Unearthing Multi-bagger Potential: Unveiling Global Atomic as the Ultimate Contrarian Opportunity

How much is war insurance on this uranium mine?

Dear ROI Club Members,

Today, I’m sharing my take on the most topical of Uranium Juniors, Global Atomic Corp (GLO.TSX).

In this article I give my take on:

The recent political events which have sent the stock price crashing circa 60% in a matter of days.

Examining the value of the company’s operation and the potential opportunity I see amongst the recent chaos.

A tactical way I’m being paid to take exposure at a significant discount (more than 40%) to the current stock price.

At the end of the article you’ll find a link to a free video presentation I’ve put together outlining a valuation target for this company and the potential for a multi-bagger ROI provided Africa doesn’t degenerate into a full blown war zone (a possibility).

The company in a nutshell:

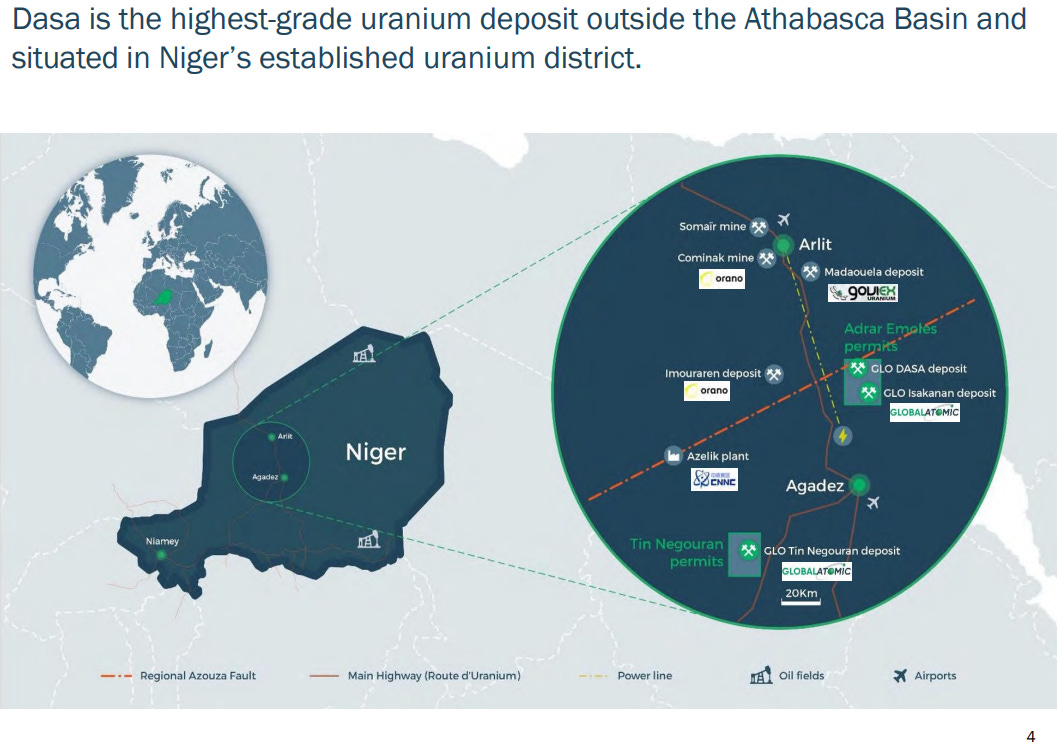

GLO is a Toronto listed developer of the highly promising greenfield Dasa project in Niger boasting an estimated 220 mm lb deposit in Niger, the region supplies approximately 5% of global Uranium production.

Phase 1 of their development boasts an NPV8 after tax of over $1B USD on a current EV of merely $177mm while the project sits right in the sweet spot of the Lassonde Curve with their first 2.1 mm pounds already contracted and expected to be in production in 2025… So how come this looks so easy?

Recent Development: Meet the new bosses

On July 26 2023, the boys in the above pic decided they had better ideas than the previous president and that they’d detain him after what appears to have been a relatively successful military coup. Read here

Needless to say the market was underwhelmed with the news:

The opportunity/valuation consideration really are better explained via the video so I won’t repeat them here. Instead I’ll outline the key risks, only one of which I believe will really lead to irreparable damage.

Full blown war and the mine goes nowhere - that’s going to hurt and likely write off the entire investment case. However, it would also take away circ 5% of supply to the world which would be bullish for the other uranium plays I hold in my portfolio.

(Full) nationalisation - unlikely, the Niger government already owns 20% and has put up decent CAPEX, they will benefit from the cash flows produced once the mine is in full production and need GLO staff to help them get to that point.

Zee Russshians - Changing political alliances in the area may lead to increased Russian control of such a key resource and it’s unclear what that would mean for western investors (I’m still smarting from my broker calling me and telling me my POLY shares would be closed out due to them being in Russia..)

Gap in Start-up funding - my estimates are that the Co. still requires roughly another $100-150 million to kick this thing off. It would take one ballsy investment banker to cut a check write now (paging Rick Rule?) so there will likely be some equity dilution via a cap raise in addition to some kind of forward deal done with spot traders who have found themselves in a pickle and need to cover some lbs sold short to utilities. I’m less concerned about this. This mine will be built outside of a war breaking out and even with a 100% dilution from current levels I have a way I think I can enter without taking a bath.

Phone a Friend Time:

I have the fortune of being friends with two guys who know this sector like few others: Justin Huhn, the Uranium Insider and Ed from GD capital.

I’ve had the pleasure of meeting both these gents in my travels, Ed has facilitated a lot of GLO’s past financing. They have told me they believe the believe the shares will stay in the ‘penalty box’ for some time to come so time value of money is a real concern.

How I’m playing it:

I believe this mine will come into production sooner or later and if it doesn’t the pressure that would put on global supply would benefit my other U positions hence I’m running towards the fire and against the crowd on this one. The question is if it happens later, how will I scale in and ensure I still receive a decent ROIC while I wait?

My idea: play the insurance company and scale in using puts.

If you’re unfamiliar with put options get up to speed here

Why this tactic?

If you believe in the thesis and believe the current $1.44 share price represents value (as I do) if there was a way for you to get paid to enter the stock at $1 would that be appealing? For me the answer is yes.

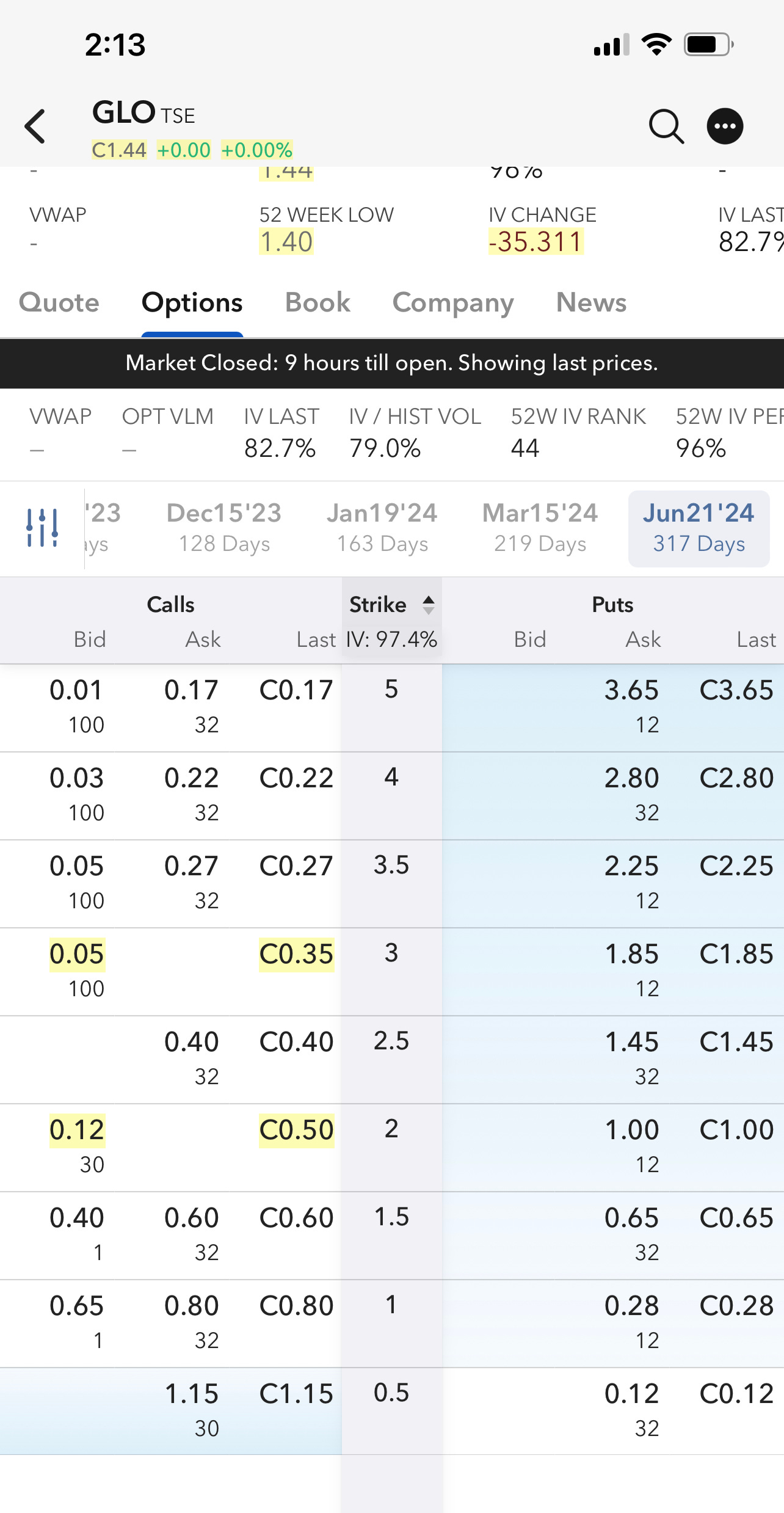

So I’m selling put options on the $1 strike for July ‘24 expiry as seen below:

So far my average price is $0.13 for every contract I’ve sold and I’ll continue to sell these in tranches until the cash required to cover these options reaches 1-2% of my portfolio. If the stock is trading below $1 I can be ‘assigned’ the stock at any time up until the expire date whereafter they expire worthless. In the even I’m ‘put’ the stock I’ll effectively be buying the shares at an ave entry of $0.87 (currently or better). Even with a 100% dilution I estimate the EV at that price to be circa $285mm USD for our NPV of over $1B for phase 1 alone (using $80/lb) or $285 mm for approximate total mine NPV of $5B. For me, the potential for this to be a long term multi bagger is too good to ignore and if the stock is above $1 next July my collateral will have earned me circa 18%+ simply for insuring the risk (13% return on cash margin + said cash earning 5% in my brokerage account).

I hope you enjoyed my ‘inked’ thoughts above.

Check out the video below for further articulation and please do share with someone who’s interested in the space.

All the best.

Benjamin Demase - The one Man Insurance Co.

Disclaimer: This article is for informational purposes only and should not be considered as financial advice. Always consult with a professional financial advisor before making any investment decisions.