Month In Review - November

Here’s my take on the most important events of November:

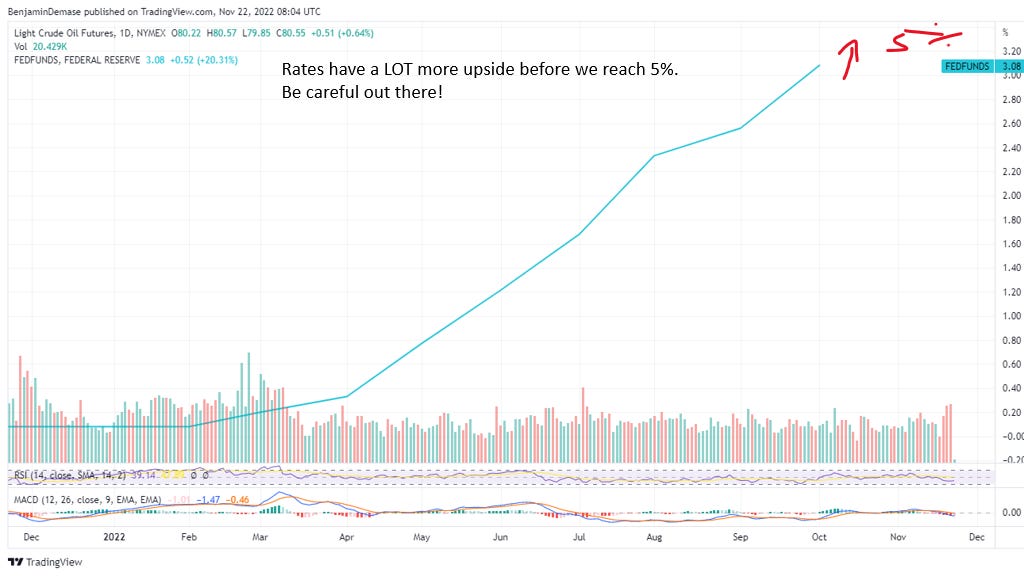

The US fed continued on its trajectory of hiking rates at a pace of 75 Basis points. The trend of higher rates looks set to continue in the short term, although the pace of rate hikes will likely slow as the US economy slows. This was implied by J Powell and Raphael Bostic’s comments following the latest fed meeting.

My impression is that the pace of rate hikes will slow moving into Q1 2023, however this will prolong the hiking cycle and delay any ‘Fed Pivot’. Bostic commented that the terminal Fed Funds Rate (FFR), that rate at which the fed would pause rate hikes or cut rates likely sits around 4.75-5%. In other words, we likely are looking at another 200 Basis point increase in FFR.

Meaning: in short, bearish equities, especially those with little-no cash flows trading at high multiples i.e Tech. I have short positions against the SPY and AAPL and am holding an outsized amount of cash (in USD)

Crude Oil likely to finish down 4-5% on the month on the back of recession based fear. My take is that short-mid term weakness in crude merely pulls the rubber band effect tighter to the upside once China re-opens and the rest of the world realizes that Russian crude will be offline (officially) Dec 5th.

However, volatility is all but guaranteed in the short term.

Meaning: Until I see the Rig count and CAPEX of the industry SIGNIFICANTLY increase, global oil supply will continue to get tighter and tighter until an eventual squeeze sending prices higher which in turn will lead to an influx in exploration capital, directly benefitting this month’s stock selection.

Ben’s Buys.

What’s Ben Buying This Month?

In this segment I give you my take on a particular stock, including my investment thesis and valuation estimate.

*Disclaimer: I am not a financial advisor and this is NOT financial advice*

WARNING: Volatility ahead!

As much as I love talking about trading, now is one of those times where I think being boring and patiently waiting is likely to pay off.

As such, I hold roughly 18% of my etoro portfolio in cash, while my main arb portfolio is more like 50% cash.

I’m ready to pounce on some opportunities should they present themselves in Q1 2023 and of course I’ll let you know when I do ;)

But, you aren’t reading this to hear about my cash reserves so without further ado here is my stock selection for this month, Tidewater. Ticker: TDW

Too see my take on TDW, please join the ROI club and I’ll see you on the other side.

All the best.

Benjamin

ROI Monthly Stock Analysis: TDW

*Disclaimer: I am not a financial advisor and this is NOT financial advice*