The Case for a New Investment Hurdle Rate

This large cap stock's compounded at a rate 35% higher than the S&P 500

Welcome back to the ROI club.

These times, well they are a’ changing.

In a world where economic cycles are accelerating, traditional benchmarks are losing relevance. I posit that it’s time to rethink how we measure success - starting with the current ‘measuring stick’ that is used almost ubiquitously across capital markets, the equity risk premium (ERP) model.

The ERP is calculated as the S&P 500 earnings yield minus the risk-free rate which is generally understood to be the US 10 year note. Said differently, its the rate above the 10 year that investors are seeking in order to go further out the risk curve and buy equities over bonds.

I’m here to commit some financial heresy and state that this model is not appropriate to use as an investment hurdle rate, at least not in the current environment.

Let’s take a look at this model, its history, its components and overlay it with today’s environment and I’ll share what I am using personally as a hurdle rate, the rate against which all investment opportunities are filtered.

The ERP.

The 1950’s gave birth to the rise of Modern Portfolio Theory where Harry Markowitz argued for a diversified portfolio to reduce risk (I am being disgracefully reductionist in the interest of brevity). To this day his work remains central to vehicles holding Yuuuuge amounts of institutional capital such as Indices and ETFs.

Building on the above idea, in the early 1960s William F. Sharpe - of SHARPE ratio fame began to promote the Capital Asset Pricing Model (CAPM) which links the expected return of an asset to its systematic risk (beta).

This model essentially interprets individual stock price divergence is a risk measure as well as uses the 10 yr note commonly as the risk free rate - two things with which I am personally in disagreement.

That notwithstanding, the model is used in financial markets as a hurdle rate/ discounter.

The above ideas were products of their time, when the earnings yield was higher than the risk free rate, which in turn was higher than the rate of inflation.

I don’t see any of the above as remaining true today and so am taking a very different approach to discounting investment opportunities.

With the current SPX earnings yield at 3.27% (now tell me again that royalties are too expensive!) as I write this and the US 10 year yielding 4.61% the ERP is negative and the risk free rate is lower than my estimate of inflation.

Applying a growth rate of 2% to the earnings yield turns the expectation positive… to a measly 0.66% as seen below:

E(Rm)=E/P+g = 3.27% + 2% = 5.27%

ERP=E(Rm)−Rf = 5.27% − 4.61% = 0.66%

(Earnings yield + growth rate - bond yield).

Even if you accept the official CPI in the USA for 2024 of 2.83% this doesn’t constitute a real return.

Shadow stats who measure the rate of inflation using the original calculation method before the various ‘adjustments’ were added, state the rate of of inflation as 12%+ for 2024. Whether you agree with that or not, just for fun, think about what the growth rate would need to be to compensate for 12% inflation.. (8.73% at current earnings yield).

During 1971-1980, an economic climate which is eerily similar to today in my opinion, the average annualised GDP growth in the USA was 2.91%, while the same inflation number was 7.92%..

This thinking has been supported by the moves in the gold market which I’ve written about here:

Discounting in a New Environment

In the above link I argued that gold is the true risk-free rate, sporting a 10% annualised return since 2020, representing a more inflation-resilient liquidity source. This forms my savings hurdle. So then, what constitutes my investment hurdle?

Rethinking the Investment Hurdle Rate

If gold’s 10% performance sets the standard for a risk-free return, what should we use as an investment hurdle rate?

To justify investment risk, we need to target a return exceeding gold’s hurdle rate whilst ensuring it compensates for the additional uncertainty and potential illiquidity associated with a long term, compounding investment.

With the 10 year not compensating for inflation, wouldn’t it be better to establish an estimate of inflation and then add on a required return?

That’s what I’m doing..

Hurdle Rate=Inflation Rate+Risk Premiums

I’m using gold as a proxy for inflation. Don’t argue with me - you just use what you think’s best.

Risk Premium = 3-5% seems historically reasonable, I’ll add 1-2% for geopolitical/currency risk as I deem fit.

Currently I say my hurdle sits around 15%.

In other words, if a prospective investment doesn’t convince me that it can return me 13-15% reliably over time, I shall not perform the ‘reverse alchemy’ of changing my gold into shares of stock.

*Note: this isn’t permanent as macro economic environments obviously change.

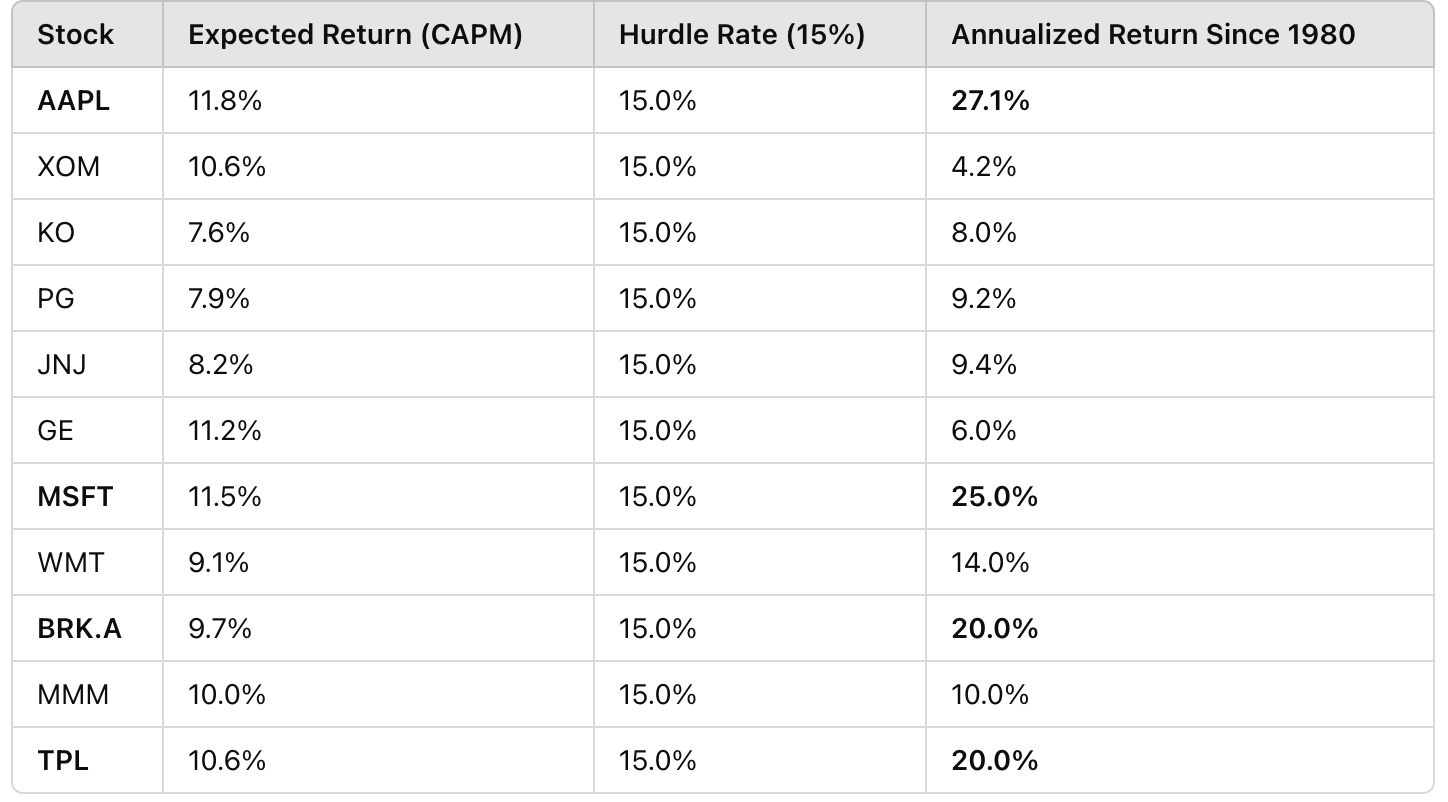

The old financial planning adage that the stock market returns approximately 10% per annum “over the long term” really depends on the period over which you measure. However, let’s humour that idea and see how a basket of well known US stocks performed since 1980, which has been an unusually benign economic environment:

Pretty dismal, especially given offical sources state the annualised ave CPI over that time at 2.91%. Imagine what happens in an environment of heightened and sustained inflation.

The 4 highlighted stocks above which surpassed the hurdle all have/had fairly capital light business models. AAPL and MSFT now face cost-creep challenges given the trends of cheap energy, capital and labour are likely over now. This is why I’ve been so insistent on examining the underlying business model rather than just quantitative ‘value’ metrics like price to earnings etc.

If you see things the way I do, you’ll now be realising just how damn difficult it may be to earn a real return over the next 5-10 years. One useful ‘hack’ that comes to mind, is to find a company who benefits from rises in the inflation proxy (gold), without the associated expenses.

To illustrate this, there’s no better example than the original gold royalty.

This company is the gold standard - literally and figuratively. The largest and best-in-class, yet with the kind of torque to rising gold prices you’d expect from a junior miner. I project it will not only clear my hurdle rate with ease but thrive in an inflationary environment, where it’s likely that over 50% of its projects would suddenly come into the money. Imagine an 800-pound gorilla with a book full of call options - that’s the opportunity at hand. Let’s dig in..

Keep reading with a 7-day free trial

Subscribe to The Royalty King to keep reading this post and get 7 days of free access to the full post archives.