Trading Update & Market Commentary

The Maverick's Trades + Notes On: Precious Metals. SBSW.

Welcome back Maverick.

Today’s piece is your update on what I’m currently doing in regards to trades and macro commentary.

It’s always great to catch up with my good friend

to get a feel for what’s happening in the southern cone. I have my eye on some real estate plays down there and can’t wait to get back. Make sure you subscribe to his substack (free).Commentary + General notes

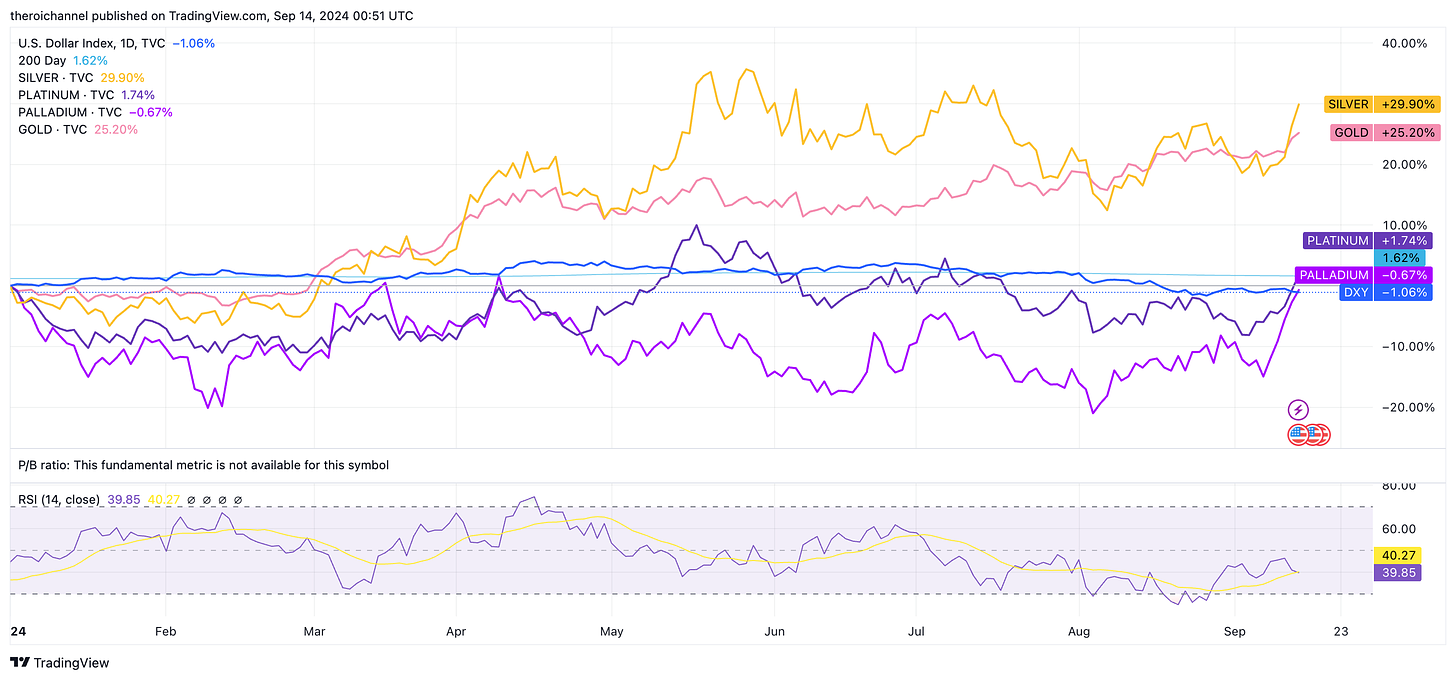

Gold/Silver have outperformed YTD and are up nearly 75% over 5 years. The interesting thing is that Us 10 yr yields have increase nearly 100% (albeit from COVID lows) and that hasn’t adversely affected the precious metals which is another strong indicator of expected monetary debasement. Think about it, if you’re getting paid twice the yield on USD bonds yet people still prefer the yield-less asset of metals what does that say about the USD’s purchasing power?

The DXY is a measurement of the USD against a basket of other fiat currencies. This index is flat ytd and up 2% over 5 years which confuses a lot of people into thinking the dollar is strong. Putting the metals price and DXY together actually leads to the conclusion that other fiat currencies are simply doing worse than the USD relatively which is far more to do with the USD’s status as the global reserve currency and far less to do with confidence in the US’s fiscal and monetary integrity.

In addition to having stacked physical bullion 5 years ago, I am now increasing my position in gold and silver royalty companies hand over fist for reasons I have mentioned repeatedly for years now and which you can access for free in past articles available inside the ROI club. I leave you with 2 examples of my favourite metals royalties here below:

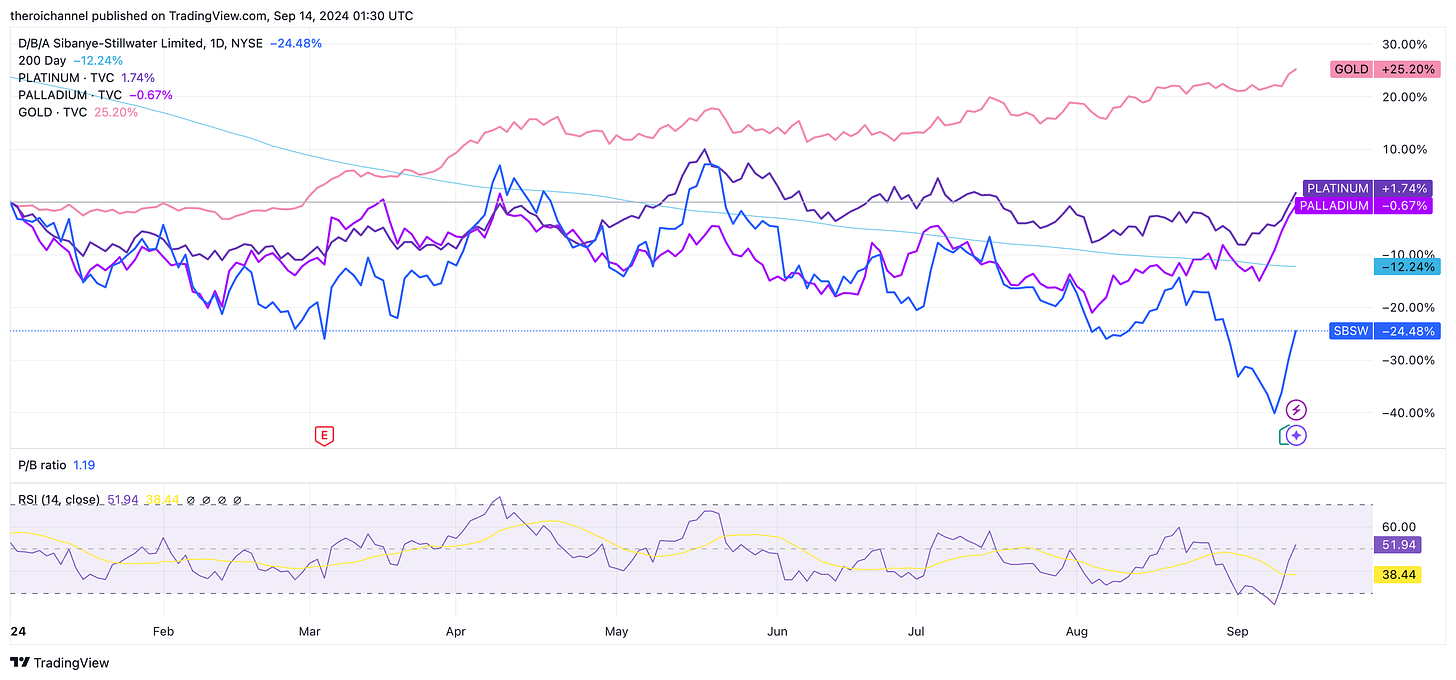

Now onto Platinum and Palladium which are sharply inflecting back up after being in the doldrums. Most likely due to the announcement that one of my irresistible

degenvalue plays, SBSW will close 50% of their US production. I estimate SBSW’s announcement could reduce oncoming global supply by 1-3% in an already tight market. I can’t help but be amused here as when I started talking about this thesis it was all about political risk in South Africa, whereas last week everyone on X was spreading nonsense about their imminent bankruptcy due to high cost USA production. The company has refinanced their most imminent debt maturities and is doing wonderful pre-paid forward sales of their gold production. Liquidity is there with roughly $2.8 Billion in current assets and only $1B in current liabilities. IMHO it has ample room to wait until PGM basket prices rise above their levelled ASIC ($1,250 ish) in which case the thing is a call option with no expiry date on a PGM bull market, with reserves multiple times higher than the current Enterprise Value, free overview here:

Trades I’m Making

Now, to business..

If you’d like to literally see the trades I make that form an integral part of my location-independent income streams then why not join the squad?

The performances of the portfolios is shared along with the positions in the private members’ area.

In true Maverick spirit, let's embrace adventure and see what happens.

See you inside the squad.

Benjamin.

Keep reading with a 7-day free trial

Subscribe to The ROI Club to keep reading this post and get 7 days of free access to the full post archives.