Merger Announcement:

I am 90% sure that I will be merging my two substacks: The ROI club and The Maverick Life when I return from South America in May. It just makes sense given substack now has a ‘segment function’ which allows different genres of content to be categorised under the same publication. Stay tuned for details.

Valuation Deep Dive: Wheaton Precious Metals $WPM.

In my last piece I wrote:

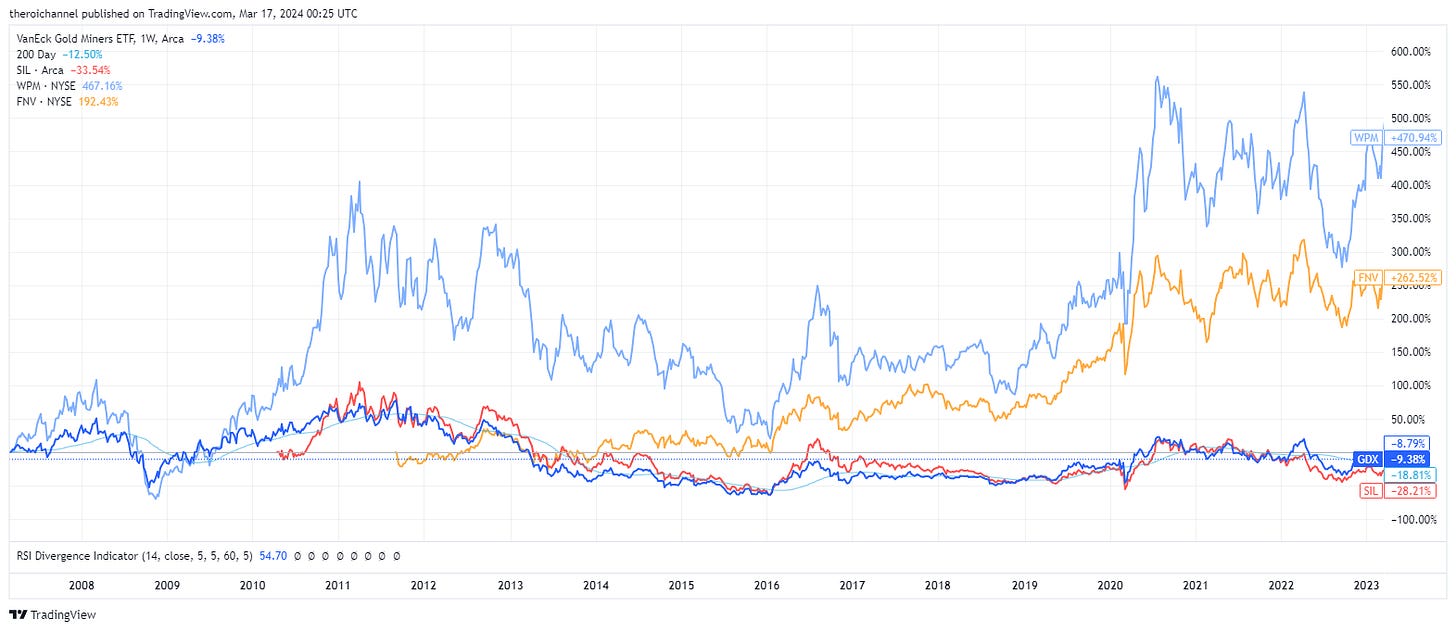

The metals trade has been frustrating for many with a massive rally, particularly in precious metals in June 2020 following the monetary and fiscal response from the US FED fizzling into a lot of sideways price action since.However, it appears that a breakout may be imminent:

Whilst the focus currently seems to be on precious metals producers and their underperformance Vs the metals, I have precious little interest in the miners themselves. Rather, my focus is on businesses that have almost all the upside to rising metals prices, that are profitable in sideways-down markets and have none of the operational or cost-inflation risks associated with mining.

How is that even possible?

Well, I’m referring to the royalty & streaming Co.s of course.

I’ve repeatedly felt since 2020 that with the current monetary and fiscal state of the world the greatest risk to my wealth and well being is inflation hence my deep dive into the commodities space over the last 4 years.

With the exception of oil, my strategy is mostly a two-pronged approach. I buy either the commodity itself (Bullion for PM, SPUT for Uranium) or companies which have claims on revenues associated with commodity production (Royalty/Streamers).

The idea being I can side-step cost inflation and operational heart ache in a high quality, high margin business which still has plenty of torque to the bull cycle and is heavily influenced by Jim Davolos and Murray Stahl’s ‘Asset-light, inflation beneficiaries’ philosophy.

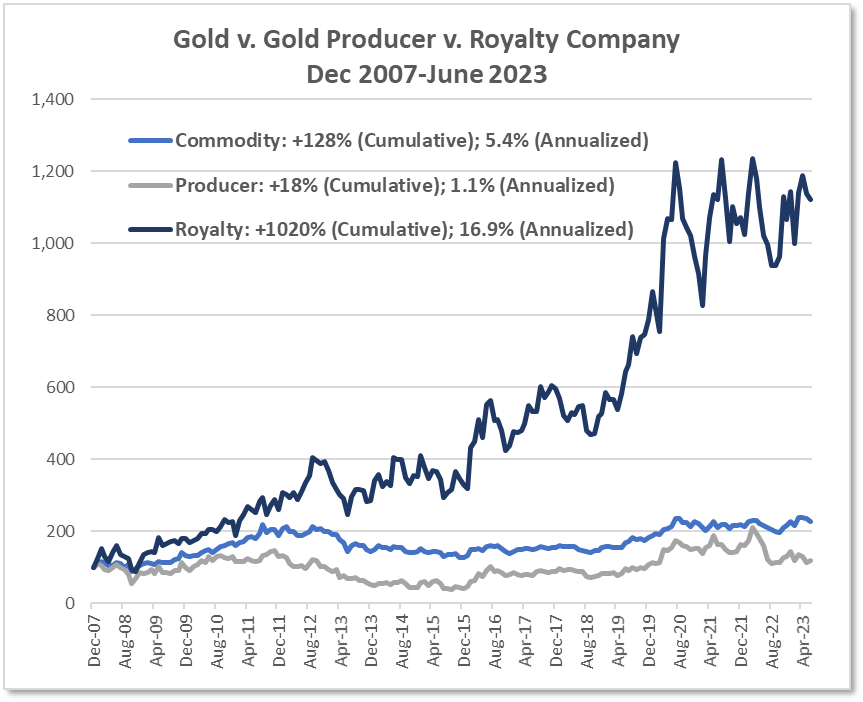

Their chart below really impresses their point on me.

But everyone knows these are good businesses so you have to pay up for them?

… A common objection I’ve seen/heard..

Well, Price is what you pay, value is what you get. So my take is worry about value first, then see if you can get it at a reasonable price. Considering the sticky nature of the margins of these companies, the safety against commodity price weakness and their torque to the upside isn’t it worth paying a little more for them?

My answer is borrowed from my previous piece in

Therein lies my take on the discussion.

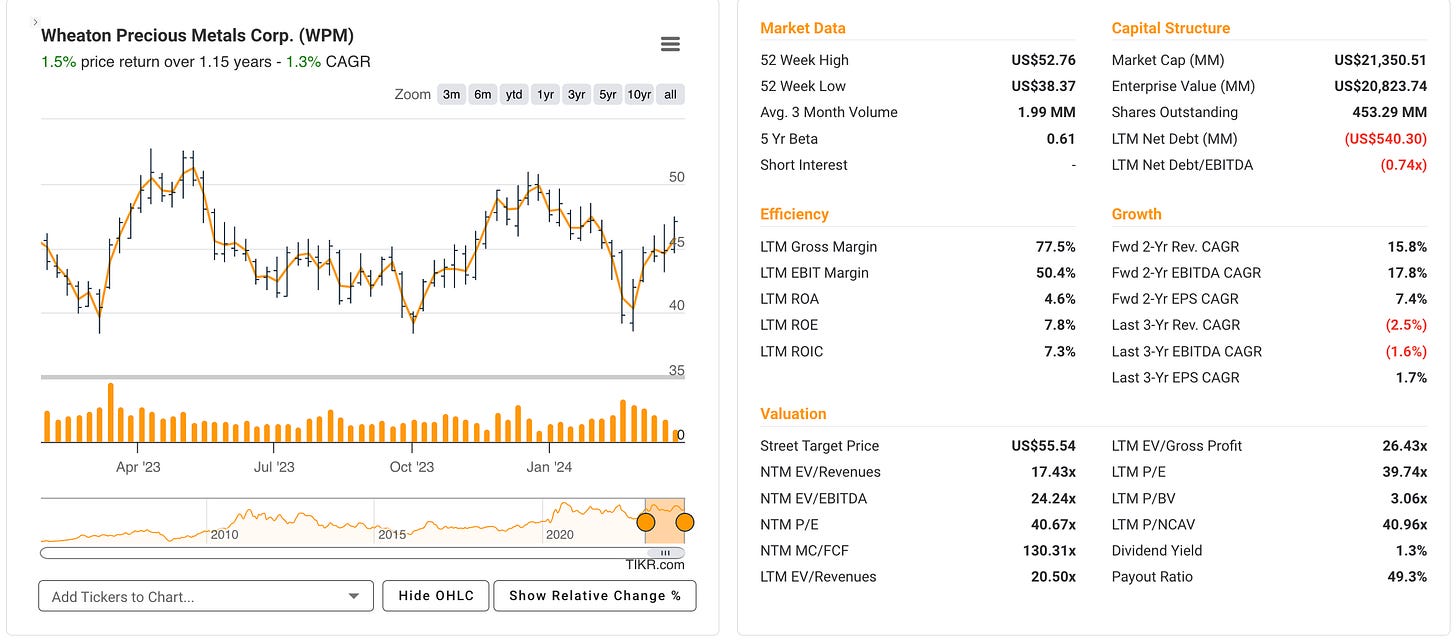

So then, what is IMHO the world’s best streaming Co. ($WPM) worth today and why do I think there’s the very rare opportunity to buy one of the highest quality businesses in the world today with a potential 100% upside case?

Let me show you my valuation..

The Business Model.

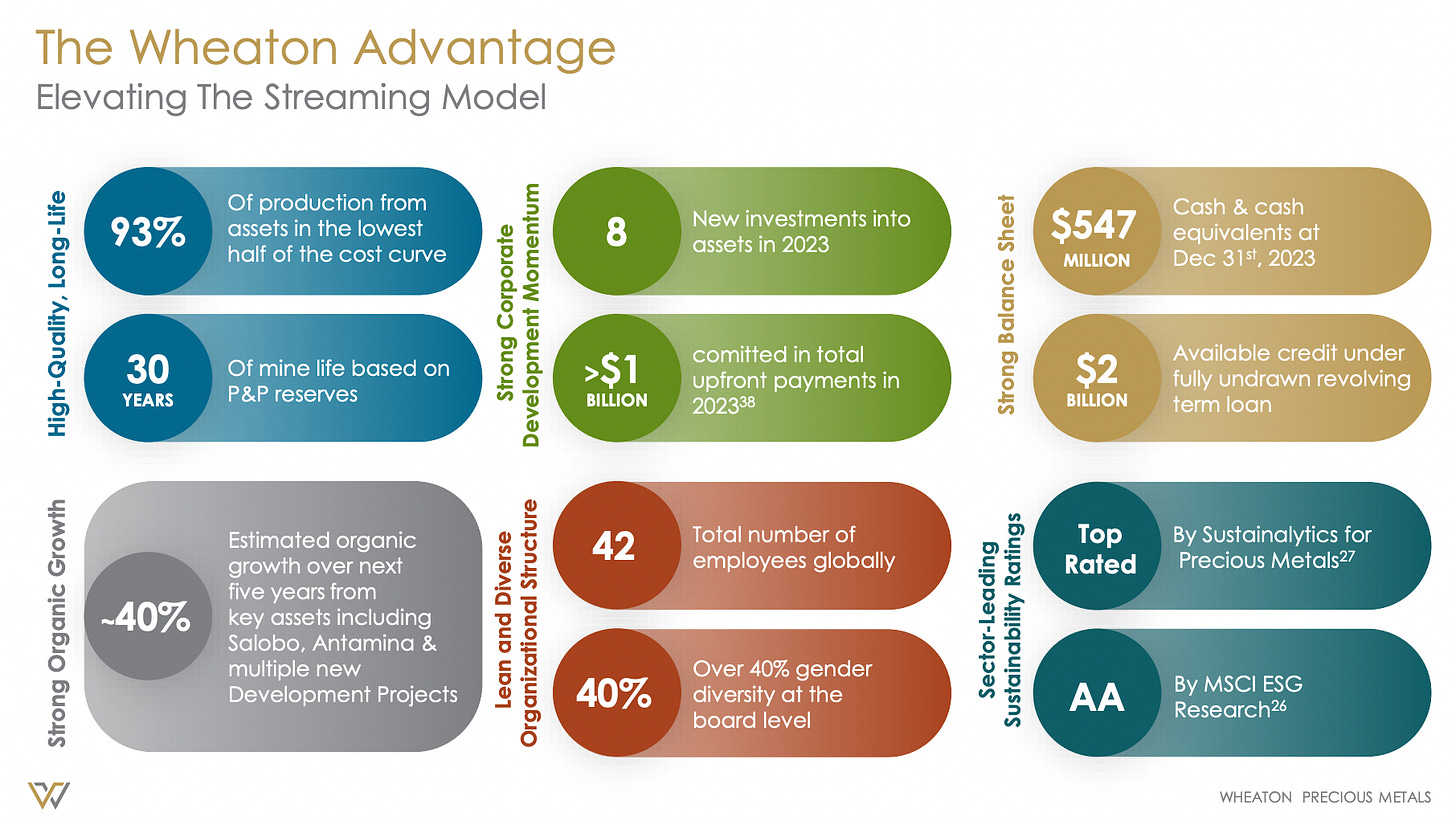

WPM finances a metals project in return for the rights to acquire a given amount of production at a certain price, either as a fixed price (i.e $800/Oz) or % of the spot price.

Yes, there are numerous various to these agreements but that’s basically it: Certain amount of production at a certain price for a defined term.

That’s it!

No operational costs associated with mining, just clipping the ticket from the top line.

This provides them with an effective breakeven of circa $400/GEO (gold oz equivalent).

Compare that with say, Newmont, a major producer whose breakeven I estimate at around $1,300/Oz you now see how WPM is still profitable in a downturn but also has massive leverage to the upside in prices thanks to their costs being both fixed and largely ‘one and done’.

WPM has large, low cost reserves and enjoys a very long runway for future growth.

So, stay with me here. My assumptions for this back of the envelope calculation for the base case will be as follows:

Production 800kOz GEO at an assumed ave realised price of $2,500 / Oz.

EBITDA Margin 75% with an EV/EBITDA of 20x (historical mean).

800kOz * $2,500 GEO = $2 Billion Rev

75% of that = $1.5 B EBITDA* 20 EV/EBITDA

= $30 Billion EV or roughly 50% upside from the Current EV of $20 B, remember?

This is giving them zero credit for expanding their margins AND the multiples for which the market will likely pay for the stock in the face of a rising price environment.

Here’s what that might look like using the above method in an environment where the GEO price, their margins and their market multiple improved by 10% each.

800Koz at $2,750 / Oz at 82.5% margin on an EV/EBITDA of 22x…

Close enough to $40 Billion EV or 100% upside with no further credit extended for production increases.

If it took 4 years for this to play out that’s an Internal rate of return (IRR) of 19% plus a very small dividend yield along the way whilst waiting.. less than 4 years expected to double my investment why even look at a junior shitco in the space when it’s on offer in one of the highest quality companies in the world with basically no more to spend..

Have I gone from value to GARP?!

Copy My Portfolio On E Toro

Disclaimer: This publication is intended solely for documenting my personal journey with options trading and investments for income and travel purposes. I am not a certified financial advisor nor am I a financial professional and none of the content provided should be construed as investment advice. It is essential to conduct your own thorough research and consult a registered financial service provider for appropriate guidance. I cannot guarantee the accuracy or completeness of the information presented. Any actions taken based on the information shared in any of my work are done at your own risk and discretion.