Welcome back to the ROI Club.

Agenda for today’s piece:

& I catch up for another great discussion.The Maverick Life Portfolio Update: I share some ‘right-tail’ call options I’m buying which I believe have massive asymmetric upside (3x or more over 2-3 years) |PAID|

For those who prefer youtube:

I’ve held interests in 2/3 of the plays mentioned which have already been a double so huge thanks to Prof Steve for bringing the ideas to me when they were at their most hated!

I’m looking to sell some put options on these plays again to capture the premium and/or get a cheaper entry price.

We also chat about NFE 0.00%↑ which we collaborated on here

The ‘Convexity’ Trades

By now you’ll now that when it comes to options trades I generally like to run the Maverick portfolio basically as an insurance company or via the ‘casino’ model.

This normally means I’m selling options on assets I like and will essentially insure the buyer in the event of a price decline whereby I’m obliged to buy the stock at a given strike price. This generates income from premium (the cash proceeds I receive from selling the option) + interest on said premium which can add annually ~5% annualised to the IRR expected from the option sale. I.e: Trades I’ve shared with the group where I sell a put option expiring in 30 days with a strike that’s 10% OTM (cheaper than it’s currently trading which might typically yield me 25% annually should they expire worthless + 5% = 30% annualised return expected.

(Multiply by billions and that’s basically Warren Buffett’ model for building wealth)

However, every now and again I am a buyer of ‘insurance’ I consider too cheap.

Normally this occurs when a company I like (trading at <50% of what I think it’s worth) has a decent chance of that value being unlocked in the near-term (1-3 years) and its OTM call options are irresistibly cheap.

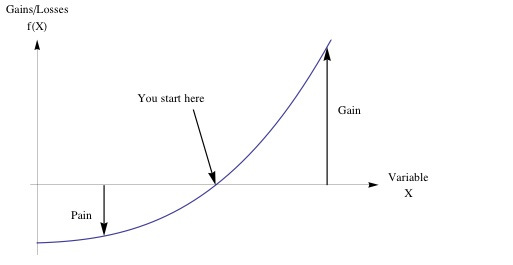

This strategy is described as ‘convexity bias’ or if you’re a fan of Nassim Taleb, ‘Anti-fragile’.

I’m taking a small amount of my portfolio this week and buying some call option spreads which have a fixed downside, 3-5x upside and 45% probability of profit.

Trades I’m Making

Now, to business..

If you’d like to literally see the trades I make that form an integral part of my location-independent income streams then why not join the squad?

You can even test drive it with a free trial.

See you inside the squad.

Benjamin.

Listen to this episode with a 7-day free trial

Subscribe to The ROI Club to listen to this post and get 7 days of free access to the full post archives.