Hello and welcome to the ROI Club.

The publication dedicated to the art and science of Return On Investment.

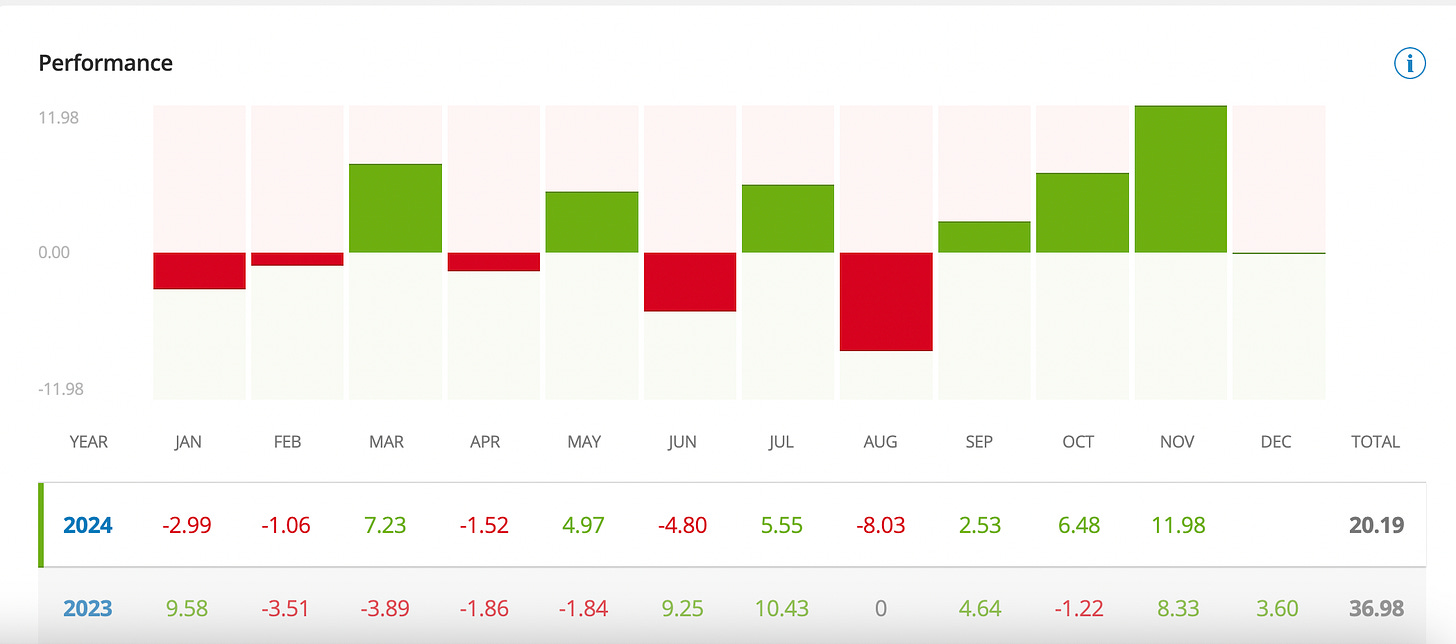

Today’s agenda: I will quickly brag share a performance update for two of my portfolios, followed by an overview of the Royalty thesis as it pertains to precious metals to provide some reprieve from my near incessant table-banging with regards to land companies with energy royalties.

Behind the paywall you will find my latest trades and where I’m allocating capital now.

Straight to it then.

E Toro Portfolio - You can copy it by clicking here

The Maverick Life Portfolio - Behind Paywall

Precious Metals Royalties.

You probably know by now that my investment preference has evolved to be almost exclusively royalty & streaming business models or similar.

In this fabulous interview with the modern father of royalty models, Pierre Lassonde stats that “the royalty and streaming model is the best business in the world”.

With his initial $2 million royalty on the Gold Strike mine having returned over $1.2 Billion in cashflows alone without his company, FNV, ever needing to write another check it’s hard not to agree with him. A 60x return from a one and done check ain’t bad.

He also shares his view that he believes the recent election of Trump is '“the best thing to happen to gold”.

So the question is, if you’re bullish on the metals, why not buy the metals themselves or their associated producers?

I believe I answer that quite comprehensively here:

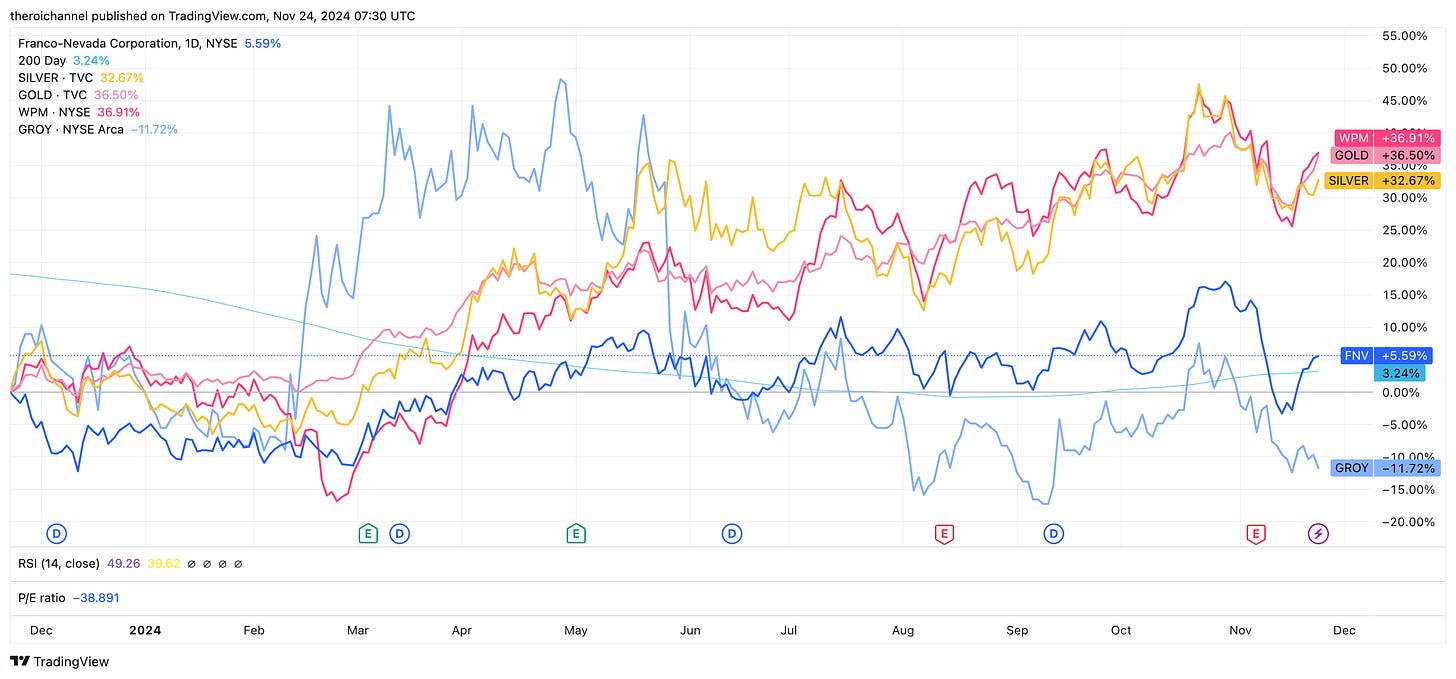

I hold a number of gold/Silver royalties, let’s look at the top 3 vs the metals over 2024:

My notes:

Whilst strongly ahead for H1, GROY has dropped to last. I have been buying more.

FNV has been replaced by WPM in terms of Market Cap but investors don’t appreciate that FNV is actually the most leverage to a rising gold price. It’s reported to have only 50% of its assets in production with the rest acting as an OTM call option with no expiration date.

They all look good to me here:

WPM looked an easy double over 1-2 years when I first started buying, nothing really changed with the thesis.

GROY growing revenues at 108% YOY and due to hit profitability 2025. They also have a nice copper stream on the vares project.

FNV IMHO can continue to grow top line at 10% comfortably and earnings at double that rate.

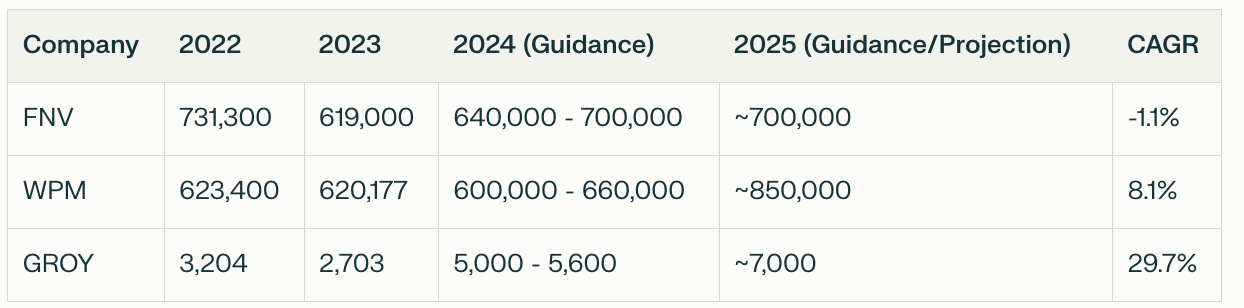

Below is my back of the envelope estimate for production in gold equivalent ounces (GEO).

FNV production likely remains stable <700k GEO until higher prices bring their call option assets into production and they finalise the dispute with the government of Panamá which halted roughly 15% of their production last year.

WPM on track to hit my conservative target of 800k GEO and likely at higher prices than even I expected.

I’m now underwriting them on $3,000 /GEO which implies a revenue of $2.4 Billion and EBITDA of close to $2B. 22x median EV/EBITDA multiple suggests $44 Billion or 10% upwards adjustment to my valuation from March.

Using the same base case for gold and GROY’s 7k GEO production I think they can nudge $17 million in EBIT for next year.

What’s a fair multiple for a company that is growing at triple-digits with nothing more to spend should they not deem it fit?

20x isn’t unreasonable imho. Ergo I can say GROY could be a $340-$350 million company within 12 months with a straight face. Might take longer than the others to get a multiple re-rate, but it has 250+ royalty contracts now.

I’ll be following with interest and I’ve upped my weighting to all the aforementioned names.

Take care.

Benjamin