Welcome to the ROI Club.

Since 2022 I’ve become almost exclusively focused on making long term investment decisions based on the underlying business models, not just the quantitative cheapness of an opportunity.

My meditations on capital-light hard asset businesses has led to my preference for Royalty and Streaming operating models, within which I’ve found my niche and nickname ‘The Royalty King’

It is then with both reverence and trepidation today that I share some high level thoughts on the one company that is the quintessential representation of the capital-light, hard asset business: Texas Pacific Land Corp. TPL 0.00%↑ .

It’s likely this will be the prequel to quite a few pieces on TPL, given it’s impossible to do it justice in one article. So to set the table for this ongoing meditation today I’ll describe the framework of a mental model I hold regarding the elements that make for a perpetual business asset that is also a true inflation beneficiary:

Texas Pacific Land Corporation

NYSE: TPL

There is something poetic about a bankrupt railroad company leaving behind a legacy that would one day become one of the most quietly powerful businesses in America. TPL was born not out of foresight, but as a residue of failure - a government attempt to build a rail connection between Texas and California.

Without recounting the entire history of TPL, the punch line is that millions of acres of West Texas land was granted to a railway that never eventuated. The bondholders, uninterested in trying to salvage the operation through empty scrubland, formed a trust and left the land to sit.

It is exceedingly rare that an entity can simply gain access to so much land for essential zero cost.

For decades, little happened. After all, who wanted desert?

However, as time passed, the world around the land began to change. Oil was discovered, pipelines, telecommunication were laid, roads and communities were built. The Permian Basin—once thought to be no more than barren grazing pastures, became one of the most productive energy regions in the world.

Its land value and revenues benefitted from the passing of time (positive theta) as it moved from simply earning pasture grazing leases to earning royalties from hydrocarbon extraction and easement fees from the necessary infrastructure supporting what is now the heartland of US oil and gas production.

TPL seldom sells land, but its reporting shows the incredible CAGR of the non-core (non royalty producing) land it has sold over recent times:

This illustrates the value of the raw land alone as an inflation beneficiary, while the royalties unlocked an entirely new revenue source for TPL, which in 2024 brought in $373 million up from $28 million in 2016 or 38% CAGR on a previously non-existent revenue source achieved with zero cost on TPL’s behalf.

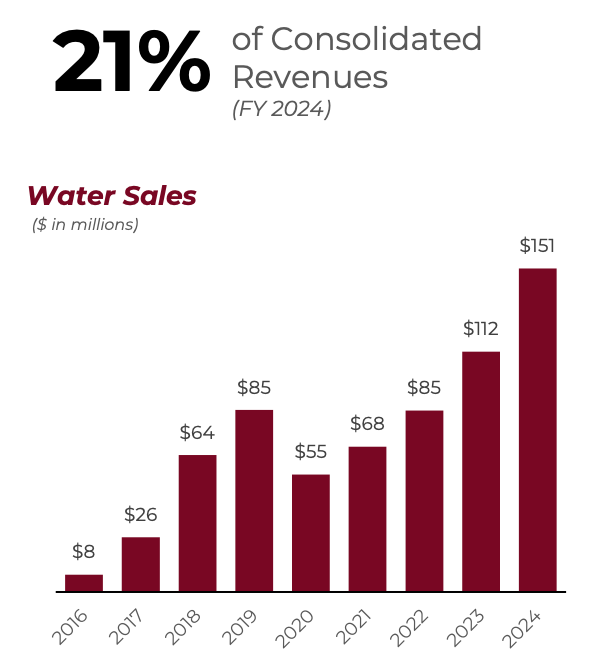

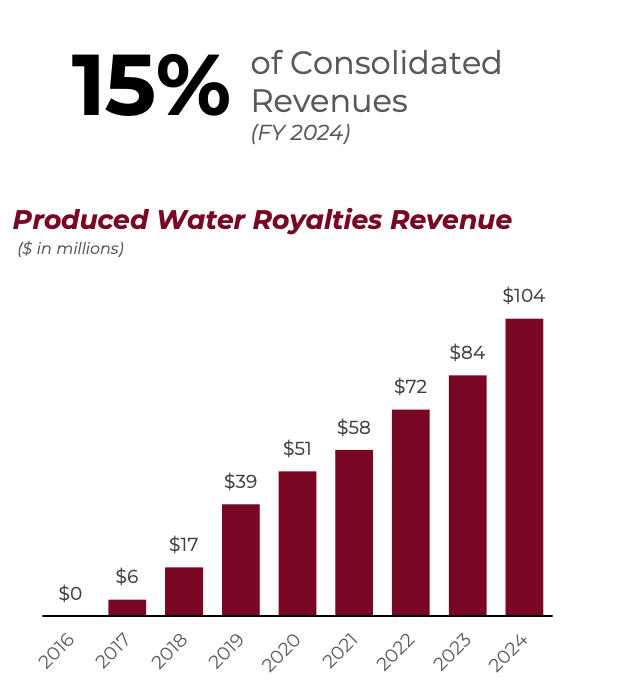

The advent of fracking on TPL’s land brought with it a newfound demand for its water and hence TPL now has another new revenue stream that didn’t exist before, that of selling ‘sourced’ water to the producers.

This essentially zero-cost new revenue stream now rakes in $151 million and $104 million annually for the sourced and produced water respectively and is growing at c44% CAGR. Overall, water now accounts for over a third of TPL’s revenues, from a standing start only a decade ago.

The handling of the produced water is of particular interest, as the volumes of water produced as a ratio of the oil produced (the water cut) appear to be increasing as the permian acreage becomes more gaseous. This in turn increases the demand and thereby the price per barrel of handling the water.

Whilst the market, in its superficiality views TPL as a legacy oil co, you might say it’s actually a water company as it’s readily apparent that water is about to overtake oil as TPL’s main revenue source.

Speaking of total revenues..

Interestingly, for comparison, the market darling NVIDIA has exhibited 39% CAGR across its overall revenue over the last decade.

But here in lies the rub, along with the third element - a capital light business model.

NNVIDA’s top line growth required expenditure that CAGR’d at 35% as seen above.

Compare this to TPL’s top line which in comparison required practically zero cost.

Earnings ‘ain’t earnings.

One stream requires perpetual spending, the other, nothing.

TPL is unique (although PSK has some similarities) in that trust-holders inherited the land and have ridden the wave of higher-end-use value added for their land over time with basically the only operational tasks required involve cashing royalty checks and a small amount of administration.

There’s a reason my hero describes TPL as the greatest company he’s ever seen.

Its genius lies in simplicity. The company doesn't drill wells, doesn't buy rigs, and doesn’t operate complex logistics. It just owns land rich in minerals, land over which others pay to drill, pump, and run pipelines. It collects royalties and easement fees. It owns all the groundwater rights, an increasingly scarce asset in West Texas and one of my central investment themes. With fewer than 100 employees, it generates hundreds of millions in high-margin cash flow.

These features allow TPL to benefit from the 4th element in the focus of today’s piece, time.

Warren Buffet has often made mention that ‘ time is the friend of the wonderful business and the enemy of the bad business’.

I refer to TPL as exhibiting ‘positive theta’ because its attributes mean its underlying value grows with time - over and above the normal discount rate used to allow for the time-value of money.

That’s the value.

On the price side, there’s also an interesting quirk which benefits TPL in the hands of a long term investor - Time arbitrage.

The idea that markets discount assets based on what they’re expecting to report within the calendar year, the axis around which Wall St and its bonus structure revolves. Resulting in many viewing TPL’s quantitative valuations such as P/E and P/S and deciding it’s too expensive, as opposed to my view that the compounding is only just hitting its strides and that the more time passes, the more value adds to the asset.

With decades of operational runway ahead,the future potential is still immense.

Water is becoming more valuable. Infrastructure needs are intensifying. West Texas, far from being played out, may prove vital for everything from oil to computing power, especially as data centers and AI geometrically add demand to local energy and cooling. TPL sits in the middle of it all, owning the land that underlies every piece of associated infrastructure you can imagine.

In the desert, time blooms.

Quick reminder grab your ticket to the Rule symposium here

Take care and do your own due diligence.

Benjamin.

PS: please share if you enjoy