Uncovering Value: The GEO Group's Assets Will Soon Be Appreciated By The Market

Good example of undervalued assets with a catalyst for re-rating in play.

Dear ROI Club Members,

Today, I’m sharing my take on The GEO Group (NYSE: GEO). In this article, we will explore the company's operations, Michael Burry's investment interest and my thesis, which centers around its potential to unlock significant value as it trades at a steep discount to its asset value.

Company Operations:

The GEO Group is a leader in the privatized corrections and detention industry, providing secure and rehabilitative services to government agencies across the globe. With a diverse portfolio of correctional, detention, and community reentry facilities, the company has established itself as a crucial player in the criminal justice sector.

Michael Burry's Investment:

As many of you are aware, Michael Burry, famed for his successful contrarian bets, has shown a notable interest in The GEO Group. The investment maven, best known for predicting the housing market collapse in 2008, has been attracted to GEO due to its intriguing valuation metrics.

Thesis:

My investment thesis revolves around the fact that The GEO Group is currently trading at a substantial discount to its asset value. This gap, IMO represents an immense opportunity for investors, especially considering the recent changes in its corporate structure.

In December of 2021 the company changed structure from a REIT to a ‘C’ Corp. This strategic move has proven to be a game-changer, as the company's free cash flow (FCF) is now paying down debt at an impressive rate.

The debt load has always been the main factor in holding back the stock’s price and I posit that with the board now having the ability to significantly de-lever the market will eventually be forced to recognise the value of the assets and future cash flows.

Unlocking Value through Deleveraging:

As the FCF continues to be channeled into debt repayment, the company's risk profile improves significantly. Once the debt is retired, I’m betting the cash is returned to shareholders via buybacks and/or dividends. Giving the company currently trades at a circa 25% FCF yield I’d be more than happy to be on the receiving end of said cash flows. However I deem it far more likely that the market will re-rate that yield to be in line with its historic mean of circa 14%. This would provide a circa 100% upside through multiple expansion alone.

Future Growth Prospects:

With a stronger financial foundation and improved cash flow, The GEO Group is now better positioned to explore growth opportunities. As the demand for privatized corrections and detention services continues to rise, the company can seize new contracts and expand its facilities, further contributing to its growth story.

Risks and Considerations:

Of course, no investment opportunity is without risks. Regulatory changes, government policies, and shifts in the corrections industry can impact The GEO Group's operations. However I don’t see the demand for their services going away anytime.

**Conclusion:**

In summary, The GEO Group presents a compelling investment opportunity for ROI Club members. Trading at a steep discount to its asset value and undergoing a successful deleveraging process, the company's financials are on a path of positive transformation. As the story unfolds, it is essential to keep a close eye on the progress and potential catalysts that could unlock further value.

In the below video I detail the most important financial metrics indicating how my investment thesis in the Co. has turned out so far. If you enjoy this analysis, consider becoming a paid member of the ROI club where you’ll get access to my best takes on value investments for just $5/month.

Best regards,

Benjamin

*Disclaimer: I am not a financial advisor and this is NOT financial advice. The purpose of this publication is merely to document my journey in investing and to share it along with my opinion. Everything shared in this publication is purely my opinion, you should not make any financial decisions based on anything you see me do or hear me say. Please seek the appropriate professional advice before making any financial decisions. *What’s On Ben’s Brain?

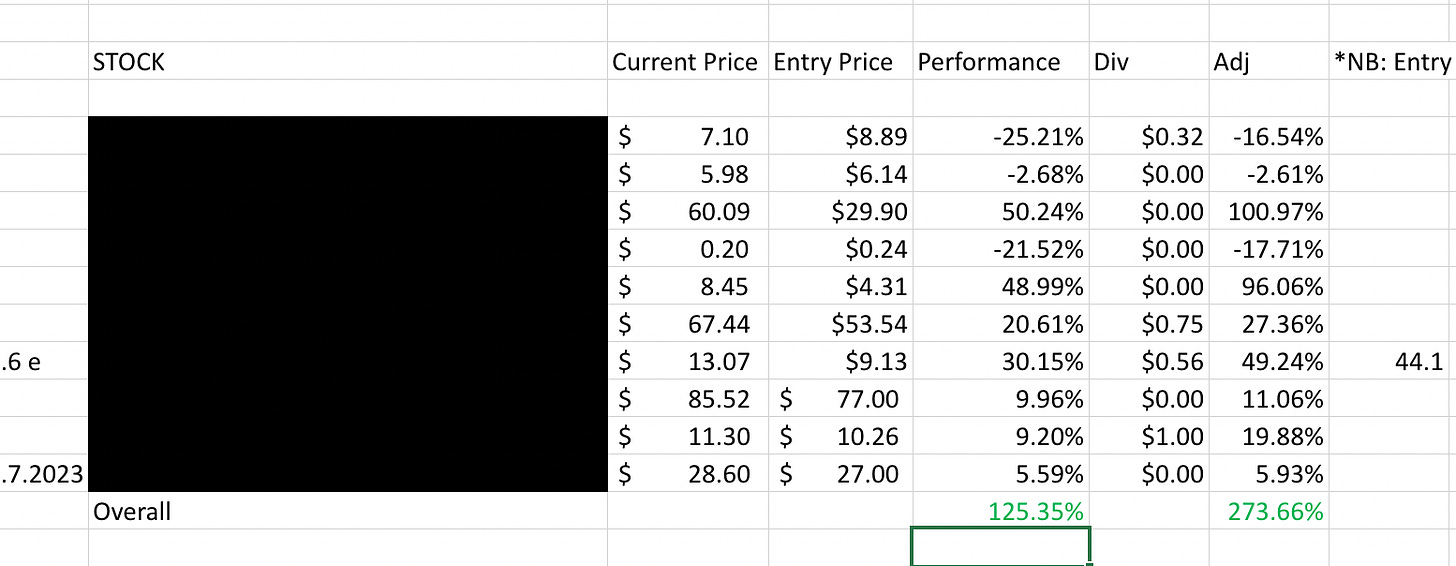

Subscribe to the ROI club today and become a member and gain access to ALL of my analyses + see a live performance breakdown of the stocks I’ve looked at in the excel sheet below ( currently up 273.66 % Adj. at time of writing).

*Important* this is a hypothetical selection of assets, the author does not and cannot guarantee results. The author is NOT qualified to give financial advice of any kind and nothing in this publication is to be considered financial advice.

Become a paid subscriber today (less than $5/month when you pay annually) and get access immediately to the video below.

Until next time, all the best & DYODD.

Benjamin.