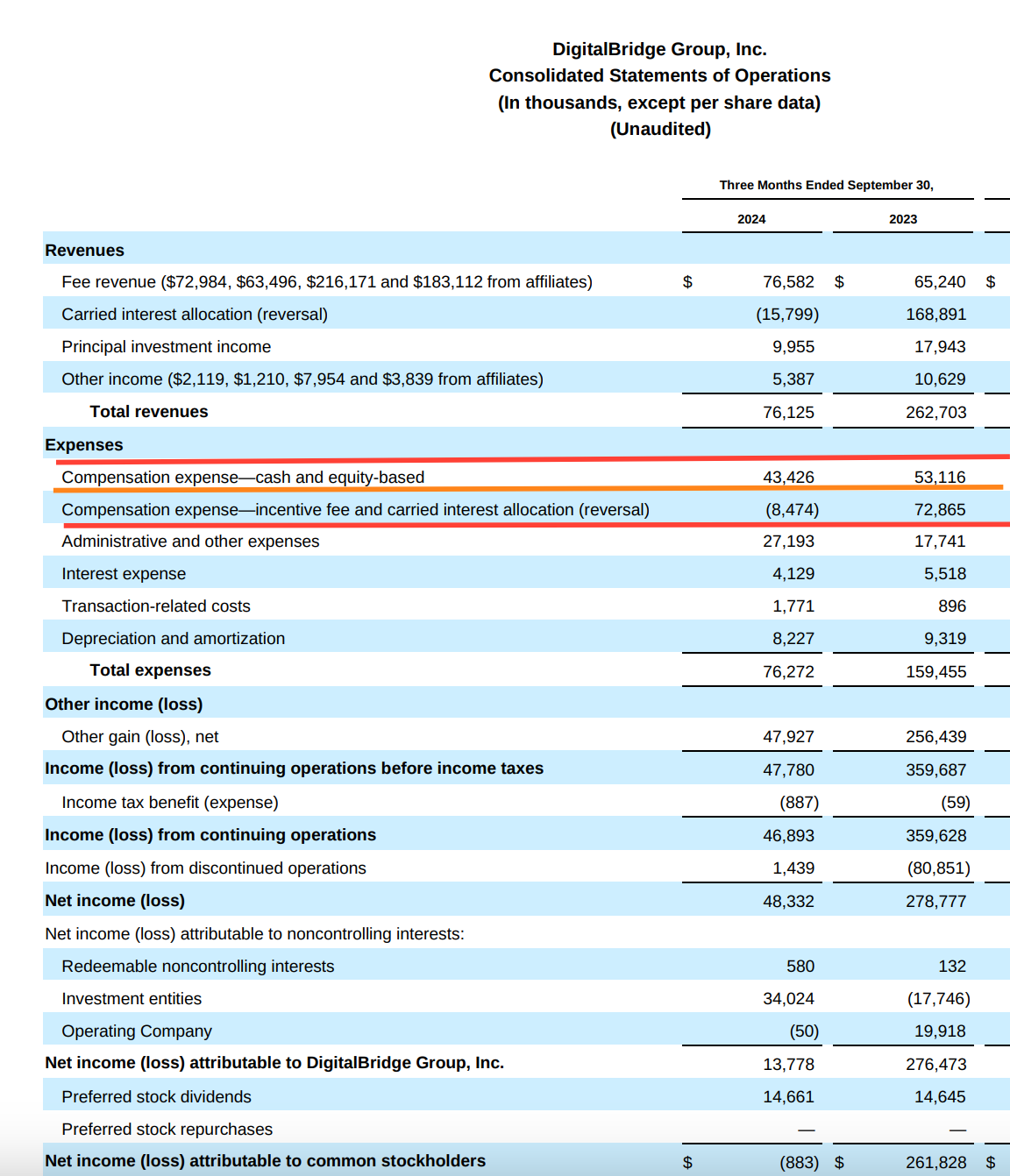

LTM run rate revenue stands at $810 mm, showing double digit growth YOY since converting from a REIT (I don’t like REITs generally but when you catch them changing corp structures at the right time it’s golden - remember my take on GEO group?!).

A significant portion of this revenue, approximately $746.5 million or 90.9%, was generated within the United States so the Trump factor likely helps here.

Now here’s what I came for: Fee revenue increased by 16% year-over-year, reaching $76.7 million, driven by massive growth in FEEUM.

The company's FEEUM grew by 14% year-over-year to $34.1 billion..

Raising that amount of capital so quickly, growing it at strong double-digit rates and then charging a 1% clip year over year is what PE dreams are made of.

However, you didn’t think they would share all of that ~$340 mm in fees with you did you anon?…

There’s a reason why PE guys are hated..

The performance fees or carried interest will be more lumpy in nature but will act as a massive bump in quarterly earnings when they’re realised and likely contributes to the stock’s volatility as not many algos understand this model.

Here they realised $28 mm in carried interest in one quarter, making their total distribution almost 6x that of the prior quarter.

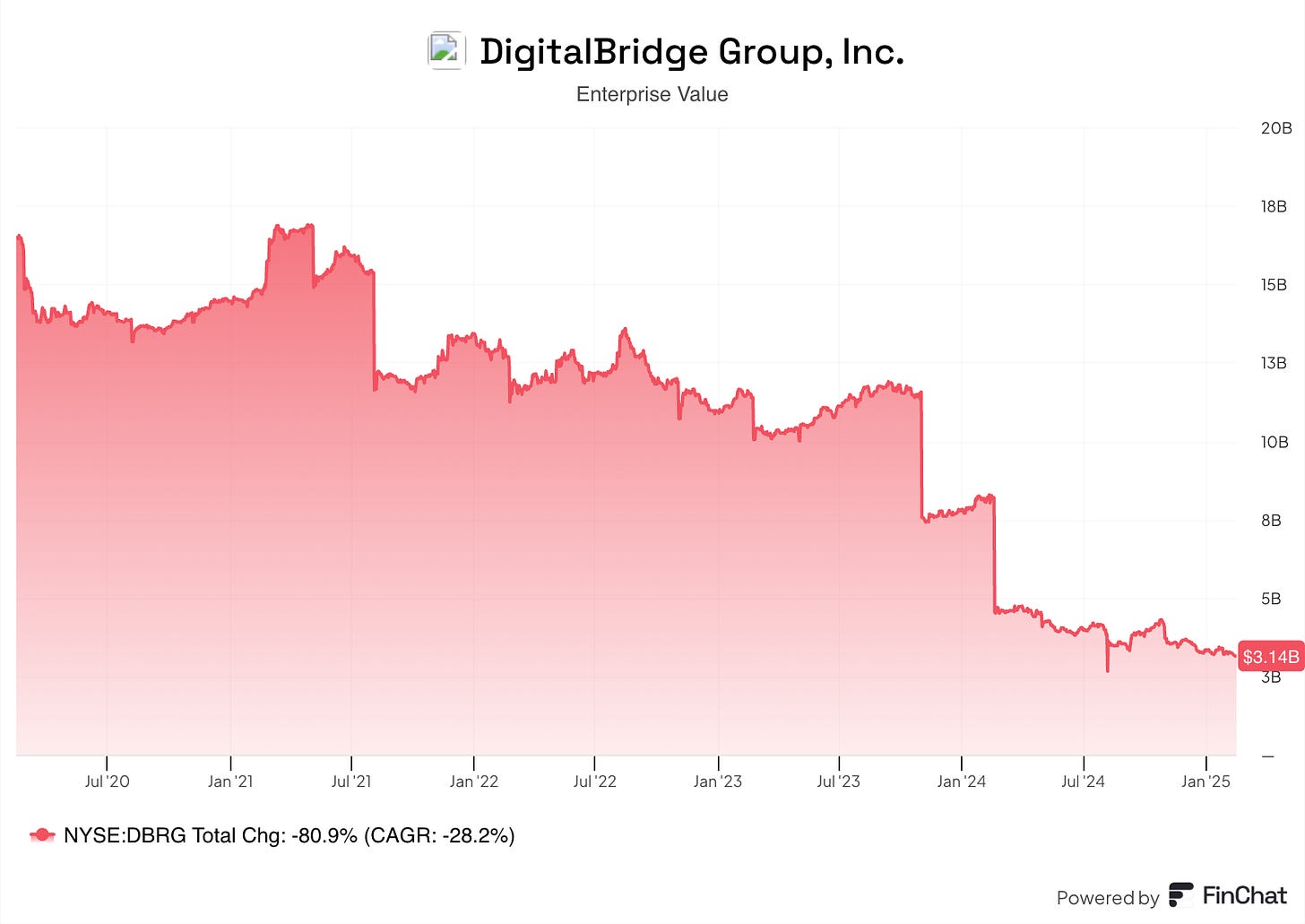

What has caught my attention recently has been the absolute shellacking the shares have experienced over the last 5 years.

DBRG is a turnaround play with a difficult to understand PE model. This is combination with negative net income which was heavily influenced by tax loss carry forwards makes the income statement look worse than it was.

Looking at the business with fresh eyes today could be an opportunity while everyone else still thinks of it as its legacy business the REIT.

They’ve now finished rotating $75 B in assets from legacy buildings into the funds management and digital infrastructure company.

I’ve taken the below screen shot to show how the accounting at first glance makes the income look terrible and can easily be misunderstood if you don’t dig deeper.

Note:

The net income has flipped positive on the back of the changes made in 2022. The Net Income excl. extraordinary items is the net income before subtracting for preferred dividends and earnings/losses in this case, from discontinued operations which have been large since pivoting strategy but have basically been worked through.

Looking at the LTM run rate for Net income Excl. extra items appears promising, given the recurring nature of these earnings, $176.83 mm of net income on offer for today’s Market Cap of $1,773 mm suggests the opportunity to buy into key tangible assets and infrastructure via a capital-light funds management business for only 10x net income which likely grows at high double digits.

Yes, the executive comp is likely to be outrageous, but clipping the ticket on nearly 1% of $34 B and growing assets under management + ownership in a portfolio of valuable infrastructure assets is something that takes my fancy.

I’m starting a small position in my e toro portfolio and will be keeping an eye on this most interesting opportunity.

Kind Regards,

Benjamin.

although the gp's take is strictly formulated, it appears that their compensation is not. compensation is deducted before profit drops to the bottom line. what prevents management from looting the company via their compensation? what are their incentives?

A different take - Over 20 years:

NPV of fee revenue (1% of $34B growing at 10% annually, discounted at 10%): $6.8 billion

NPV of distributable earnings (30% margin on fee revenue, discounted at 10%): $2.04 billion, more than today's entire MC.

Note: This is for the fee generation arm of the business alone.

An investor with this mindset is likely getting an interest in $34 Billion of infrastructure assets at no extra cost..