Hello and welcome back to the ROI club, where members get access to my investment insights from all around the globe.

My key points noted from June:

Tighter fiscal policy even as recession looms, inflation is the problem but you can’t solve that by cutting demand while the supply side is unimpacted. Likely impact on markets: a nasty sell-off in equities that’s more related to lack of liquidity than business case fundamentals (well, for energy stocks, tech etc deserve a shellacking given their current valuations make zero sense to me)

With monetary policy acting with a lag, it’s highly likely we’ll see some market carnage even though the FED have paused the hiking cycle (for now).

Anecdote: in Australia right now small businesses are feeling the pinch. Rate increases in mortgages, rent (commercial and residential) and the CPI are having an observable effect on consumer spending.

Yesterday one client of mine asked for my opinion on his commercial rent review, indexed to the CPI it’s set to increase by 7%. Later that same day another client flat out told me that if his mortgage rate increases further he will “almost certainly lose his house”..

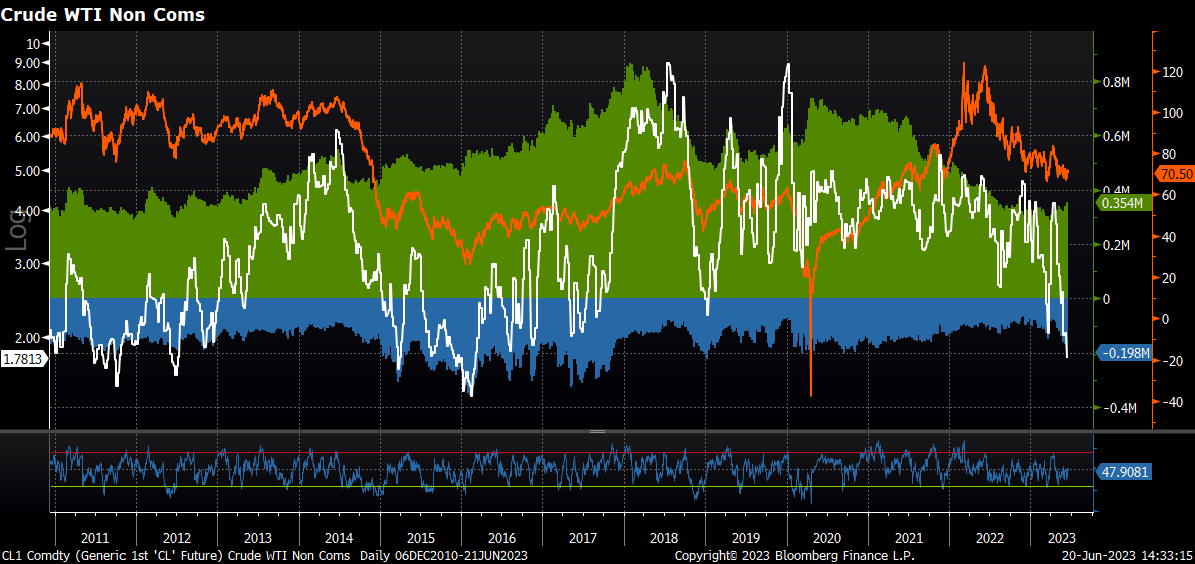

I have been positioning quite defensively all year. The only sector I’m interested in at all right now is the energy space and I’ve been writing some options on some select stocks that are paying me big dividends in that most crucial asset, the USD (one such stock is featured below for paid members).

Energy stocks are still stocks, hence in a liquidity or panic event they will likely get smashed along with the rest of the market. Ergo I think it’s instructive to keep the main points of the investment thesis front of mind as below:

Bull case hinges on:

US recession not eventuating or not being as bad as feared

China re-opening and demanding 1mm bbl/day+

OPEC+ continuing to cut and provide a floor under crude prices (I' want to see $70 min)

US Shale growth following the path Shubham Garg expects (i.e: lower than most expect)

In my view, this makes no sense given that inventories are at their lowest in approx. 30 years and obviously since then global population (and hence fuel consumption) has grown enormously.

A longer term, possibly less volatile space in energy is the coal trade. I have been allocating to the sector in very small tranches now that NEWC prices have returned closer to normalcy. I’ll keep you updated if I spot any more new plays that excite me.

What’s On Ben’s Brain?

In this segment I give you my take on a particular stock, including my investment thesis and valuation estimate.

In this month’s members-only section:

My take on a fully integrated large cap oil company with a current dividend yield of over 20% trading at approximately book value.. not a typo…

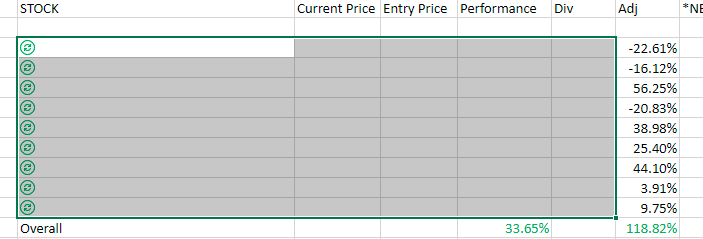

Subscribe to the ROI club today and become a member and gain access to ALL of my analyses + see a live performance breakdown of the stocks I’ve looked at in the excel sheet below ( currently up 118% Adj. at time of writing).

*Important* this is a hypothetical selection of assets, the author does not and cannot guarantee results. The author is NOT qualified to give financial advice of any kind and nothing in this publication is to be considered financial advice.

Become a paid subscriber today (less than $5/month when you pay annually) and get access immediately to the video below.

Until next time, all the best & DYODD.

Benjamin.

*Disclaimer: I am not a financial advisor and this is NOT financial advice. The purpose of this publication is merely to document my journey in investing and to share it along with my opinion. Everything shared in this publication is purely my opinion, you should not make any financial decisions based on anything you see me do or hear me say. Please seek the appropriate professional advice before making any financial decisions. *

Keep reading with a 7-day free trial

Subscribe to The ROI Club to keep reading this post and get 7 days of free access to the full post archives.