Wildcatting in Patagonia.

Updates from the Centre Of The Earth: Speculating on the next shale boom!

*PSA - The Rule Natural Resource Symposium Is Almost Here*

Get your tickets here before it’s too late.

“Only buy something that you'd be perfectly happy to hold if the market shut down for ten years. -Warren Buffett.

The stock market last closed for an extended period of time from July 31, 1914 to December 12, 1914.

Just imagine today how people would lose their minds if the exchanges closed for 4 months… whatever would we creators talk about?

For me, the above quote is at its most relevant.

It’s been only 2 weeks since my last written piece and I notice that even a meagre fortnight has been enough for some people to experience angst as to when I will be publishing next.

This is honestly not a favourable mindset for the individual investor and I’ve found that my recent 2 week vacation from the keyboard has sharpened my focus and, much to my surprise, the world has not ended without my being plugged into the day to day financial media.

Having no debt, minimal leverage and owning capital-light, high quality assets like royalties has made it easy for me to stay away from the hustle of the financial media while I focus on acquiring some real estate down here in Argentina.

You may have noticed this year I have really pulled back on selling options for income.

I want some time where I don’t have to pay so much close attention to the market gyrations. Additionally, I need my focus on cementing the foundations of a solid financial and geopolitically diverse base as having a family of my own is likely on the horizon soon - I’m terrified!

Ergo, I need a base layer that is far simpler to operate and can be done without me. Then, with that in place, I’ll return to writing large options contracts.

So, while some people, to quote my Uncle Rick “Experience trauma holding a stock over a long weekend” I’m down here scaling mountains and thinking about the next generation or two and how I can layer my interests such that they will survive, thrive and yield fruits decades ahead without me even in the picture.

A book I read when I was 22 outlined a strategy where a ‘bread and butter business’ forms the base of your wealth generation, with the cashflow it generates used to purchase cash generating real estate and thereon upwards moving the cashflow towards more financialized assets.

At 29 I thought I had this organised beautifully, and in fact I did, however nearly all my assets were in Australia and with the all that transpired during 2020-2022 I became acutely aware that I needed to geo-diversify my assets (note: it’s really quite difficulty to move a real estate portfolio across oceans).

Here I am now, recently turned 34 (I know - I don’t look it) and have accumulated multiple passports and residencies along with making my businesses capital light and geographically agnostic for the most part.

Which brings me to today’s topic, Real Estate.

More specifically, Real Estate which actually generates positive cash yields - remember that?!

More specifically again, Cash generating Real Estate that’s outside the jurisdiction of the Australian government who now seem to want to tax unrealised capital gains on retirement accounts without indexation for inflation.

Banana republic risk is no longer a joke.

Argentina

I spent my first week in Buenos Aires checking out the residential market with the help of Mike and the team at Buy Sell BA. This will be a subject of plenty additional pieces including a podcast to describe the unique experience that is buying real estate in this fine republic I love so dearly.

But for today’s focus, we’re going full gaucho, off the beaten path, wildcatter speculating in what I think might be a tremendous opportunity in a place you’ll never come across by accident - The ‘petrol zone’ of Vaca Muerta.

Many people want to invest in the promise of Argentina’s reviving hydrocarbon industry. Most foreigners will have to be content with buying YPF etc on the Bolsa, which has its merits to be sure.

Here I find myself with an advantage.

My suegra is a real estate agent in the gran city of Cipoletti, Rio Negro and it was she who came up with an idea which I would normally consider an insane speculation- but in this case, I think it could be genius.

Buying pozos ( dwellings under construction) and renting them directly to the large oil & gas producers who will use them as accomodation for their shift workers.

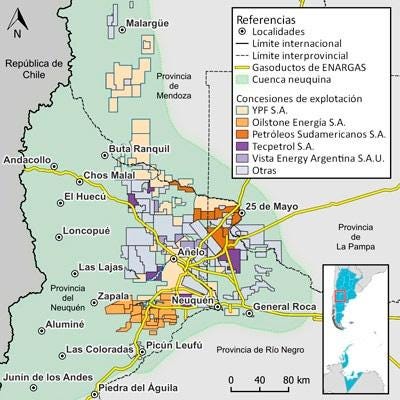

Some brief Culture for the gringos: Neuquén and Cipoletti are twin cities located in la zona petrolera. More importantly, they lie within the most important zone la Cuenca Neuquina which boasts the most reserves in the country.

The area experiences heavy traffic associated with the booming energy industry and boasts a population of roughly 430,000 between the cities combined.

The playbook here is similar to buying residential housing in mining towns in Australia when they were on the cusp of booming, only here I actually see less risk as there’s no credit in the market, the prices are low and the local economy is less mono-dependent on extractive industries which boom and bust.

While Buenos Aires is still my favourite metropolis and I plan to buy there also, the yields are low and besides, I am at heart a country-boy.

Prices are shockingly expensive in BA, with nothing decent really available in Neighbourhoods like Palermo less than $3,200/m2. The only games in town there for me would be commercial leasing (not my thing) and high end luxury short term rentals (competitive and the subject of another day).

In comparison, used property here, at the top of the Patagonia region currently goes for around $1,100 USD/ M2 with new property around $1,400-1,800 m2 (according to suegra).

As far as yields go, I’d be confident you could achieve double digits through simple, traditional long term rentals.

Not a bad base case, particularly when it’s currently so difficult to find cashflow positive real estate in so many parts of the world.

Remember, this is in Nequén/Cipoletti which is roughly 90 mins drive from the heart of the extraction activity.

If you want full, undiluted degenerative exposure to Vaca Muerta itself, you’ll need to look in a little town called Añelo. That’s the centre base of oil and gas workers in Vaca Muerta. The last census done here was in 2018 which stated 17,893 inhabitants and I suspect that probably included a few stray dogs.

My more adventurous side is called to this type of project which, according to many developers, are offering 15% cash returns through direct rental contracts with the oil majors such as Shell, Chevron, YPF etc.

This type of advertising immediately induces doubt for me and hence I consulted with Suegra, who had the following to say

"Acá hay muchos desarrolladores y yo confío en pocos. Pero hay dos en los que confío y no tengo duda de que esto será una gran inversión."

- Here there are many developers, few of whom I trust. However there are two I trust and I have no doubt this will be a great investment.

There you have it - straight from the horse’s mouth.

If you wish to learn which ones are Suegra-approved you’ll need to get in contact + bear gifts - Pinot Noir and chocolate are the minimum requirements even to get an a appointment and from there it’s all cold hard cash.

Alternatively, I’ll be writing about my final investment decision if and where I make it.

The best of my ideas often seem crazy on the surface but have a logic to them once unpacked. For me, a base case being a boring and steady rental in a bigger city like Neuquén with double digit yields and price per m2 around the low $1,000 seems less crazy then the negative yields on offer in most OECD countries.

Add in the fact that the local supply for rentals is tight and getting tighter, whereas the vacancy rates in Australia for instance are now purely artificial, relying on essentially importing demand from overseas thanks to an outlandish open borders experiment to prevent the bubble from popping.

Some exposure here + some degenerative direct exposure to developments soon to be completed in Añelo as a call option seem like the simplest and fastest way to automate a lot of my business income in a way that provides steady cash flow and luckily in my case, readily available property management.

Replicating my income and taking most of my personal input out of the picture at the same time in a few swift moves is key because in the event something happens to me, the train keeps rolling without a hitch and if not, well the steady cash flow can be invested monthly across a host of portfolios of which I plan to narrow down to 3: long term land/royalty compounders, dividends and a more actively managed option portfolio.

With just a little bit of patience and shrewd manoeuvring, I think I can automate an income level that took me 10 years to build in around 10 months.

Game on.

Take care and do your own due diligence.

Benjamin

PS: please share if you enjoy, I hope I’m providing a unique perspective here.