Welcome back to the ROI Club.

Today’s piece focuses on the middle child of the 3 sisters of offshore drilling, Transocean ($RIG). I contend that the middle child, although often the most problematic during infancy, is the most talented, independent and ultimately productive of the litter.. (I shall not answer questions as to where I sit in my family order..)

On September 27, 2021 I published the fact that I was long Rig stock (and an irresponsible amount of its LEAPS with an ave strike of $2) in this video.

Being a young man and not impervious to hubris I confidently wrote:

“Transocean is not an investment - it's a speculation. It's also not for the faint-hearted. However, I am willing to speculate as I believe the risk-reward ratio is satisfactory for my means. IMO, RIG is worth approx $6-7/share if it bankrupts - which would double an investment in the stock from here, albeit you'd have to wait a bit for the re-structure. The true reason for speculation in $RIG is that it has a built-in call option on the price of oil which, I happen to believe, is going higher and sooner than most expect. As I explain here - that could leave us with a 5x return (5 Bagger) from here”.

Given there’s been a tendency for some to view the offshore driller trade as basically a dichotomy between VAL 0.00%↑ and RIG 0.00%↑ , I’ve taken the liberty of creating a reductionist flow diagram of my vision for the future below:

Flow Summary

Valaris signs contracts, securing finance and stock buy backs → Market saturation → Higher day rates ($630K before new builds) → VAL stock rises

Trim VAL, rotate into RIG → RIG benefits from higher rates → RIG pays down debt → RIG's stock re-rated = Happy days.

For further commentary on the sector check my last here:

Now let’s revise the thesis for RIG in a similar flow, check in with its recent news & criticisms and see where we (I) stand.

The thesis overview: RIG doesn't bankrupt →Market sells off to <0.3 book value (*you are here*)→ $7B debt over 5 years with $8-9B revenue backlog covers debt (albeit timing is important)→ Higher day rates boost cashflows + Market re-rates to higher multiple → Ben exits → Market eventually collapses (once DR sustainably encourage new builds).

Obviously this is not set in stone but it’s more or less what I’m playing for.

The FUD:

Now the biggest knock on RIG has always been that it won’t have the liquidity to survive and ergo it’ll bankrupt before I get another round of orgasmic pleasure from multiple returns on capital and (even more important) a feeling of intellectual superiority over the haters on X.

So, here are some thoughts on that.

My mate Tommy Deepwater tells me that they have the liquidity runway to see them through and that additionally, they could use their unencumbered vessels as collateral for financing should conditions worsen.

For instance, management used Deepwater Aquila as collateral to secure $325 mm in financing and Deepwater Titan for $525 mm. Additionally the option to refinance these notes remains should they wish to further improve the maturity profile or amortisation schedule.

Day Rates

You guys know the deal - if Drill ships cost $1B+ to build new and the financiers require a minimum IRR of 15% one can deduce that day rates need to be well north of $600,000/day. For those of you who care, see my assumptions:

Rig cost: $1 billion

Required IRR: 15%

Rig lifespan: 20 years (typical for modern offshore rigs)

Utilization rate: 90% (allowing for some downtime)

Operating costs: $150,000 per day (rough estimate including crew, maintenance, etc.)

No salvage value at the end of 20 years

Calculation:

Annual days of operation: 365 * 0.90 = 328.5 days

Annual cash flow needed for 15% IRR:

PMT(15%, 20, -1000000000) = $163,211,621 per yearDaily revenue needed:

$163,211,621 / 328.5 days = $496,838 per dayMinimum day rate:

$496,838 + $150,000 (operating costs) = $646,838 per day

Here’s a link to the current state of play: updated fleet status.

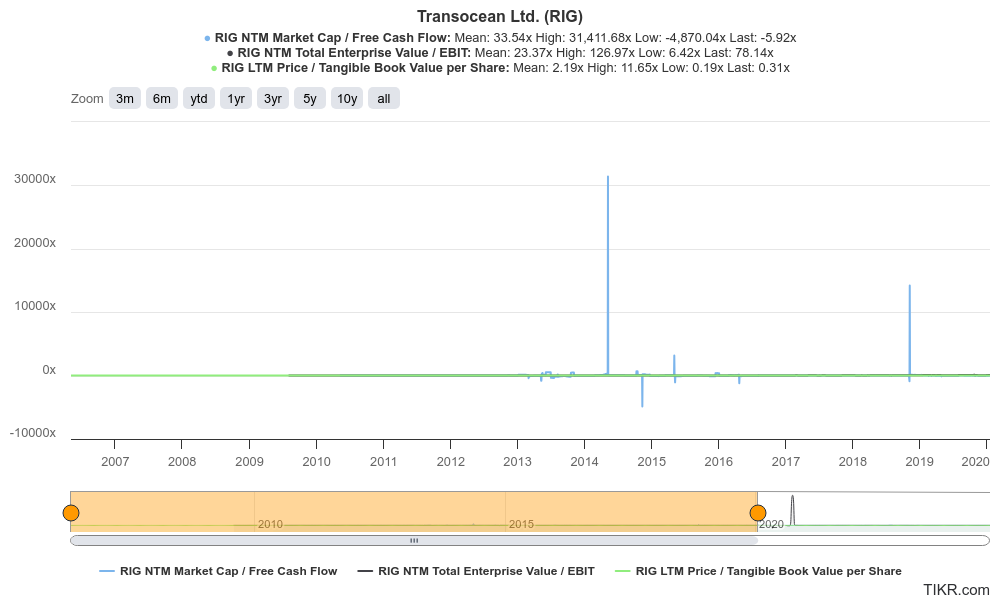

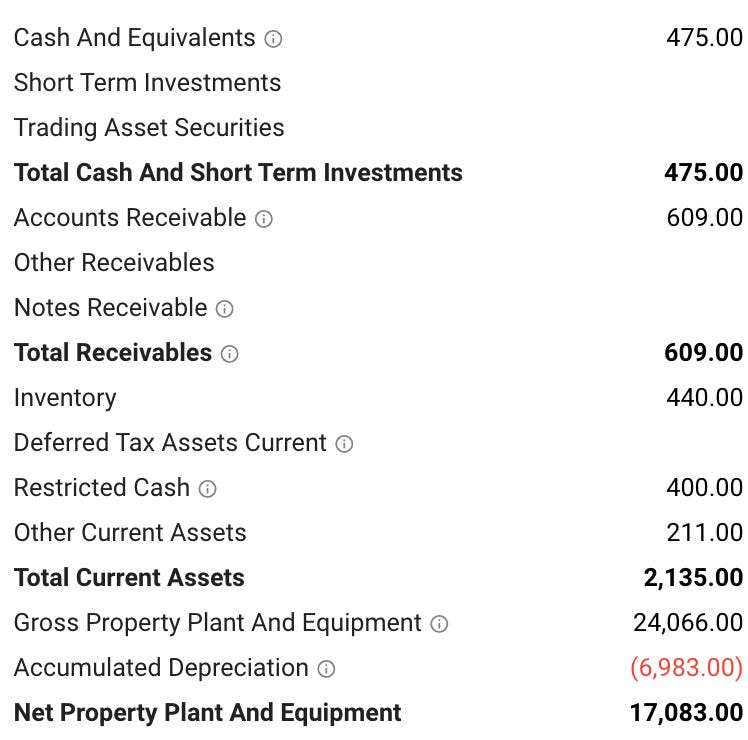

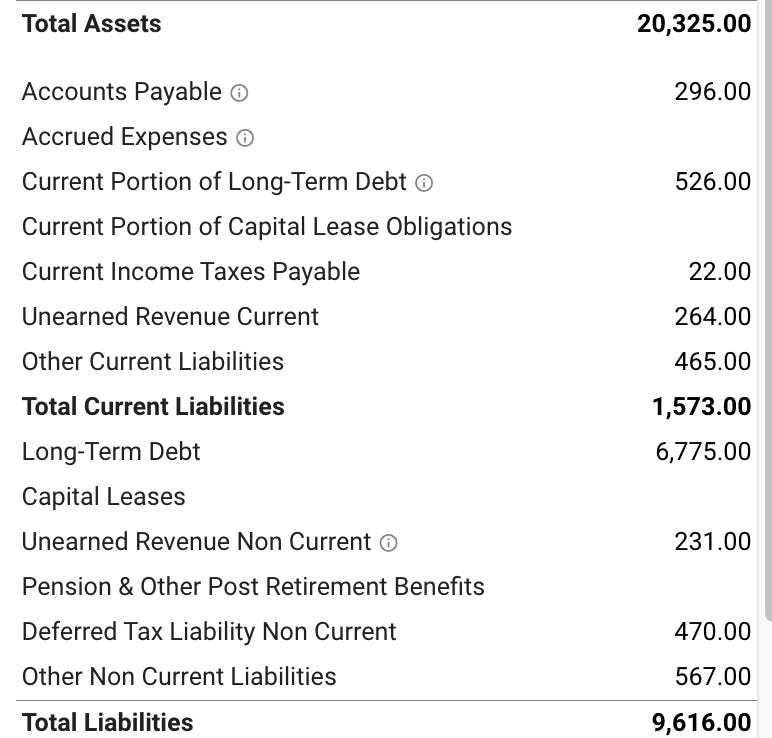

RIG Valuation - The Balance Sheet

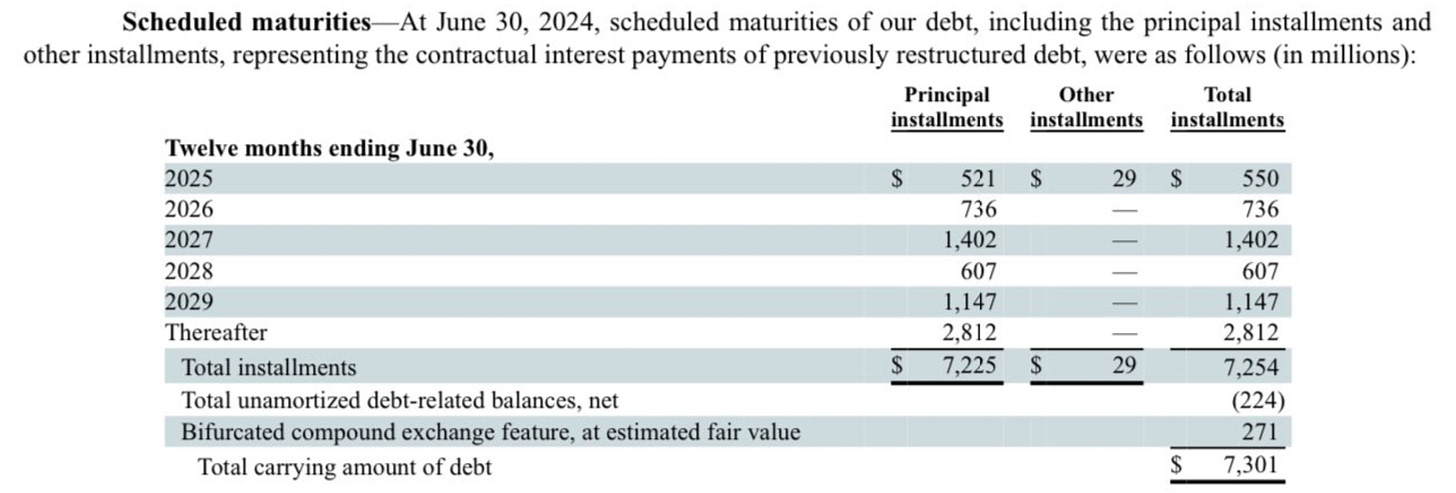

First, the elephant in the room, the debt wall:

Fleet new build cost:

Semi-submersibles: 8*$700 million= $5.6 billion

Drillships 25*$1 billion= $25 billion

Total Fleet New build Cost: $30.6 billion or $34.97 per share at tine of writing.

The Income Statement

Day rates and income projection notes:

Average age of drillers: 9.3 years ave day rate: $288k/day (inc cold stacked) $438K for those active.

25 rigs at that rate - estimate of OPEX = $3.8 Billion

+ 8 Semis at current ave DR of $416,591 = ~$1 B

Total revenue estimated ~$4.8 Billion.

$4.8 Billion at EBITDA margin of 38% = $1.8 Billion in EBITDA, from which they should be able to service and retire the principal from the above maturities.

*Analysts are guiding $4 Billion in revenues and $1.5 B in EBITDA for those who don’t like my numbers*

Multiples & End Valuations:

An EV/EBITDA of 20x implies a value (not a price target) of $36 Billion for the enterprise with the highest spec fleet which is deleveraging right into a rising rate cycle. That would imply a share price of $41.16 per share currently.

In other words, a 10x from here.

Now I know, I know.. You’ll be thinking to yourself wtf would someone give an EV/EBITDA yield of 5% a chance when T bills pay close to?

Well, they may not.

Or they may, if a stagflationary environment means that 5% is negative in real terms and this companies cashflows skyrocket upon an inflection in day rates.

Additionally and more sensibly, I can look at the asset value to check I am not completely off track.

Current Book value is accounted at $12.25/share and yes I know there are lots of questions about this.

But if/as the company de-levers I expect the liability reduction to mitigate the depreciation in their asset value and hence the historic mean of 2x BV might not seem so silly in a few years, implying a ~$25 stock price or a 6x from here. Heck, 1xBV from here is a double…

Summary

Rig is not for everyone - there’s a lot that can go wrong, however there’s also a lot that can go right. I’m back in here and adding to my position via options and tranches.

Not a recommendation of course and DYODD.

All the best,

Benjamin.

Great stuff, enjoy content.

You had perfect market timing with your buy and sell on RIG!

Can you confirm these data points I pulled from Twitter?

RIG recently contracted 2 @>$500k day rate, up from $400k 18 months ago

What’s the new build parity ? I’ve seen $750-$1000k based on $800-$1000k new build cost, and taking a few years to come to market—depending on rate of day rate rise, we probably have at least 5 years before cycle top?

There’s about 10 cold stacked rigs, whose lower refurbishing cost vs new build cost could add supply before new build, dampening day rate rise.

So it could be a few years before day rates inflect, and shareholder returns rise to cause re-rate. So anyone in RIG would need to be patient—instead of timing the inflection, I just buy and hold a core position, hoping for a double in 5 years, trading in and out a smaller part with the high volatility.

As you say, they could but are unlikely to go bankrupt and are trading below NAV or book value.

Question: can you help us understand how VAL differs from RIG? how far out on average is RIG booked? Asked another way, how long does it take for leading edge day rates to meaningfully affect average day rate? How does this compare to Valaris? Is that why VAL will inflect first? Or, I suppose it’s mainly due to fact it will take longer for RIG to be profitable due to need for much higher debt payments than RIG? Which type investor would goto RIG vs VAL?