Why U.S. Natural Gas Prices Will Converge with Global Markets—and How to Invest Wisely

NFE update + Key themes for 2025

Hello and welcome back to the ROI Club.

I hope you had a wonderfully fulfilling holiday season, this end of year was a breakthrough for me personally.

I felt a profound sense of peace and happiness—for the first time, I wasn't consumed by a sense of lack or furiously jotting down goals to chase in the coming year out of dissatisfaction with myself or my life. Instead, I experienced a harmony across all the major pillars of life: health, wealth, love, and happiness.

I truly wish the same for you.

Now, you all want to see my investment thoughts in written form according to the latest poll so I’ll return philosophy to the shelf for now (although I honestly believe it’s extremely helpful).

To start 2025 with clarity, I’ve put together a brief table below of my top macro investment themes, key indicators to watch and my main investments chosen to express the theme.

*HM: Steel & metals which are due to run but I think they might be a ‘26/27 story.

The above are in no particular order and I’ll expand into each theme as the year develops, starting with today’s thoughts on an idea I’ve had for a while: US Nat Gas is simply too cheap.

Let’s take a look.

The Current Landscape

For years, U.S. natural gas prices have been a global outlier. Domestic prices, typically measured at Henry Hub, have remained significantly lower than European TTF or Asian JKM benchmarks. The reasons are well-documented: rapid shale growth, relatively low production costs, and limited export capacity. However, this disparity is closing fast as tall the aforementioned factors are inflecting.

To understand the crux of the trade set up, let’s cover a few simple definitions as they apply to this particular thesis:

Spread: The difference between the U.S. Henry Hub price and the international benchmark prices (like TTF for Europe or JKM for Asia).

Convergence: The trend or extent to which these prices move towards each other over time.

Just how big has this spread been recently?

Average Spread Over 2022-2025:

U.S. vs. Europe:

2022: $33.52

2023: $10.67

2024: $6.64

Average Spread: ($33.52 + $10.67 + $6.64) / 4 = $12.70/MMBtu

U.S. vs. Asia:

2022: $30.32

2023: $15.77

2024: $11.42

Average Spread: ($30.32 + $15.77 + $11.42 ) / 4 = $14.38 /MMBtu

What are the factors accelerating this convergence?

I’ve identified the following keys:

Expanding LNG Export Capacity

The U.S. is on track to significantly increase its LNG export capacity. According to the U.S. Energy Information Administration (EIA), North America's LNG export capacity is expected to more than double between 2024 and 2028, with the U.S. contributing an additional 9.7 billion cubic feet per day (Bcf/d) from new projects currently under construction. (EIA.gov)

Slowing Production Growth

While the U.S. has abundant reserves, production growth is decelerating. Resource depletion in top-tier drilling zones, combined with stricter capital discipline among producers, has constrained output. This tighter supply dynamic further supports higher prices.

Global Energy Demand and Price Arbitrage

Europe and Asia remain desperate for reliable energy sources, with natural gas often trading at 3-4x U.S. prices. This arb incentivises producers to prioritise exports, aligning U.S. and international prices more closely. (TradingEconomics.com)

Now before we all go full cowboy and try to set up a long-short trade and lever it to the gills like it’s 2021, let’s remember that Europe’s energy policies remain just as ineffective as in 2022. Ergo, we may see higher prices on both ends and your short leg end might indeed cost more than your long leg makes you when all costs are considered.

Gas futures trading is infamous for its extreme volatility.

Price swings of 10-20% in a single session are not uncommon, driven by unpredictable factors like weather, geopolitical tensions, or speculative trading.

There’s a reason they call gas the widow-maker.

This is why I prefer to express my view via guaranteed margins (NFE) or high quality business models with free call options on higher gas prices (TPL, LB, VNOM, SJT etc).

Natural gas producers simply operate under undesirable economics that make them poor vehicles for this trade such as: Hedging Limits, high reinvestment rates and operational cost pressures.

Better Alternatives:

Land companies with royalty rights like Landbridge (LB), Viper Energy Partners (VNOM) and Texas Pacific Land (TPL) offer a more compelling way to capitalise on rising gas prices via:

Free Exposure to Gas Prices:

Royalty holders don’t bear the operational costs of drilling. This means they benefit directly from rising prices without exposure to rising costs. Essentially, natural gas prices act as a free call option for these players.

Inflation Hedge:

Royalties grow alongside commodity prices, offering a natural hedge against inflation and a steady income stream that appreciate.

More on this idea here:

Now time for a little victory lap update on one of my most intriguing holdings, New Fortress Energy (NFE).

The Case for New Fortress Energy (NFE) Revisited.

NFE takes a different approach by de-risking the natural gas trade entirely via

Locked-In Margins:

NFE operates on long-term government contracts that secure average margins of $7/MMBtu. This eliminates exposure to the volatility of spot markets.

Strategic Positioning:

A vertically integrated player, NFE enjoys a first-mover advantage in supplying finish solutions for the rapidly growing global LNG demand while maintaining cost advantages due to its initial heavy investment in infrastructure.

New fortress energy (NFE) has seen volatility in its stock price since I began speaking about it, with management trying desperately to snatch defeat from the jaws of victory.

You can find two long form takes on my investment thesis in the archives, with the most recent being here:

In 2024 it reached peak of $34 before a strange series of events lead to them scrambling to restructure their debt maturities and Wes Edens, founder and CEO tipping in an extra $50 million to steady the ship.

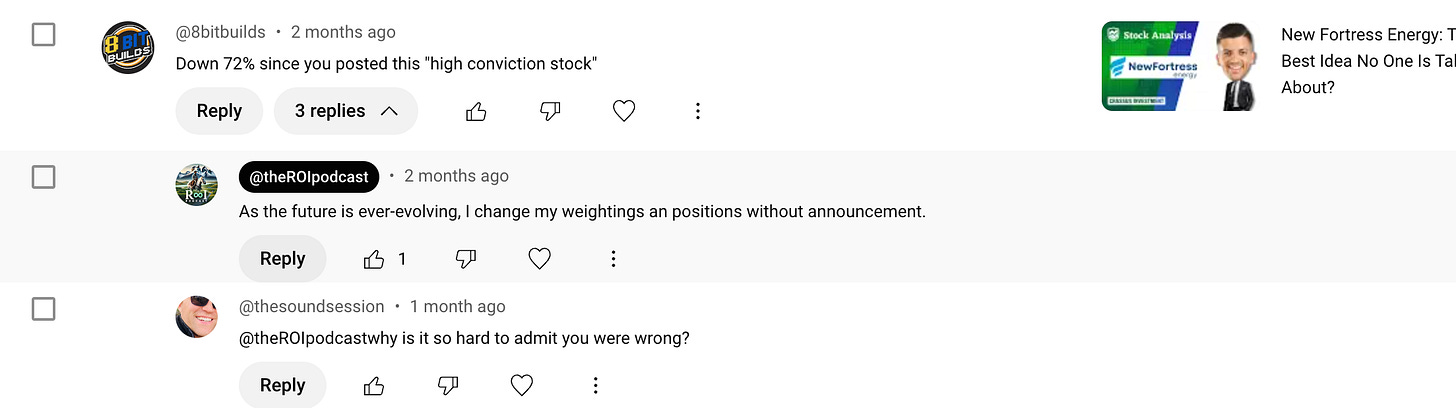

This lead to the stock being heavily sold off, down to a nadir of $7.97 which in turn lead to me receiving certain comments such as the below:

NFE is now one of my top performers.

Good time to remind everyone - Just because I talk about something doesn’t necessarily mean I own it and if you’re looking at videos months/years old I may have changed my position/position sizing. If you wish to copy what I do you and have me manage positions you can copy the E Toro Portfolio here.

Incidentally, despite a 10% drawdown in December 2024 thanks to a vicious tax-loss season for some of my holdings, the portfolio is doing just fine.

NFE has first mover advantage in supplying power contracts to certain growth markets and to even replace the company’s infrastructure would be preclusively expensive.

It’s market cap still trades at a discount to its depreciated property plant and equipment value while the company has locked in government contracts to supply 170 TBTU per annum with an average margin of $7/mmBTU which is roughly $1.1 Billion in EBITDA with an average overall life of contract at 18 years.

This alone accounts for only part of their current projects, median analyst estimates show an expected EBITDA of $1.5 Billion in 2025.

In my last piece on the company I wrote:

Without accounting for future growth and contracts won, that logic allows me to envision an EV of ~$25 Billion by the end of this decade or 10x its current market cap.

Whilst the chance to buy it at ~1.5x EBITDA is no longer there (that occurred when the lobotomised comments were disturbing my channel) I remain long, as I see nothing that has really threatened the big picture thesis described above.

As always though, not a recommendation - DYODD and take care.

Benjamin

Hi Benjamin, did you look into the Canadian natural gas thesis? The divergence is also substantial (even bigger it seems) and they are nearing completion of LNG Canada project and Coastal GasLink pipeline. And maybe playing it through Topaz Energy royalty company (TPZ.TO).

Great macro themes. If we are wrong, at least we'll be wrong together.